You Might Also Enjoy

Book Overview

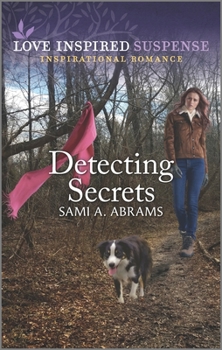

Tracking the scents of the missing might be the only way to save them. Partnered with her air-scent dog and Sheriff Dennis Monroe, marriage and family therapist Charlotte Bradley is desperate to put an end to a black-market baby smuggling ring in Anderson County. Who is kidnapping the pregnant girls she counsels and taking their babies? As Charlotte searches for answers, she and Dennis must dodge gunfire and deadly attacks. But the sinister agenda they uncover just might include her. From Love Inspired Suspense: Courage. Danger. Faith. Deputies of Anderson County Book 1: Buried Cold Case Secrets

Book 2: Twin Murder Mix-Up

Book 3: Detecting Secrets

Book 2: Twin Murder Mix-Up

Book 3: Detecting Secrets

Format:Mass Market Paperback

Language:English

ISBN:1335587586

ISBN13:9781335587589

Release Date:February 2023

Publisher:Love Inspired Suspense

Length:224 Pages

Weight:0.30 lbs.

Dimensions:1.0" x 4.3" x 6.2"

Related Subjects

Business Business & Investing Economics Introduction Investing Personal Finance Popular EconomicsCustomer Reviews

5 customer ratings | 4 reviews

Rated 5 starsLoved this book, and highly recommend it!

By Nikita Wells,

This is the second book I've read by Sami Abrams, and it's just as good as her last one! This book features Charlotte Bradley, a therapist who counsels families, helps out at her local pregnancy center and also works part time as a search and rescue handler with her sweet dog Theo. She works together with the local sheriff Dennis Monroe (who's pretty sweet himself lol) on a case involving the disappearance of a young pregnant...

0Report