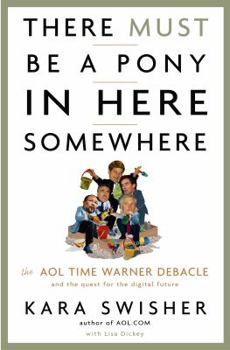

There Must Be a Pony in Here Somewhere: The AOL Time Warner Debacle and the Quest for a Digital Future

Select Format

Select Condition

Book Overview

"AOL had found itself at the edge of disaster so frequently that one of its first executives, a brassy Vietnam veteran and restaurateur named Jim Kimsey, had taken the punch line of an old joke... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1400049636

ISBN13:9781400049639

Release Date:October 2003

Publisher:Crown Business

Length:320 Pages

Weight:1.53 lbs.

Dimensions:9.6" x 1.1" x 6.4"

Customer Reviews

5 ratings

This is not just about AOL

Published by Thriftbooks.com User , 20 years ago

Swisher is a remarkable writer. She is able to capture the personalities, hubris, technological hype, and all the other elements that went into one of the worst merger deals in history. She has a remarkable ability to capture both the substance of the deal points, how both entities came to the position that they did and yet offer larger lessons on corporate America. The book is entertaining and instructive. It would be a great read if you are interested in any of the following topics - the internet bubble, corporate egos, corporate finance, the new versus the old media or if you simply want to read a very entertaining book.

The story of people behind the rise and fall of AOL

Published by Thriftbooks.com User , 21 years ago

This book chronicles the saga of the much maligned merger between AOL and Time Warner. A deal that exemplifies the era of dot.com speculations, shady accounting, and wealth created by the absurd free-for-all that was the mid to late `90's. When the bottom dropped out of the dot.com boom the merger left few standing and the biggest single financial loss in corporate history. The book looks at the storied and unlikely emergence of AOL, through an often dizzying and phoenix-like rising from the ashes of one failed concept after another. Throughout, the narcissistic antics of the leaders of the company are legendary. David Colburn, the famed deal maker at AOL, used particularly colorful language in his wholesale assault on those he sought to best (Page 46), never content to merely close a deal but demoralize people in the process. He is but one of the many examples. Time Warner head Jerry Levin, who took most of the blame for the disastrous merger, was himself a study in what happens when leaders insulate themselves from feedback. The sections on Levin are perhaps the most interesting. Devastated by the murder of his son, and the events of 9-11, Levin occasionally demonstrated "jerry mcguire-esqe" moments of humanity, including a plea for the organization to dedicate itself to serving the public good. (Page 207) A plea that was met by outright hostility as it was timed with the release of the admission that the new AOL-Time-Warner would miss all of its projected financials. Steve Case, himself a unique individual, is profiled as an enigma. Both eventually take the fall for the financial debacle. Throughout the book the author provides powerful, yet subtle, glimpses of how real life values and meaning intercede in the "hamster on a wheel" joke that is the true character of many corporate executives. Despite the money and the power, it is clear that many of these leaders were disillusioned and left wondering what life really means. Of particular interest here is perhaps the best example ever assembled of the power of culture. The culture clash between Time and Warner was never resolved even prior to the even worse clash of the AOL deal. An executive describing the cultural issues existing at Time Warner prior to the deal underscores the magnitude of the gap: "At Warner, if you didn't make mistakes you'd be fired because you were not taking enough chances; At Time the attitude was - don't make mistakes". (Page 73) The clash with AOL was even more severe. The AOL executives were hated with a passion usually left to sports rivalries and terrorists, and often employees compared the merger to the "Nazi's invading Paris". When several key AOL leaders were ousted it was compared to the fall of the Taliban! There are simply way too many examples of failed due diligence, obviously on the financial and contractual aspects of the deal, but also on the total lack of insight into the devastating impact of the culture clash and poor integration

Wonderful, Easy to Read Perspective on AOL-Time Warner Deal

Published by Thriftbooks.com User , 22 years ago

I would get this book prior to any trip...it is well-written with an irreverent, breezy style and an eye to the clever phrase or interesting anecdote. It is fun to read. The author, Kara Swisher, not only chronicles the AOL-Time Warner transaction but also provides interesting perspective on the late 90's and early 00's. One could ask why my comments and why this particular book? The book has value in that the author lived through this period, understood the genesis of the acquiring company, AOL, and importantly, was a keen observer of Time Warner (including its key players, Jerry Levin and Ted Turner among others) and the transaction that took place. To give you a sense of her style and perspective, she describes the merger as " a company without any assets acquiring a company without a clue."What makes the book worthwhile is the author, her style and most importantly, the relationships she established with almost all of the main players. She had extraordinary access to them over time and they were comfortable enough with her to provide their own perspectives in something other than a self serving manner. There are no heroes only fools, some more gullible than others.Buy it, you'll enjoy it and you will remember to look for Kara Swisher's by-line when you next read the Wall Street Journal.

Excellent account of the AOL - Time Warner merger.

Published by Thriftbooks.com User , 22 years ago

This is a very good book on the AOL Time Warner merger. This merger is unusual, because it is the acquirer (AOL) that got weakened much more than the acquired (Time Warner). Also interesting, it is not so obvious why that was the case. Right after the merger, the AOL executives got the upper hand over the Time Warner ones. This was logical, and was a confirmation of who bought up whom. So, given that the AOL executives had the upper hand, and that AOL was doing great before the merger, what triggered the demise of the company post merger? The author makes a well detailed and successful case that the unraveling of AOL was associated with the bitterness of the Time Warner executives as the result of not being treated as equals. As a result, they conducted a quiet mutiny by consciously underperforming on all the projects and ventures related to AOL. And, they succeeded marvelously. The author also makes a case that AOL is not over. And, that it has still a bright future within the internet and technology domain. Here the author is on much thinner ice. Her case is more about subjectivity and personal likings than anything else. Nevertheless, this book is overall an excellent and easy read. The author style is very lively and makes for a fast page turner. It is also very personal. She seems to know and meet everyone in the industry and have interesting personal opinions on them all. This renders the book so much more interesting then just an extended Harvard case study which so many books of this type end up becoming.

It's about more than just AOL

Published by Thriftbooks.com User , 22 years ago

This is more than a page-turner about the ill fated deal. Ordinarily an objective reporter, Swisher gives her prescription for redeeming the consumer friendliness of the AOL Internet service -- abandoned by its management for deals: "advertising" and positioning deals with upstart dot coms needing IPO credibility; and the calculated megadeal of putting Time Warner's valuable "traditional" media assets under the dot com "bubble". Inadvertently, Swisher also makes another important point: believe what you read, but be skeptical about believing it as truth. Thanks to her superlative reporting for the Wall Street Journal out of Silicon Valley, the "street" (if not the public) understood the radical importance of the Internet, but lost its critical faculties about which players had real businesses. Concurrently, Time Inc.'s "Fortune" magazine also chronicled many newsworthy Internet stories. Too many must have believed the media hype, and regrettably, too many entrepreneurs crashed when reality set in. Swisher tells the AOL Time Warner story thoroughly and dramatically. Her book should be required reading in business schools.