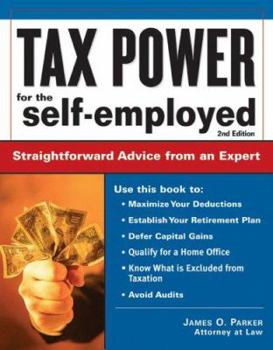

Tax Power for the Self-Employed: Straightforward Advice from an Expert

Select Format

Select Condition

Book Overview

Tax Power for the Self-Employed addresses the specific and particular tax laws and regulations facing a self-employed individual. Unlike other small businesses, it focuses on the individual who either runs a single-person small business (or one with an otherwise limited number of employees) or the person who does something to make extra money that he or she may consider a hobby or side job, but from which the IRS expects tax to be paid. Discussions...

Format:Paperback

Language:English

ISBN:1572485760

ISBN13:9781572485761

Release Date:December 2006

Publisher:Sphinx Publishing

Length:260 Pages

Weight:1.00 lbs.

Dimensions:0.6" x 7.5" x 9.3"

Customer Reviews

0 rating