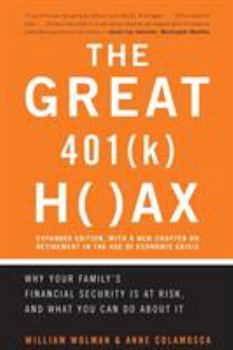

The Great 401(k) Hoax: Why Your Family's Financial Security Is at Risk, and What You Can Do about It

Select Format

Select Condition

Book Overview

According to business and finance journalists Bill Wolman and Anne Colamosca, the American public has been hoodwinked: 401(k)s, the most popular mechanism for retirement investing, were established to satisfy corporate, not individual, interests. They are replacing defined benefit-pension plans at an alarming rate and are vulnerable to the vicissitudes of the market, which -- if history serves as our guide -- is destined for at least a decade of lackluster...

Format:Paperback

Language:English

ISBN:0738208523

ISBN13:9780738208527

Release Date:April 2003

Publisher:Basic Books

Length:272 Pages

Weight:0.84 lbs.

Dimensions:0.8" x 6.0" x 8.9"

Customer Reviews

5 ratings

Book is mostly right

Published by Thriftbooks.com User , 16 years ago

The 401K was a substitute for funded pensions which employers hated to pay to an ever aging population. We are now at the mercy of the free...Not so free market which has proven over time to be manipulated by the power brokers. I would suggest you invest in your 401K only if your employer matches and allows it to be self directed. There is no one out there more interested in taking care of your own future than yourself. Buy the book and others like it if only to educate yourself.

Understanding the Myths and Realities of 401-K Plans

Published by Thriftbooks.com User , 18 years ago

I read and was enlightened by the hardcover edition of Wolman and Colamosca's book when it was first published and am looking forward to reading the updates in the recently released paperback edition. Companies encouraged baby boomers to join the 401-K bandwagon. Now, as we begin to enter retirement years, our large demographic may provide a magnified study of the impact of such plans. Perhaps this will benefit younger members of the workforce, especially if the Bush Administration re-visits its efforts to foster worker-managed-retirement-investment programs.

So Many "A-ha" Moments

Published by Thriftbooks.com User , 18 years ago

I'd been feeling suspicious and uncomfortable for years with regards to Stock Market investing, Mutual funds and 401K's and pension plans in particular. I never really knew why aside from this feeling that "The Street" was always trying to pull a fast one on us little guys. I applaud and thank the authors for this book and the effort to educate the masses. The patience and wisdom with which they explain the "fallacy of composition" as the basic principal behind the danger of investing in the stock market and especially a 401K for one's retirement is the best and most important element of the book. I'm feeling as if I've just been pulled from a burning building. This book also reveals the many advantages corporations have over wage earners and the individual investors. Reading this book will arm the average American with the knowledge needed to prevent costly investment mistakes - like complacency and too much trust in our corporate employers and wall street gurus.

A good perspective on the risks inherent in 401k plans

Published by Thriftbooks.com User , 19 years ago

The authors set out to prove that 401k plans are inherently risky and in many cases inadequate to meet the retirement needs of people. They make their case by using historical analysis and they manage to do it well. They draw a parallel comparision between the politics, culture and economics of the 1920s and the 1990s. Just as the 1920s led to the Great Crash and the Depression, the new millenium looks ready for similar economic hardships. This can have a devastating effect on the retirement plans for most Americans. Before 401(k) plans came into the picture, "defined pension plans" had become popular ( though not as popular as 401k was eventually to become). Those were the Golden years of the American economy (1945-1973). It represented a certain commitment by American companies to their workers. Most companies were doing well in those years and could guarantee the monthly pension checks to retirees. As America suffered slow-growth years from 1973 to the mid 90s, the solution that emerged for improving corporate balance sheets was simple: Design a pension system that depended not on defined benefits for employees but on defined contributions made mainly by employees. As corporations were having more trouble making money, the 401(k) became the new model for pensions. Various other factors contributed to Americans shifting more and more of their assets into stocks/Mutual funds/401k plans over the years: 1. First is the Wall Street propaganda resulting from the massive drive to capture the public's resources. Andrew Smithers, the brilliant British financial analyst, once told the authors that he could make a lot of money by being a bull and being wrong than by being a bear and being right. 2. Delusive academic research, demonstrating that stock investments, patiently made over the years, were a safe and superior source of investment. Professor Jeremy Siegel's book "Stocks for the Long Run" has been one of the most repected sources of delusion. To Siegel, the failure to grow rich is an individual's failure to save enough or to be patient, not of the way in which society as a totality works. 3. The economic boom years from 1995-1999 provided much incentive and validated the Wall Street propaganda and the delusive academic research. The authors discuss the various evils in the stock market, the current American economy and the 401k plan. They propose various reforms such as banning of company stock contributions, allowing employees to shift their funds at any time they want to, keeping transaction fees low and discouraging conflicts of interest between employees and their corporate employees. Until new legislation arrives to fix our 401(k) plans, we are stuck with what exists. Investing in Inflation-indexed government bonds, though not frequently made available in 401(k) plans, come across as the best way to plan for retirement in the current situation. This book is worth a read just to get a historical perspective of the

Important Topics, Blurred Focus

Published by Thriftbooks.com User , 20 years ago

Today's 401 (k) retirement plans will not fulfill the implicit promise they represent for Americans hoping to retire in comfort. William Wolman and Anne Colamosca believe they are structurally flawed and have investment biases that are out of touch with the economic realities faced by Americans in a post bubble period. Their ideal retirement plan would have greater investment options, but with less emphasis on stocks, no restrictions on the ability to buy or sell securities, and little or no stock of the employee's company, with company matches being made as cash rather than stock. This book is a call for reform as well as a marginally useful guide to investing in the new millennium. The text occasionally rambles and the authors' political bias is distracting [ e.g. 401 (k) plans are the result of an excessive faith in the free market, Americans are entitled to their pensions as "citizens" rather than as employees, etc.], but a strong case is ultimately made for reform.It is a key premise of this book that the equity markets will be stagnant for some time. This "stillwater" period of slow growth and anemic returns will be the result of a slowing in IT spending, the sticky consequences of a decade of accumulated debt, an aging population that consumes less, additional accounting scandals that will undermine investor confidence, globalization (viz. offshoring), and a national hubris that misses most of this.At three periods in the 20th century stock market prices became dramatically out of balance with underlying earnings, collapsed, and two decades passed before prices surpassed their bubble highs. Significantly, the general rates of return for equities in the twenty years following the 1901, 1929, and 1966 peaks averaged less than two percent! Even now after the market blowoff in the 1990's stocks appear to be overvalued based on an historical price earnings ratio comparison for the S & P 500. For the entire 20th century stocks traded at a multiple of 12 times their earnings and in the post-1945 era 15 times earnings. Today the S & P 500 is still trading at 22 times earnings.So what kinds of investments will work in this slow growth decade. The authors struggle to come up with persuasive answers. High paying dividend stocks are recommended in the earlier, hardcover edition, but proposed changes to the tax law make the authors wary. Bonds were recommended as "the core" of our 401 (k), but after a string of successful years and with the likelihood of higher interest rates their future performance becomes problematic. Better to stick with Treasury inflation-indexed bonds (TIPs), short term CDs, cash, and some exposure to the expanding Chinese and Indian equity markets or even a high-tech fund. The resulting picture is muddled. Perhaps part of the answer to secure a comfortable retirement lies beyond an imperfect 401 (k). It might include alternative strategies such as immediate annuities, reverse mortgages to unlock real estate equity, commodities a