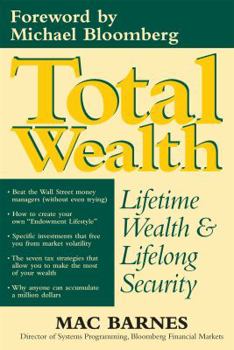

Total Wealth: Lifetime Wealth and Lifelong Security

Select Format

Select Condition

Book Overview

In Total Wealth , Bloomberg partner Mac Barnes shows you the secrets to earning money the easy way, the surefire way, the way that can make every person a millionaire. You want the knowledge that makes Wall Street giants? You're holding it in your hands.

Format:Hardcover

Language:English

ISBN:0895262355

ISBN13:9780895262356

Release Date:February 2001

Publisher:Regnery Publishing

Length:242 Pages

Weight:1.11 lbs.

Dimensions:0.9" x 6.4" x 9.3"

Customer Reviews

4 ratings

Helpful

Published by Thriftbooks.com User , 19 years ago

Although this book repeats the "invest in index funds for the long haul" approach, which is well covered in other books like "The Four Pillars of Investing" by William Bernstein, I think this books most helpful contribution is in its practical application of how lifestyle and investing impact one another. The dilemma that the author addresses is one where we have to choose whether to spend our money or to save and invest our money, and his solution is that you can do both by using debt while keeping your money invested. The book unifies investing strategy with debt strategy via its "Personal Endowment Account" approach, which boils down to "keep all your money invested in index funds, which historically have generated total returns (which is equal to price appreciation plus portfolio size growth via dividends resulting in compound growth) of around 14%, while funding your lifestyle needs (e.g., house, car, college, etc.) via debt at a lower interest rate, so that the net result is positive growth." Keeping your money invested also helps insofar as it defers capital gains taxes, which positively impacts the compounding effect. The author also addresses the thorny issue of timing market entry. His solution is basically dollar cost averaging, again, not a new idea, but one that fits well in the strategy outlined in the book. Personally, I have not run across anything quite like the Personal Endowment Account concept in my readings, and I think it's a very helpful concept, since most investing books just talk about investing, but don't really touch on the reality that living costs money. This book bridges these two aspects of personal finance. Also, I like his conservative approach, which is that you don't take out debt in excess of the amounts invested in your Personal Endowment Account, which makes for disciplined spending and borrowing.

Good stuff!

Published by Thriftbooks.com User , 21 years ago

This book has reiterated what I have read in many places,including fool.com, which is that the safest and highest returning longterm investment is equity index funds. Mac Barnes' book gives the graphs of the history of market performance in order to support his argument that passively investing in index mutual funds will have you beating 93% of actively managed funds (after taking into consideration taxes and management fees). He also makes the point that the S & P 500 is made up of the 'leaders' of the market, and so it is the best investment. (better than, say, a total market fund such as Wilshire 5000). My only complaint is that he doesn't clearly explain what he means at the beginning of the book when he says things like "Imagine if all the cars you ever owned (or will own), plus your house, plus other major expenses were all in your PEA (personal endowment account) compounding for life?" What he is trying to say (and eventually does) is that if you have any free cash, it should be invested in the market. You shouldn't pay cash for your house, cars, or anything you can buy on credit at a reasonable interest rate. (less than the expected rate of return in the market) This is an important concept, and the most original one in the book. He should emphasize it clearly earlier in the book. The only other complaint I have is that he barely touches on IRA's and 401K's. He assumes that your long term investment is made either in addition to, or instead of within a retirement fund. He DOES say you should obtain all possible matching funds from your employer as part of a 401K. But, besides that, he doesn't get into many of the advantages or disadvantages of using retirement accounts as part of an overall wealth building plan. Besides that, this was a great common-sense level book with simple math in the examples, and no confusing technical jargon. The plan does assume you will be working for most of your life, and that you don't intend to use the profits of your investments as near term income. Obviously, you have to be able to make payments on any loans or mortgages until they are repaid. Ideally, you also have more money to continue contributing into the fund, as well. I think this book is especially useful for young people who have lots of time, and few financial commitments. The crux of this book is especially if you have lots of time, put anything you can into the market as soon as possible.

Beating the pros, made simple

Published by Thriftbooks.com User , 22 years ago

Here's a book that insults all guru's in the market. 93% of all mutual fund managers have failed to beat the index, so Mac Barnes says, 'why try?' Invest for the long haul and don't bother watching CNBC. You will win. He also gives keen insight in other financial matters that I never considered, such as 'to lease or borrow.' You will be shocked at the conclusion. Mac isn't trying to wow you with great strategies and concepts. Just keep it simple, more simple than you ever realized. Excellent book. I did not put it down (and I am a financial consultant).

A thoughtful book on a pleasant subject.

Published by Thriftbooks.com User , 23 years ago

This book tells how to manage your financial life. Although it is full of sage, practical advice, it is really a book of ideas. It is written with a light touch and is a pleasure to read. The ideas in the book are based on a few principles: 1) stocks produce handsome returns (at least they have for the past two hundred years); 2) the risk of investing in stocks is not terribly great if you go about it the right way and your time horizon is reasonably long; 3) capital appreciation is not taxed until it is realized; and 4) an index fund provides a good vehicle for most people to participate in the stock market. From these principles Barnes argues that you should create for yourself a "personal endowment account" (PEA) and invest it in an index fund with the intention of never touching it. Furthermore, once you have set aside enough cash to cover upcoming expenses and emergencies, you want to put as much as possible into your PEA and let it grow. How to evaluate the risks associated with your investment and your lifestyle is discussed very thoughtfully. Beyond that, much of the book is devoted to finding clever ways to put as much money as possible into the PEA and clever ways to avoid having to take it out. Most people can put much more money to work for much longer than they would ever have imagined before reading this book. That is the road to Total Wealth.