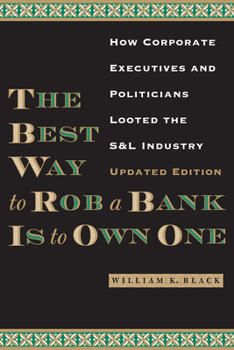

The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&l Industry

Select Format

Select Condition

Book Overview

In this expert insider's account of the savings and loan debacle of the 1980s, William Black lays bare the strategies that corrupt CEOs and CFOs--in collusion with those who have regulatory oversight of their industries--use to defraud companies for their personal gain. Recounting the investigations he conducted as Director of Litigation for the Federal Home Loan Bank Board, Black fully reveals how Charles Keating and hundreds of other S&L owners...

Format:Paperback

Language:English

ISBN:0292754183

ISBN13:9780292754188

Release Date:September 2013

Publisher:University of Texas Press

Length:384 Pages

Weight:1.16 lbs.

Dimensions:1.1" x 6.0" x 8.9"

Customer Reviews

5 ratings

Bank Thieves and CEO's Exposed as Parasites

Published by Thriftbooks.com User , 15 years ago

This book really blows the lid off the corrupt industry of banking. Banks have stolen our resources, destroyed our economies and impoverished our nation with their sleazy, manipulative and unethical tactics. I have also researched the industry in depth over the past 11 years and expose the tricks of the disgusting trade at my website bankingwhistleblower.wordpress.com You will be amazed at just how dirty and corrupt the current banking industry is.

Sadly, still relevant

Published by Thriftbooks.com User , 15 years ago

A couple times I put off reading this book because of it's subtitle (looting of the S & L industry). I wanted to read about what I thought of as more current issues like the problems in the financial industry. How glad I now am to have read The Best Way to Rob a Bank is to Own One. The book does show step by step how the fraud in the S & Ls was perpetuated. Mr. Black, who was part of the agency that was supposed to regulate the S & L industry, gives the insider's perspective of what happened. He's also interested in detailing the factors in the environment that made it possible for the fraud to occur, be covered up, and finally collapse. Factors ideological (regulation is not needed), budgetary (under-staffed, inexperienced regulators), and political (the power of bought politicians). This makes what happened in the 1980's feel contemporary. There were patterns then that seem familiar to what is happening these days. (I am writing in April 2009.) For example, Mr. Black shows how the S & L fraud was abetted by compliant accountants. Nowadays we've learned how compliant accounting firms falsely rated financial securities to the benefit of the bankers. And just recently political pressure was successfully brought to bear on the FASB (Financial Accounting Standards Board) to loosen up the Mark-to-Market accounting rules. To what end we will have to wait and see; after reading Best Way to Rob I am not sanguine. I can't avoid the conclusion that the environment that resulted in corruption 20 years ago is still with us. And I begin to think that Obama's economic advisors will not change things. So, this book is sobering. Parts of the story left me open-mouthed. Like the fact that Charles Keating continued to operate, and loot, for 2 years after his illegal practices were uncovered. In fact, he got the agency that was supposed to regulate S & L's to agree to a cease and desist order against itself: the agency agreed it would not take any action against Keating !!! The author writes in a concise, clear way. And although you know the final outcome, he makes it a page-turner along the way. I kept reading and reading to follow what happens next. One of the lessons Mr. Black would like to get across is that FRAUD HAPPENS. Don't be fooled by back-slapping, look-you-in-the-eye charismatic fellows. Fraud is not accidental. It will arise when conditions make for opportunities. He's convinced me.

