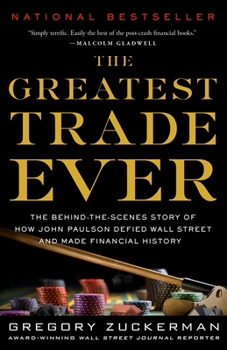

The Greatest Trade Ever: The Behind-The-Scenes Story of How John Paulson Defied Wall Street and Made Financial History

Select Format

Select Condition

Book Overview

In 2006, hedge fund manager John Paulson realized something few others suspected--that the housing market and the value of subprime mortgages were grossly inflated and headed for a major fall. Paulson's background was in mergers and acquisitions, however, and he knew little about real estate or how to wager against housing. He had spent a career as an also-ran on Wall Street. But Paulson was convinced this was his chance to make his mark. He just...

Format:Paperback

Language:English

ISBN:0385529945

ISBN13:9780385529945

Release Date:December 2010

Publisher:Crown Currency

Length:320 Pages

Weight:0.59 lbs.

Dimensions:0.7" x 5.3" x 8.0"

Customer Reviews

4 ratings

A great Wall Street saga...

Published by Thriftbooks.com User , 15 years ago

Apparently Michael Moore had trouble finding someone able to explain the nature of the now-infamous credit default swaps to him, if you believe Moore's latest film about the Wall Street apocalypse. All I can say is that it's too bad he didn't have Greg Zuckerman's phone number. Five minutes, and I guarantee that Zuckerman could explain the raison d'etre and basic functions of these credit derivatives. But that's because Zuckerman is a smart financial journalist, one who would rather explore what is really going on behind the scenes on Wall Street -- getting to know the people and understand the products and strategies that led to the recent debacle -- and generate 'scoops' that way rather than chase the story only after it has blown up. He's the kind of financial journalist that even Jon Stewart, with all his scorn for CNBC, could or should admire. And in this narrative, Zuckerman takes us beyond the world inhabited by the likes of Lehman Brothers' Dick Fuld, Jimmy Cayne of Bear Stearns and Lloyd Blankfein of Goldman Sachs, to the hidden corners of Wall Street, where a handful of folks who were decidedly NOT household names until 2007 were coming to question the business that was responsible for an ever-greater proportion of profits at nearly every investment bank and financial institution. How, they wondered, could so many people be so bullish about the housing market when it seemed so clear (as mortgage originators rushed to finance outsize home loans to people with no jobs, no credit history and no downpayment) that disaster was just around the corner? Perhaps because they were outsiders -- as Zuckerman deftly shows us -- they were in a unique position to criticize and, more importantly, to act on their conviction that something was seriously amiss. John Paulson, who by 2008 would be a multi-billionaire and arguably the most important hedge fund manager since George Soros won billions betting against the Bank of England decades earlier, was a hedge fund outsider who had, until very recently, scrambled to be taken seriously by his own investors. With the help of Paolo Pellegrini, a failed investment banker, he put together the 'greatest trade' of the title -- a bearish bet on the housing industry and the financial services companies supporting it. Some put 'the greatest trade' in place too early and lost out because they couldn't afford to stay in the game long enough for it to pay off -- revealing another truth of the way financial markets and bubbles function. Others, like Paulson and Greg Lippman -- a Deutsche Bank trader who never really fit in on the trading desk and never could even fake an interest in sports -- would stake their personal and professional futures on believing that they were right and that the bubble was about to burst, even as the rest of Wall Street derided them. This is the book to turn to for real insight on how Wall Street works, particularly when it comes to grasping the important and convoluted links between hed

Fantastic Read!

Published by Thriftbooks.com User , 15 years ago

This is an incredible book about John Paulson, and in general, the trade against the housing market. This is a great read for anyone who is interested in how an investment thesis is constructed and executed. There were two pleasant surprises of the book: 1. Cast of Characters - How different investors, besides John Paulson, also saw the similar trade opportunity and went for it. As the crisis unfolded John Paulson, George Soros and a host of other investors were revealed to have been shorting the housing market. The surprise was learning about the host of other, "unknown" investors from a medical school dropout to a cocky Deutsche Bank trader to wealthy real-estate mogul to a recently graduated MBA, each of whom recognized the crisis before most others and were able to trade against the rest of the investment community. 2. The transformation of John Paulson - He was initially described someone who was smart, but not as someone who always "had to be the best" or a natural leader; in other words he was not the classic alpha male. John Paulson was portrayed as a random i-banker with awkward communication skills, a weak handshake and an affinity for the NYC club scene. Many actually saw his career as stalled and unexceptional. The book is very good at showing how he transformed himself from a run of the mill finance professional to someone whose ambition grew and grew....and once he saw the opportunity he calmly executed his trade and transformed his life. (A small side note...this is also the one of the best books describing the technical terms of the housing crisis (e.g. CDS, MBS).) Finally, even though the ending is essentially known (the collapse of the housing market), the description and narrative of the sequence of events is riveting. A great read for anyone interested in finance, the markets, and the real estate crash.

Excellent read, excellent education on a complicated subject. FASCINATING!

Published by Thriftbooks.com User , 15 years ago

I just began reading this book and I can't put it down. I am not in the field of finance and have always been a bit intimidated by it as a result of my ignorance, but once I read the introduction and began to read the book, I find the basics of investing as well as the events leading up to the recent economic breakdown and Paulson's unbelievable trade, laid out in a clear, thoughtful, concise, and intriguing manner. Zuckerman writes with the skill of a seasoned finance intellectual combined with the style and savvy of someone who makes it his business to keep on top of current events and the goings on in the tumultuous social world of finance, and shows how it all ties together. At the same time, Zuckerman puts Regular Joe at ease, maintaining his interest with writing and details that are anything but dry. I am enjoying the book thoroughly and you will too!

Right place, right time

Published by Thriftbooks.com User , 15 years ago

The Greatest Trade Ever is a peek behind the curtain that veils the inner working of Wall Street. The plot centers around the capitalization of John Paulson and others on the demise of the subprime market. While Paulson has risen to somewhat god-like status on Wall Street, this book portrays him as the tortoise- sticking to the tried and true while everyone else was losing their heads trying to milk the real estate bubble. Paulson wasn't always perceived as the guy to watch. This book follows the rise of his star as he predicts the subprime crisis. Zuckerman does an excellent job of fleshing out the man behind the legend. Rather than exacting financial heroics, Zuckerman's portrayal of Paulson shows his determined pursuit of the tried and true methods which ultimately lead to success and notoriety. In the beginning, Paulson comes off somewhat bland and staid- a stick-to-the-stats kinda guy... that eventually lands him billions of dollars. I think what made this so intriguing was Zuckerman's interviews and direct insider access. The reader gets to follow the execution of, literally, the greatest trade ever. We also get a close-to-the-ground view of the machinations of Wall Street which is fascinating in and of itself. What went into Paulson's success was arriving at a very simple analysis of how real estate prices had varied from what the historical trend suggested. Arriving at that simple analysis, however, was a very complex process and Paulson wasn't the only one attempting to capture that. The nearest I can describe, it comes off like a horse race with Paulson coming from behind in the last furlong to win the Derby. Paulson was not without doubts and reading Zuckerman's account of Paulson's personal struggle with those doubts, overcoming various obstacles and finally reaping unprecedented success is truly riveting. I am a bit of an economics geek, but I really think that almost anyone would find this book entertaining, if not fascinating.