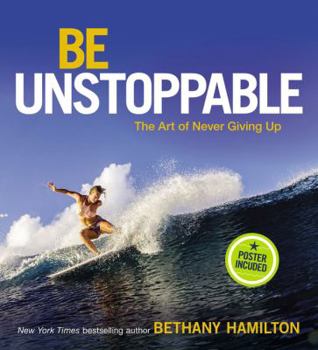

Be Unstoppable: The Art of Never Giving Up

Select Format

Select Condition

You Might Also Enjoy

Book Overview

Showcasing page after page of breathtaking photos and life-changing inspiration from champion surfer and Christian role model Bethany Hamilton, Be Unstoppable is a beautiful gift of encouragement for any young adult to boldly follow your passions, live in faith, and be unstoppable as well.

After losing her left arm to a 14-foot tiger shark and returning to the competitive surfing waters a month later, New York Times bestselling author and champion surfer Bethany Hamilton is the heroine in one of the biggest comeback stories of our era.

In Be Unstoppable, Bethany shares how faith, love, and passion have been the fuel to push her beyond all expectations. Alongside her insights are spectacular, full-color photos of Bethany the world-class surfer in action, capturing both her mastery of her sport as well as the beauty and raw power of the ocean.

Whether in school, sports, faith, or friendships, the tenacity, courage, and wisdom that pops from these pages will help you find the unstoppable in your own life.

Be bold. Be inspired. Be unstoppable.

Be Unstoppable:

Features the inspirational words of sought-after public speaker, champion surfer, and spiritual icon Bethany HamiltonIncludes more than 60 breathtaking photos from the making of her new documentary, Bethany Hamilton: UnstoppableCaptures Bethany's sense of wonder and adventure throughout every pageIs a full-color, giftable photo book with a decorated coverCustomer Reviews

Rated 5 starsRead it...

If you are interested in shamanic subjects & are reading people like John Perkins and Carlos Castaneda, then you will want to read this.... which pre-dates those. This is a story not an essay or direct teaching, but understandings are there for the taking. I come away from this book (read in one day) appreciative but also with a vague wondering if the story is exactly as it seems... did it really happen? does it...

0Report