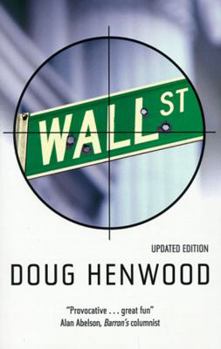

Wall Street: How It Works and for Whom

Select Format

Select Condition

Book Overview

A scathing dissection of the wheeling and dealing in the world's greatest financial center. Spot rates, zero coupons, blue chips, futures, options on futures, indexes, options on indexes. The... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:086091495X

ISBN13:9780860914952

Release Date:June 1997

Publisher:Verso

Length:372 Pages

Weight:1.75 lbs.

Dimensions:1.2" x 6.3" x 9.6"

Customer Reviews

5 ratings

The Truth

Published by Thriftbooks.com User , 21 years ago

First a word about the publishing house: Verso Publishing is probably the finest publishing house in the world. When in a bind simply pick up any one of their titles and one cannot go wrong. It's imperative to read at least a few of their books at least once. Henwood's Wall Street blows the lid off high finance like few other works. It's the definitive critical analysis (along with some of William Greider's books) of the high circles of wealthy investors. Throughout Wall Street it rips apart the Federal Reserve Board and exposes its gritty innards. Henwood demonstrates that the Fed is an undemocratic institution that's obsessed with any hints of labor militancy, its biggest fear being wage inflation. The Monetary School is also dissected by Henwood, being exposed as the fraudulent theory it truly is (or clever ruling class ideology). He points out that the Monetarists' ostensibly blamed the federal government for the Great Depression. Of course this has the fascinating effect of letting capitalism completely off the hook. The concepts of over productivity and income polarization, which were the defining characteristics of the 1920s, are rarely to be found in their school of thought. Constant pressure by Wall Street for ever higher stock prices is what spurred most of the downsizing during the last decade according to Henwood. He smartly points out that this pressure for quick profit growth can often squelch research and development and investment projects which would benefit society. Because shareholders may very well deem these projects irrelevant to short-term profit growth. Underlying Wall Street throughout Henwood continually pays homage to Karl Marx and some of his incredibly accurate predictions. He also demolishes old shibboleths such as the well worn canard that higher wages automatically translate into reduced employment opportunities, or that rising stock prices always mean a rosy economic picture for the general population. Wall Street proves that rising stock prices can often coincide with a poor economy for the masses. Henwood documents the fraudulent work done by professional money managers who'd be better off throwing darts at a dart board than using their investment "skills" when making investment decisions for clients. Some of the most important and informative sections deal with the rising consumer debt of the average American citizen. Being leveraged to the hilt, the family unit has basically been turned into a player in a giant Ponzi scheme. Capitalism in the United States desperately relies on credit-financed consumption to stay afloat. Most books dealing with such an overarching topic give a paltry and dissatisfying "What is to be Done" final chapter. This isn't the case for Wall Street. Henwood offers up many concrete and plausible solutions. Finally at one point asserting that an authentic financial transformation must be made along with an attack on capitalist social power in general.

Illuminating

Published by Thriftbooks.com User , 22 years ago

Critics of America's financial system (capitalism) have pointed to economic deficiencies such as recessions, depressions, unemployment (and underemployment) and so forth as cracks in the system, and with a lot of these cracks popping up recently I've become more interested in the financial system and what's wrong with it. Doug Henwood's book "Wall Street" is very helpful in that respect. We also see a picture of economic history that for some reason we don't see in the news much: over the past thirty years, hours worked have increased, productivity has increased enormously, wealth for the rich has increased enormously but household debt has exploded as hourly wages (inflation-adjusted) have fallen. This is a very interesting trend which I didn't even know about until I read Henwood's book. I guess I'd heard people mention it in passing, but until he lays out the data, where it came from (BLS, Federal Reserve, NBER etc.), puts it on charts etc. it doesn't really hit you as being real as opposed to rhetoric.Economic books can be dry reading, thus Henwood's wit helps make the reading more enjoyable. Henwood's sympathies also seem to lay with working class people over the rich who the financial markets usually serve, which makes reading easier as well as I don't have to read every passage critically wondering if he is trying to BS me into believing something that's against my interest to believe. This book got me interested in Henwood's other ventures - his newsletter, magazine, radio show, web site, mailing list etc. and they are all interesting as well. I hope every American reads this so they can understand better how this economic system works - after all, the fact that you spend most of your time in life working in order to get money means that *understanding* how money works is one of the more important things in life, right?

