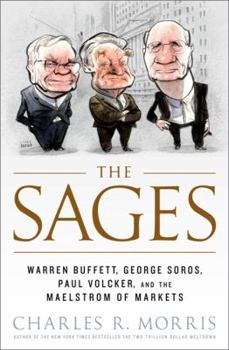

The Sages: Warren Buffett, George Soros, Paul Volcker, and the Maelstrom of Markets

Select Format

Select Condition

Book Overview

Throughout the violent financial disruptions of the past several years, three men have stood out as beacons of judgment and wisdom: Warren Buffett, George Soros, and Paul Volcker. Though their... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1586487523

ISBN13:9781586487522

Release Date:June 2009

Publisher:PublicAffairs

Length:201 Pages

Weight:0.70 lbs.

Dimensions:0.8" x 5.6" x 8.3"

Customer Reviews

5 ratings

Insightful and provocative

Published by Thriftbooks.com User , 15 years ago

Morris speaks from a deep background in economic theory and analysis. His insightful recounting of both people and events in recent financial markets is provocative. He relates his subjects' unique vision and interpretation of financial market cycles in an interesting and easy to understand way.

The three sages dance to their own music

Published by Thriftbooks.com User , 15 years ago

Morris does a nice job summarizing some of their key accomplishments. While doing that, the reader will learn about some important events in the past forty years or so. The book is divided into four chapters. One chapter is dedicated to each sage and the final chapter is some of the author's thoughts and insights on capitalism and the markets. He interviewed Soros and Volcker but did not have direct access to Buffett. This is not a light read. Like his previous book, "Trillion Dollar Meltdown", background knowledge of finance and economics makes the reader appreciate the book more. The casual reader who wants to learn about these three important figures may get confused at some of the more intricate financial parts of the book. I greatly respect the three sages but I disagree with the author that the three saw the 2008 crisis coming. While they might have known that we were on a path of destruction, even they did not know how and when it would manifest itself in the real world. If they did, you can be sure that Soros and Buffett would have made billions more than they did at that time. Soros has written many books. Morris summarizes Soros' philosophies on philanthropy and investing. Large section is dedicated to recounting Soros' one year diary in the 1980's. Unlike, Buffett, Soros' investing strategies are mysterious. Aside from very general theories and thoughts, Soros has not described how he goes about making investing decisions. Soros' son even acknowledges that his father's back pain may influence his investing decisions more than anything else. I am skeptical of his son's anecdote (which Soros, himself, does not deny) given Soros' amazing success. I have read extensively on Buffett so I got very little out of that chapter, but if you know little about Buffett, then you may find it worthwhile. This chapter is based on what has already been written about Buffett and his own letters to Berkshire Hathaway shareholders. If you have read Schroeder's "Snowball", then perhaps you, too will find little new in this section. I got the most out of the Volcker section mostly because I knew least about him. Morris' account of how Volcker managed to break inflation was interesting. He takes you behind the scenes of the Fed at the time.

What went wrong: in the eyes of the wise men

Published by Thriftbooks.com User , 15 years ago

This book gives us a short biography of three of the most successful financial figures of the last 20th and early 21st century: George Soros, Warren Buffet and Paul Volcker. The first two are billionaires, with a decades long run of success in the markets. The third was the Federal Reserve chief who, under Reagan, broke inflation and restored our economy to strength in the 1980s. Except the book really is not about the men. The book is really about the economic crisis. Using the three men, their careers and their insights, as a narrative device, Morris gives us a quick and lucid overview of the economic ups and downs of the last thirty years. The moral of the story is fairly straightforward. For our economy to succeed, we need to stick to creating value. America went badly wrong in the last ten years by letting itself be seduced by the promises of rapid wealth based on Wall Street tricks and financial flim-flam rather than actually producing goods and services that people want, for less money than the competiton produces them. The three figures are very different. Soros darts in and out of the market, riding the ups and downs of market fashion like a surfer. He is successful, because he understands how volatile the market is and the forces, both rational and irrational, that move it. Buffett is the polar opposite of Soros. He looks for undervalued companies, with long-term value. He buys for long periods of time. What Soros and Buffett both have in common is not buying the lastest fashionable nonsense from Wall Street. Soros makes money off the fact that other idiots buy into fashion and so produce violent market swings; Buffett makes money by looking for real value, which fashion disdains. And Volcker is not a financer. He is a career public servant known for total integrity. This is a very good book. The three figures all can see reality. By giving us their collective vision, Morris shows us, quickly and effectively, what is so wrong with the recent economic idiocies.

wisdom of the sages

Published by Thriftbooks.com User , 15 years ago

This book on the "longest recession in postwar history," is made up of three biographical essays about three men who have lived this and previous economic disasters of recent times: Buffet, Soros, and Volcker. Warren Buffet and George Soros are consummate investors; Economist Paul Volcker is a crisis-solver - an inflation slayer, more graphically. The author wants to understand from these VIPs how and why most experts failed, and only a few succeeded, to see the coming of this near-depression recession. Other experts like Paul Krugman have offered their explanations. What is new in this book is that Soros has warned of the gathering "'superbubble' in the 1990s (p. viii)." Buffet worried about financial excesses even earlier than Soros. Apparently close friendly and colleagues have known for a long time of Volcker's concerns about the states of the US and global economies, but the ex-Fed Chairman kept quiet because he did not want his worries to undermine the authority of his successor. Why did these men see what many didn't see? - because they are not dogmatists; they are commonsense pragmatists. Instead of allowing blind fixation with quantitative idiocy of late, the three VIPs avoided dogma with high integrity and preparedness to accept mistakes and to move on with enthusiasm. History is part teacher and part cheerleader here. Volcker saw the strengths and weaknesses of Keynesian policy in dealing with the inflation of the 1965-1980. Soros and Buffet made billions of dollars in good and bad economic times. All three sages respect free markets, but they also understand that freedom has its limits. Ideal efficient markets assume a statistical person pursuing her/his self-interests (maximum satisfaction = utility). Unfortunately application of that model to real life is a folly, because financial markets play dice with other people's money. If you like historical biographies, you will love this book. And there are new facts to learn. Did you know, for example, that Soros' Open Society organization is named after Karl Popper's book Open Society and Its Enemies (1945)"? Interesting stuff. Amavilah, Author Modeling Determinants of Income in Embedded Economies ISBN: 1600210465 ISBN: 1600210465 Quotable Arthur Schopenhauer ISBN: 9781430324959

All was well.

Published by Thriftbooks.com User , 15 years ago

This was a gift for my husband. He enjoyed it very much, and it arrived in a timely fashion. Thank you.