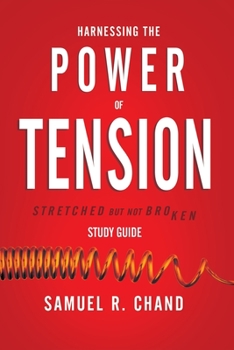

Harnessing the Power of Tension - Study Guide: Stretched but Not Broken

Select Format

Select Condition

Book Overview

We all need a little tension--or maybe a lot of it

The word tension comes from the Latin word tendere, which means "to stretch." It's not a bad thing to be stretched in our careers, our parenting, our ministries, or our leadership. Without tension, we become stagnant and stop growing. In fact, we might even say that tension is both inevitable and, in may cases, desirable in life and leadership.

In Harnessing the Power of Tension: Stretched but Not Broken, international leadership consultant Sam Chand examines tension as it arises in and between the arenas of business, church, and family. The presence of tension isn't a flaw in you, a threat from others, or a problem to solve. It's a strain to be used. When you develop this perspective, you'll experience less pressure to figure everything out and less compulsion to resolve it quickly and completely.

When we accept tension as a reality of life, we gain confidence and mental clarity when we encounter it. Our focus isn't on getting rid of tension, but using it to create something better than before. We don't walk on eggshells, afraid to say the wrong thing. We learn when to speak up, when to ask questions, when to listen, and when to let things go. As we relax in the middle of tension, we see people and situations more clearly, and we invite others into the process of creativity using tension in life and leadership.