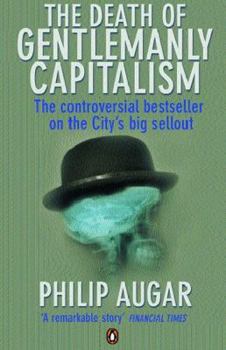

The Death of Gentlemanly Capitalism: First Edition

Select Format

Select Condition

Book Overview

A revolution took place in the City in the 80s and 90s. The cosy club of British merchant banking collapsed in a series of sell-outs, closures and scandals. This left the City dominated by US and... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0140286683

ISBN13:9780140286687

Release Date:May 2005

Publisher:Penguin Global

Length:416 Pages

Weight:0.85 lbs.

Customer Reviews

1 rating

The Collapse of British Broking

Published by Thriftbooks.com User , 14 years ago

The City, London's financial district, is often described as being like the Wimbledon tennis tournament--held in London, staffed by locals, dominated by foreigners but still generating lots of prestige and money as well as jobs for the UK. Most City people say they don't mind that the district has become a "foreign affair". For them, ownership doesn't matter. "Show me a single statistic where the City is in decline", was how the governor of the Bank of England challenged the author to back up his argument. But Philip Augar, a former City executive turned consultant, begs to differ. He says ownership does matter, as it confers power and influence. He argues that the current situation, in which many leading British firms have sold out to foreign owners, has left the City with no control over its own destiny. He sees the absence of a single British-owned investment bank with meaningful global aspirations as a serious deficiency. And he argues that London's position as the leading secondary financial centre is not as secure as it appears. It may be unpopular to talk about national interest or national industry. But Augar's book raises the question of whether it is all right, in the name of globalization and market principles, to allow a nation's key industry to fall under the domination of foreign powers. For him, the analogy with the Wimbledon tournament is flawed: "Wimbledon is British owned, the performers are foreign; the City is foreign owned, the performers are British. Ownership brings control and it is the City's lack of control over its own destiny that creates concern." Meanwhile, financial institutions and multinational firms have not become stateless entities. "Ask any London employee of Merrill Lynch or Goldman, or UBS or Dresdner Bank the nationality of the company they work for and you do not have long to wait for an answer. As we have seen in manufacturing industry, head office determines the strategy, the culture and the commitment." Before the Big Bang reforms of the last half of the 1980s, the City was a simple, inward-looking world where everybody knew everybody. Most of the products handled were British. On the market floor, those who did not play by the rules were ostracized. The sense of family was cultivated by the partnership structure of most broking firms and merchant banks. Real time computer models, even spreadsheets, were years away. Notebooks, ledgers, and the backs of envelopes were more common risk-management tools. Broking was held to be a flair business which too much management would stifle. Appraisals, formal targets and training for staff were still in their infancy. Basic administrative skills were also in short supply so that record keeping and process--dismissed as red tape in the smaller partnerships--were not part of the prevailing culture. Elements of a class system were also predominant. "Everything from the way people dressed, spoke and ate to the buildings and rooms in which they worked was der