Mastered by the CEO

(Book #4 in the Mastered By Series)

From New York Times and USA Today Bestselling Author Opal Carew Rachel Clark How did I wind up in King's bed as his sex slave? Being totally dominated by him? It all started when King bought the company I work for. The last time I was out of work-after handing King my resignation--it took two years before I found another position and I'm desperate to avoid that situation again. So now I'll do whatever I can to keep my job. But, in fact, even with me submitting to his every whim, there's no guarantee. King says I'm difficult and never do what I'm told--which is true-so is this simply penance for past sins? Or if I prove I'll follow his commands without question, will he keep me on?I don't know. And frankly, I don't care. When I'm in his arms, all I care about is staying there. Forever. But that's not an option. James "King" Taylor When I bought Bernier Electronics, I didn't know Rachel was one of the junior executives. With our history, there's no way I can keep her on. I need executives who will do as I say, not constantly question my every move. I'd like to say it's a difficult decision, but it's not. Our past has proven she won't fit in my management team. But it's never simple. When she worked for me five years ago, we had a clandestine affair. She insisted on keeping it strictly sexual, but I wanted so much more. When she left, I was devastated. Clearly, it meant more to me than it did to her. The truth is I still want her in my bed. But I won't hire her just for the sex. She insists she can change, that she'll do exactly as she's told, but I know that'll never work. Still, offering her the chance to prove herself-by becoming my submissive for an entire weekend-will prove to her it'll never work. I never dominated her when we were together before, and the mere thought has me rock-hard. I just hope I can handle losing her again after I experience the sweetness of her submission. ~~~ Receive a free read by joining the Opal Carew Reader Group.Just copy & paste this into your browser ==> OpalCarew.com/ReaderGroup ~~~ All books in the Mastered By series are stand-alone HEA stories with no cliff-hangers and can be read in any order. Other books in the Mastered By series: Played by the Master Mastered by the Boss Mastered by my Guardian Mastered by the CEO And coming soon are: Mastered by her Captor Mastered by the Sheikh Mastered by the Billionaire ~~~ Sample quotes from Mastered by the CEO: "I'm more than just the man who bought your company. You and I have history." "You never do as you're told. You always make everything so difficult." "What if I promised I would do exactly what you tell me. Without question." She locked gazes with him. "Every time." "I'll do anything to prove to you that I can follow your orders." "Stop fighting me. You know you'll lose." "Another word and I'll put you in the bedroom and lock the door." She frowned. "That would be kidnapping." He chuckled. "I doubt you'd make the charge stick." "Please, I'll do anything you want to keep my job." "What I'm proposing is that you become my sex slave for a weekend. You'll do everything I tell you without hesitation." "Rise and shine, sleepy slave. It's time for you to serve me again." "King." She smiled. "I was dreaming about you. It was a very hot dream."

Format:Paperback

Language:English

ISBN:1530193966

ISBN13:9781530193967

Release Date:April 2016

Publisher:Createspace Independent Publishing Platform

Length:126 Pages

Weight:0.40 lbs.

Dimensions:0.3" x 5.0" x 8.0"

You Might Also Enjoy

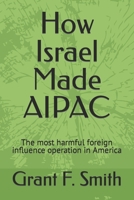

More by Grant F. Smith

Customer Reviews

6 customer ratings | 5 reviews

There are currently no reviews. Be the first to review this work.