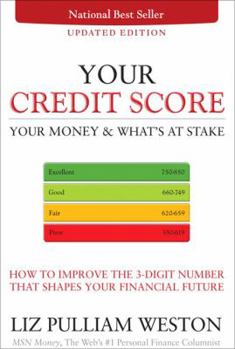

Your Credit Score, Your Money & What's at Stake: How to Improve the 3-Digit Number That Shapes Your Financial Future

Select Format

Select Condition

Book Overview

Improve your credit score, for real, with the #1 best-selling guide you can trust! Today, a good credit score is essential for getting credit, getting a job, even getting car insurance or a cellphone.... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0137016611

ISBN13:9780137016617

Release Date:January 2009

Publisher:FT Press

Length:199 Pages

Weight:0.64 lbs.

Dimensions:0.6" x 6.5" x 9.0"

Customer Reviews

5 ratings

Valuable book scores in more ways than one

Published by Thriftbooks.com User , 15 years ago

This updated edition (there's an updated Introduction, several references to the current credit and banking crisis, and an explanation of FICO 08, the new version of FICO) of YOUR CREDIT SCORE, YOUR MONEY & WHAT'S AT STAKE turned out to be a lot more valuable to me than I thought. I had a good idea of what went into making one's FICO credit score, but this book debunked a few important myths I believed. As Liz Pulliam Weston explains in the first chapter, "Why Your Credit Score Matters," even a little ignorance about how to make your score higher can cost hundreds of thousands of dollars in higher interest payments over the course of a lifetime. For example, paying your credit card balances in full each month, while a money-saving good idea, has no bearing on your score. What matters is how close your balance is to your credit limit, regardless of whether you pay it in full or not. The biggest myth? That closing accounts will help raise your score. According to Weston, closing accounts will never raise your score and can frequently lower it. There are several other tidbits where those came from! At the time of this review, the "Search Inside this Book" function is unavailable, so I think it might be helpful to include the chapter listings: 1 - Why Your Credit Score Matters 2 - How Credit Scoring Works 3 - VantageScore - A Revolution or Just More of the Same? 4 - Improving Your Score - The Right Way 5 - Credit-Scoring Myths 6 - Coping with a Credit Crisis 7 - Rebuilding Your Score After a Credit Disaster 8 - Identify Theft and Your Credit 9 - Emergency! Fixing Your Credit Score Fast 10 - Insurance and Your Credit Score 11 - Keeping Your Score Healthy While not all of the chapters were useful to my situation, and a lot of the information was known to me, I learned something useful in almost every one. I found the chapter about Insurance (how and why insurers base rates on your credit score) to be especially educational. I got a LOT of use out of this book. It is clearly written and a quick read. It's hard to overestimate how important a person's credit score is to his or her financial life. Highly recommended.

Short Sweet and To The REAL Points

Published by Thriftbooks.com User , 15 years ago

The book was a quick read. Found out items like closing old charge cards is NOT good for your credit, lowering your credit limits does not help, however, paying your credit card payment the day before the monthly close date, ahead of your monthly bill's arrival will help your credit.

Excellent Guide to Cleaning Up Credit Problems

Published by Thriftbooks.com User , 18 years ago

I picked up this book at the Airport, read it on the plane and then immediately ran my FICO - which was a very sorry 521! Using Weston's advice I was able to get to a much more respectable 680 and rising (over a nine-month period)! For the price, it is a much better guide than those kits (including Suzy's) offered on the Internet.

A complete and accessible plan for improving a credit score

Published by Thriftbooks.com User , 19 years ago

One of the most critically important aspects of sound financial planning is the establishment and maintenance of a sound credit rating. But sometimes "things happen" that result in damage to a credit rating. In Your Credit Score: How To Fix, Improve, And Protect the 3-Digit Number That Shapes Your Financial Future, personal finance journalist Liz Pulliam Weston provides the reader with a complete and accessible plan for improving a credit score that has been damaged through error, neglect, or debt load. Readers will learn what a FICO score is and why it's so important to their financial well being both short term and long term. Readers will learn how to lighten debt loads, cut credit card rates, review their credit history, improve their credit rating, save money, and employ a credit rating to their best personal and professional advantage. No personal or community library Money/Finance Management reference collection can be considered comprehensive or up-to-date without the inclusion of Liz Weston's Your Credit Score!

Wondefully concise book on your financial grade score

Published by Thriftbooks.com User , 19 years ago

Liz Pullman Weston has written a wonderfully concise and easy to understand book on "Your Credit Score", a poorly understood system used to calculate our financial GPA. She uses her expert paragraph and writing skills to give us an easy to comprehend, information filled book with good examples and follow-up reference material where needed. She has taken a topic and material that has been kept in the dark for years and made it understandable and manageable for the average individual. She not only defines and explains the "Credit Score", but also illustrates what can be done to improve it, no matter what your present score is. This is an easy to read, concise book that will benefit anybody at all interested in their financial health. Five Stars all the way!