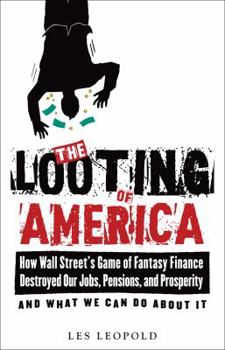

The Looting of America: How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity--And What We Can Do about It

How could the best and brightest (and most highly paid) in finance crash the global economy and then get us to bail them out as well? What caused this mess in the first place? Housing? Greed? Dumb... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:1603582053

ISBN13:9781603582056

Release Date:June 2009

Publisher:Chelsea Green Publishing Company

Length:219 Pages

Weight:0.70 lbs.

Dimensions:0.6" x 5.4" x 8.4"

Customer Reviews

5 ratings

Of all the books you might read on the financial meltdown of '08, this might be the most recent...

Published by Thriftbooks.com User , 15 years ago

...and considering it's a very well-researched book that covers all the basics of what's already known about the financial markets and the junk securities that dragged them into a black hole, that should be all you need to know. Yes, Les Leopold is a leftist and has done a lot of work for organized labor, and yes, he's an outsider to finance. But I've read a lot of material on the derivatives shell game (including Frank Partnoy's FIASCO), and Leopold gives a very even-handed presentation of what happened, how it happened, and, most importantly, since many people have a painfully oversimplified view of the situation, what exactly the problem was -- addiction to risk, systemic shell-games remniscent of the Banach-Tarski paradox (look it up, or better yet google "Arlo Lipof"), and a systemic disregard for the actual effects on Main Street (or, more specifically in this case, the town of Whitefish Bay, WI, which had bought heavily into the credit default swap market and lost big). Along the way, Leopold derives a strong rebuttal to free-market economics -- without regulation, greed will drag a free market into near-incoherence. Like many such books, it's preaching to the choir to a certain extent, but only because the free-market fundamentalists of the world really refuse to pay any recognition to criticisms of their ideas. And at the end of the day, Leopold doesn't have much new to say that hasn't already been said by other critics of the conditions that created the crash. But if you want to know the basics, or if something doesn't ring true about the push to blame the Democrats in Congress or the millions of people caught up in bad mortgages, this book is probably about the best place to start.

Unfortunately, this preaches to the choir

Published by Thriftbooks.com User , 15 years ago

Just minutes after I finished reading this I happened to be standing in a long, slow moving line at a store. Someone wondered why they didn't have more clerks working just before a long holiday weekend and the man in front of me voiced the opinion that "nobody wants to work anymore". Somehow that led us into a discussion of the Wall Street/Banking crash. His first comment was "It's Barney Frank's fault". Of course I knew he was referring to the Community Reinvestment Act. I challenged him on that, but he just got more angry. Unfortunately, attitudes like his (and the 1 star review below) are pretty common. I call it "Fox News" mentality. Nothing is going to change their minds. It's sad. The vast majority of these people aren't wealthy, but they are singing the song the wealthy want them to sing. Anyway, this is a great book. I loved the analogy to "fantasy baseball"; indeed, that's exactly what this is all about. I'd love to see some sort of multiplicative wage cap as he suggested - even if it were set at 100 times the low end it would still do good! However, any suggestion of that will just cause our Fox News loving friends to insist that doing that will just drive executive talent overseas. Of course they will have been fed that line by greedy people who actually would be affected by such a cap. I had not understood the full impact of the "CDO squared" games until I read this. I tried to explain some of that to the man I mentioned above; he'd have none of it: this was strictly from sub-prime lending to poor people and it was all Barney Frank's fault. End of discussion. It's refreshing to read someone who knows they don't have all the answers. Economics is complicated, and good intentions can lead to unexpected horrors. But, as he says, we've tried the "let the wealthy have whatever they want". That sure hasn't worked. Why don't we try not letting them have so much for a while and see what happens? It looks like a no-brainer: returning wealth to the middle and lower class would decrease welfare needs, increase demand for real goods, and increase governments overall tax take. What's not to like? Oh, yeah, the super-rich would only be "ordinary rich". Gosh, that's awful - guess we can't do that!

Read this book!!

Published by Thriftbooks.com User , 15 years ago

A must read for those of us who started to believe the worst is over. But be forewarned: this book will reawaken the anger, frustration, and fear you felt during the 2008 crash. The book clearly explains what happened and why. You'll finally be able to understand collateralized debt obligations (CDOs), credit default swaps (CDS), and all that "fantasy finance." And there's a handy glossary in case your grasp of these tricky topics starts to slip again. The book is a page-turner. There was a point where I couldn't put it down.

Elucidating

Published by Thriftbooks.com User , 15 years ago

I had read and liked Leopold's previous book about labor leader Tony Mazzochi, so was curious about this new title. This is a shorter, more compact book, but that's one of its virtues. It takes on the task of explaining what the heck just happened to our economy, and lays it all out in readable prose, carefully outlining the various shaky financial products that proved to be worthless and that somehow missed the due attention of regulators. The author does a good job of identifying both the culprits and victims of this scam, and offers a compelling explanation for why a vibrant labor movement might have helped keep the banking and corporate titans honest. This is not a happy book, because one senses the problems Leopold discusses are not going to disappear overnight. He has a very nice touch as a writer, weaving easy-to-follow examples and analogies throughout the text. But it's not "economics for dummies" by any means. He's obviously done his homework and the material has depth and intellectual heft. I'd recommend this to anyone seeking a greater understanding of the "crash of 08," and its significance for us all.

Smart, punchy, eye-opening

Published by Thriftbooks.com User , 15 years ago

An extremely lively and lucid account of the economic crisis and how we got here. Since reading it, I actually find myself able to talk coherently about credit default swaps - and that's saying something. Unbelievably, this book makes derivatives almost easy to understand. It also exposes, with lightness and humor, the high-level greed and corruption that has caused so many people to lose their homes and jobs. Bring out the pitchforks!