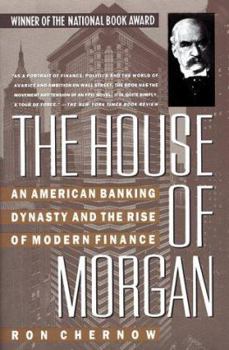

The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance

Select Format

Select Condition

Book Overview

The most ambitious history ever written about an American banking dynasty, The House of Morgan traces the astonishing path of the J.P. Morgan empire with the sweep of an epic novel. "Brilliantly... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0671734008

ISBN13:9780671734008

Release Date:January 1991

Publisher:Simon & Schuster

Length:812 Pages

Weight:2.45 lbs.

Dimensions:1.9" x 6.1" x 9.2"

Customer Reviews

6 ratings

Misleading

Published by Jean , 1 year ago

My only gripe is that the description was a "Like new" book. This book however has gone through the ringer. Cracks and scratches everywhere. Stains everywhere, bent. Would not have bought the book. The content itself is wonderful.

Stick With it, You'll Be Pleased

Published by Thriftbooks.com User , 21 years ago

"The House of Morgan" is one of the best business biography books I've ever read. It is an unbelievably comprehensive piece of research work on an important banking history in the United States. The stories of the people behind JP Morgan & Co give readers so much hopes and belief that anything is possible in your life. Mr. Chernow covers the company's historical and current background in great detail. He also presents a more technical view on what happen in the cycles of US economy that spans over many decades. What I like most about the book is the coverage of individuals involved in building and leading the firms (JP Morgan and Morgan Stanley). These groups of talented individuals are amazing leaders whose stories are worth reading. I thought that the first 40 pages were pretty slow, but the actions did pick up real soon. By the 700th page, I was hoping there would be a second book written on the House of Morgan. I was especially impressed with Mr. Thomas Lamont that I proceeded to read a separate biography on him. I loved the book so much that I went on to buy some other books related to it - (RJR Nabisco story on Leverage Buyout and The Chief: The Life of William Randolph Hearst). It's a thick book but it's really worth the time to read. You'll be pleased with yourself!

Sympathy for the baron

Published by Thriftbooks.com User , 22 years ago

No one writes about the history of modern finance better than Chernow and this is the biggest story of modern finance. What else do you need to know?The only downside for me was that the book¡¯s most compelling character, old red nose himself, dies a third of the way into the history, leaving us with a procession of interesting but by no means fascinating individuals to carry us through to the roaring 1980s. This is not to fault Chernow. He makes his aim clear from the start: to write about Morgan and the financial universe he helped create. He never pretends this is a tell-all about J.P. and his infamous philandering, temper and power-brokering, (though there was more than enough juicy tidbits to keep the pages turning). Most fascinating of all was Chernow's sympathetic portrayal of J.P. as a reluctant master of the universe, someone who took control of disorderly and scandal-ridden U.S. financial market to tame them and bring honor to the upstart United States of America. It was quite touching. Not what I expected when I picked up the story of America's most infamous robber baron. We could use someone like him today.

Possibly the best business history ever written

Published by Thriftbooks.com User , 24 years ago

Ron Chernow's "The House of Morgan" is both an engaging history of the Morgan banks and a brilliant account of the growth of global finance from Victorian times through the late 1980's. It's every bit as enjoyable as Chernow's "The Warburgs," but provides a better analysis than the Warburg book of key business and political developments of the 20th century. No one should be intimidated by this book's length or the complexity of its subject. Its pages are rich with lively portraits of the sometimes quirky men who ran the Morgan banks, the high and mighty of the world with whom they did business, and the world's many critics of such concentrated economic might. Pierpont and Jack Morgan and their successors at the top get the most detailed treatment, but figures as diverse as Brandeis, Mussolini, Lindbergh (the son-in-law of a top Morgan partner), Bryan, Theodore Roosevelt and Margaret Thatcher all play a part in the story, not to mention interesting but lesser-known figures like Ferdinand Pecora, Judge Harold Medina and central bankers from Britain, Germany, Italy and Japan. As a backdrop to the Morgan saga, this book includes accounts of the main events of 20th-century financial history, such as the Panic of 1907, the creation of the Federal Reserve system, the Crash of 1929 and the depression and bank failures that followed it, the New Dealers' attack on banks led by Pecora that resulted in the Glass-Steagall Act and the separation of commercial banking from investment banking, and the rise of hostile takeovers, Eurodollars, petrodollars, Latin American lending, junk bonds and the securitization of debt, all refreshingly written for laymen rather than experts. "The House of Morgan" has perhaps two overriding themes. The first is that as the years have passed, and the Morgan banks have faced increasing competition, the Morgan bankers' need to maintain their global preeminence has led them to take bigger and bigger risks. Some of these risks have resulted in large financial loss, but more often they have resulted in a loss of both public and customers' confidence, which has eroded the very preeminence that the banks seek to maintain. The second theme is that the top Morgan bankers have consistently underestimated the power of government to control what they do, and even make their lives miserable. From Pierpont on down, they have ignored government at their peril. It's almost a certainty that with the next big economic downturn, the Morgan banks will be attacked again, and I hope that Chernow will be on the scene to provide an account of it.

Those were the days

Published by Thriftbooks.com User , 24 years ago

Was it the writing or the main character that made this a fascinating read? answer- both! Chernow brought the character and his environment alive(early 20th Century New York merchant society),and what a character JP Morgan was! I read this book some years ago and what has remained with me ever since is the image of JP Morgan as a somewhat reluctant Titan. Sure he was larger than life and his famous piercing stare DOES come through in the photographs. You can easily imagine people hustling out of his way as he strode down Wall Street. Yet Chernow does a good job of humanizing the man, explaining clearly that he really had no choice (family upbringing, apprenticeship, business inheritance) all worked to make JP Morgan what he was. What also comes across is the fact that the Financial world at the time almost demanded and needed a JP Morgan. The early pioneering days of Wall street are vividly portrayed.JP Morgan's role in leading, cajoling, directing and bullying where necessary,to ensure that industries and markets developed - is explained clearly. You certainly get the sense that the man understood the times and took seriously his responsibility as a person of influence and power. Greed, surprisingly to me, does not seem to be a major factor in explaining JP Morgan. All in all an interesting insight into a bygone era and a fascinating character.

One of the great books of business history

Published by Thriftbooks.com User , 25 years ago

A terrific read!Ron Chernow does an excellent job in reviewing the life of the greatest American financier and the legacy he created. A must read for anyone interested in the history of investment banking and how America took away the mantle as the financial center of the world away from Europe this century. Highly recommended.