An informed view of Wall Street from a leftist perspective

Published by Thriftbooks.com User , 23 years ago

I have worked on Wall Street and I have to say this gives a pretty decent macroeconomic view of Wall Street. He explains stocks, bonds, derivatives, currencies, the Federal Reserve, Bretton Woods, the (in)efficiency of markets and many other topics. He then interprets what these things mean from a leftist perspective. The financial world is heavily right wing and accuses the left wing of not understanding how economics work and thus why the right wing is right about economics. This book will demystify acronyms like LIBOR, GDP and CAPM, and explain to you in Wall Street terminology how the rich are robbing the working class in this country (and the world) blind. Henwood's book, like Marx's Capital, is at heart an economic treatise with political ideas sandwiched in between the economic data and analysis. I said at the beginning I have worked on Wall Street and that is the truth - once you see the machine up close, or even become a cog in the machine, you realize how right people like Mr. Henwood really are.

impressive critique of stock markets

Published by Thriftbooks.com User , 27 years ago

This is an impressive book; well researched, written in a detached and scholarly way, yet full of humour, it convincingly shatters most of the myths that have shaped economic policy in the world since the mid-seventies. Henwood claims, supported by a lot of evidence, that stockmarkets fulfill no useful purpose as far as production of real goods and services is concerned; we could abolish them with no loss for the economic well-being of society. More: he demonstrates that the enhanced power of stockmarket investors over corporations - a phenomenon that goes back to the mid-seventies, for until then American capitalism was content, for all practical purposes, to leave control to managers - had disastrous consequences for the standard of living of employees (i.e. most of the population): reduced growth and investment rates, massive layoffs, shrinking wages, etc. This, of course, had already been stated in dozens of other books on the subjects of Wall Street, Corporate America, Reaganism,etc; but Mr. Henwood goes far beyond the mere "corporate trashing" shool of litterature. He introduces the hipothesis that the abandonement of keynesianism - and the consequent adoption of monetarism - as the main doctrine in the academic and economic policy centers of the western word since the seventies was a direct consequence of a new political and ideological strategy of American and European elites: faced with the growing confidence of an increasingly restless and uncontrollable working class "pampered" by decades of growth, full employment and a welfare net that gave "them" a sense of security and empowerment, the ruling classes of the West slowly but effectively began to implement a cure of austerity. Clamping down on demand because of supposedly "high" prices, increasing interest rates, reducing deficits, striving to reach a "natural" rate of unemployment that meant throwing thousands on the dole queues - all in the name of the new economic ortodoxy of monetarism - slowly eroded the economic and consequently also the political power of non-elites. No wonder then if the nineties have been a decade of undisputed rule by corporate and financial elites on both sides of the Atlantic. Mr. Henwood concludes his book with a few Keynesian prescriptions (do's and dont's) to overcome the present situation: don't privatise social security, tax wealth (like Switzerland presently does, as he reminds us), tax currency transactions and stockmarket investments, above all go for a policy of growth and full employment. There are, he says, no sound economic reasons not to follow this line of action, but of course elites will do everything in their (enormous) power to prevent a return to any form of Keynesianism, however mild. Henwood's analysis and conclusions are thus really an Appeal to Reason: a world where the ideas of Keynes are seen by the establisment as a dangerous form of radicalism must no doubt be out of its mind.

An insider's expose of the markets & the market

Published by Thriftbooks.com User , 27 years ago

Wall Street is that most rare thing, a critique of capitalism that knows what it is talking about. Doug Henwood has been writing about Wall Street for some time. He produces the Left Business Observer, subtitled 'accumulation and its discontents', which looks like a cross between a bulletin for investors and a revolutionary manifesto. Henwood's insider knowledge of Wall Street means that he can be as radical as he likes, without being shrugged off as inconsequential. Henwood is scathing about the idea that the stock market and its financial off-shoots exist to mobilise resources for production. As he points out, that is not what they have been doing. If anything the mergers and shake-outs are about taking resources out of production where profits are low. Over and over again Henwood emphasies the divergence between making money on the markets and real production. As he points out, growth in the stock exchange can as easily reflect faltering production as a boom. Henwood reports the growth of investor-power in the USA, the increasing clamour for a greater return on their stock. Astutely, he traces its origins to the first stirrings of ethical investment, when small investors first started to make their voices heard at shareholders meeting by demanding disinvestment from apartheid South Africa. But as Henwood notes, what started with the highest of intentions quickly turned into furious demands for bigger dividends, to be paid for by more lay-offs. Henwood's sources are eclectic: the most up-to-date neo-Keynesians jostle Sandor Ferenczi's psychoanalytic theories of money, Karl Marx's Capital and even the lyrics of a song by eighties punk band the Slits. But what keeps Henwood sharp is his basic intuition that it is the whole system that is at fault, not any singular feature of it. Introducing a chapter on the key players, he says that he could go on about Ivan Boesky and other disgraced traders, but that would only make the rest look artificially good. And, by way of a conclusion ('What is (not) to be done'), Henwood explains the weakness of every piecemeal scheme of reforming the markets, from ethical capitalism, to democratising the federal bank. In that spirit he knows, too that the current trend for knocking the financial markets only to praise capitalist industry must be wrong. The reason is that the perverse growth of the financial markets is a symptom of the slow-down of capitalist investment, but not its cause. James Heartfiel