A New Pertinence

Published by Thriftbooks.com User , 15 years ago

Bill Black's "The Best Way to Rob a Bank Is to Own One" has a new pertinence. He was just interviewed on 'Bill Moyers Journal' on April 3, 2009. Both video and transcript are available at the PBS 'Bill Moyers Journal' site. They are well worth viewing and then reading (and then buy the book). I do hope that Mr. Black lives to write a new book about the current scam, as Bill Moyers quotes from Black's earlier investigations, "...so enraged was one of those bankers, Charles Keating -- after whom the senate's so-called 'Keating Five' were named -- he sent a memo that read, in part, 'get Black -- kill him dead.' Metaphorically, of course. Of course." I wish Mr. Black well and safe, after this interview... From the transcript: BILL MOYERS: "...his main targets are the Wall Street barons, heirs of an earlier generation whose scandalous rip-offs of wealth back in the 1930s earned them comparison to Al Capone and the mob, and the nickname "banksters." and WILLIAM K. BLACK: "Well, the way that you do it [large corporate failures and scandals] is to make really bad loans, because they pay better. Then you grow extremely rapidly, in other words, you're a Ponzi-like scheme. And the third thing you do is we call it leverage. That just means borrowing a lot of money, and the combination creates a situation where you have guaranteed record profits in the early years. That makes you rich, through the bonuses that modern executive compensation has produced. It also makes it inevitable that there's going to be a disaster down the road."

Cracks in the Empire

Published by Thriftbooks.com User , 18 years ago

William Black's book, The Best Way to Rob a Bank is to Own One,is on the one hand an act of courage, and to an excellent journey into the morass and collapse of the Savings & Loan industry. Bill Black should know better than anyone, as he was one of the inside attorney's trying to coral bankers gone wild on highly speculative ventures... Mr. Black walks us down the chamber of horrors of the Savings & Loan collapse, and gives us a bird's eye view of bank corrupt. What is most interesting is that Mr. Black finds the trends within in the industry itself, that it was actually CONTROL FRAUD were bankers, accountants, appraisers, bank executives and politicians colluded together to bring an already shaky and weak industry down. Everyone who wants to understand that the Savings & Loan was the first cracks in the empire, civilizations have always been brought down by poorly run fractional reserve fiat currency bankig systems. What was the cry from people from Alan Greenspan was for more deregulation, and at the time, Greenspan, a banker who was with Morgan Stanley prior to his excellency/chairmanship/ at the Federal Reserve System, was that the Lincoln Savings & Loan, was one of the best run S & Ls in the country... What resulted was deregulation and desupervision... Attorneys and accountants for hire, audits performed on Savings & Loans which made them look like a picture of financial health when in fact the S & L industry had terminal cancer...Massive insolvency, virtually no reserves, coverups, and famous politicians genuflecting to the Savings & Loan industry, the Keating Five; John Glen, John McCain, Alan Cranston, Dennis DeConcini, Donald Riegle..All pressuring the Bank Board for leniency... Every American should read this book...this control fraud of the eighties in the Savings & Loan industry makes Enron look like a game of childrens marbles..We learn little, we remember little in this United States of Amnesia.. The Best Way To Rob A Bank Is to Own One, by William Black is a true sign that there is a crack in the American empire's treasury.. A recommended read if your really want to understand what happened in the Savings & Loan collapse, which the AMERICAN TAXPAYER WILL PAY FOR $200 BILLION OR MORE. As Thomas Jefferson once said, "Banking Establishments Are More Dangerous Than Standing Armies." Hats off to Bill Black. Barry J. Dyke, RIA, Hampton, NH

The inside story

Published by Thriftbooks.com User , 19 years ago

Take it from someone who was toiling down in the trenches chasing the bad guys, this book is a first hand account of how the Reagan administration and Speaker Wright fiddled while the savings and loan crisis burned. It explains how, and why, the government for years did not try to stop the corporate criminals who went on one of the largest financial crime sprees in the history of the United States. This is an important work, not only for its historic value in explaining this particular outbreak of white collar crime in the savings and loan industry, but also because it carefully lays out the patterns of control fraud that will continue to recur in different corporate venues as long as people are willing to steal and lie to try and gain an economic advantage. This should be required reading for every financial regulator in the United States. Alan Greenspan, who recently argued that personal reputation in business practices should be more important than enforcing rules, should read it twice (or as many times as it takes until Mr. Greenspan can remember why he trusted Charles Keating).