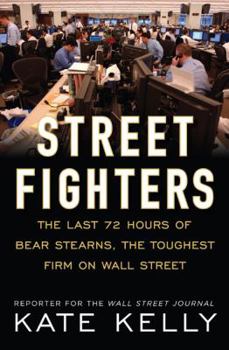

Street Fighters: The Last 72 Hours of Bear Stearns, the Toughest Firm on Wall Street

Select Format

Select Condition

Book Overview

The acclaimed New York Times bestseller--an explosive, inside look at the demise of a Wall Street giant The fall of Bear Stearns in March 2008 set off a wave of global financial turmoil that rippled... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1591842735

ISBN13:9781591842736

Release Date:May 2009

Publisher:Portfolio

Length:256 Pages

Weight:0.45 lbs.

Dimensions:0.9" x 6.4" x 9.3"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

5 ratings

Utterly Compelling--Perfect Companion Piece to TOO BIG TO FAIL

Published by Thriftbooks.com User , 15 years ago

This book is a tremendous, swift--almost frenzied--account of the last four days in the life of Bear Stearns. It is a fast, lucid and exhilarating read that fills in the gaps glossed over by Sorkin in his excellent book TOO BIG TO FAIL. As mesmerizing as TOO BIG TO FAIL is, it pays only passing attention to the failure of Bear. This book by Kate Kelly, unlike a number of other business books lately, is carefully and well written. Not a word is wasted. With sparse, direct and blunt prose, we get a contoured sense of many of the key players not only at Bear but also we get a sense of Paulson, Geither and Bernanke. The writing is stark and unadorned, but it serves its purpose, and the ultimate effect is that she has authored a book that literally is hard to put down. An important contribution to the rapidly growing library that will allow us to get a better understanding of our current financial crisis.

john b

Published by Thriftbooks.com User , 15 years ago

Very good book with hour by hour account of happenings. As former banker(retired) it was riviting.

Good insight into interaction between Bear, Treasury and the Fed

Published by Thriftbooks.com User , 15 years ago

I enjoyed this book very much. I appreciated the behind the scenes look at not only the various players from Bear Stearns but the interplay between Bear, the Government, and individuals such as Bernanke, Dimon, and Paulson. The book gives you a greater appreciation as to how the current crisis happened, and makes you wonder why we ever paid taxes to support the Financial Regulatory System. In this case, the SEC, which comes across as totally asleep at the switch.

A dramatic TKO on Wall Street

Published by Thriftbooks.com User , 15 years ago

As I began to read this account of "the last 72 hours of Bear Stearns, the toughest firm on Wall Street," so powerful are Kate Kelly's narrative and descriptive skills that it soon seemed as if I were seeing a film rather than reading a book. Colorful characters, fast-moving plot, vivid images, lively dialog, riveting conflicts and confrontations, increasing tension, and then.... The book's narrative begins at 5:30 P.M. on Thursday, March 13, 2008, and continues until 8:30 PM on Sunday, March 16, 2008, followed by an Epilogue in which Kelly reviews subsequent developments at other firms (e.g. Lehman, AIG, Merrill) and provides a follow-up on Bear Stearns' key leaders. From Thursday through Sunday, at a pace that astonished everyone involved, the once-proud firm of "street fighters...lean, scrappy, and hungry for profits," a firm that had "an underdog's spirit, and relished the chance to knock more well-heeled firms down a peg or two," saw its stock take a "breathtaking drop." It had sold for $172 in January of 2007, was selling for $57 on March 13, 2008, and continued to plunge so far and so fast ($30.00 on March 14) that when Bear received J.P. Morgan Chase's final offer, the stock was valued at $2.00. How to explain Bear's decline and fall? Kelly offers several reasons. Here are four: 1. Dysfunctional leadership (e.g. its CFO, Sam Molinaro, was "hopelessly disorganized" amidst toxic infighting between and among the firm's leaders) 2. Decision-making that Jim Collins describes (in How the Mighty Fall) as "grasping for salvation" in Stage 4 of a five-stage process of organizational decline 3. Indifference to promising new diagnostics such as a risk-assessment matrix to pinpoint the firm's exposure to the markets that a Bear employee had taken years to develop 4. Senior managers' obsession with wealth accumulation, with a concern for the firm's welfare only to the extent that it enabled them to achieve that objective Over time, it became obvious to Bear's leaders (including board members) that the firm would either have to accept the best offer (and whether or not there would be any remained in doubt throughout most of the frantic weekend) or file for bankruptcy. Meanwhile, negotiations continued with other firms (notably J.P. Morgan Chase, Goldman Sachs, and J.C. Flowers), with the Federal Reserve (Tim Geithner, Ben Bernanke, and Kevin Walsh), and the U.S. Treasury (Hank Paulson and Bob Steel). Advisors to Bear Stearns included Gary Parr (Lazard), Rodge Cohen (Sullivan & Cromwell LLP), and Dennis Block (Cadwalader, Wickersham & Taft LLP). Finally, the deal was made with J.P. Morgan Chase. In her Epilogue, Kelly notes that "Bear failed because the credit crisis of 2008 killed every firm with a large mortgage business, too little diversification to offset the losses from bad loans, and the inability to be proactive. These factors ruined Lehman Brothers, and, directly or indirectly, almost sank Fannie, Freddie, AIG, and Merrill Lynch -

Who To Blame For The Bear Stern Collapse? Meet the Suspects....

Published by Thriftbooks.com User , 15 years ago

Kate Kelly originally wrote this story for the Wall Street Journal last May, detailing the events that lead up to the complete collapse of Bear Stearns during last year's mortgage meltdown. Here in //Street Fighters//, she expands the story, covering the 72 hours from Thursday, March 13, to Sunday, March 16, 2008. There are plenty of flashbacks of the previous year, explaining how Bear became over-leveraged in toxic mortgage assets and how they ended up "suddenly" with too little operating cash for business the next day and ended up being sold to JP Morgan for a rock-bottom $2.00 a share. Kelly interviewed players in and out of Bear, coordinating stories to create a compelling narrative of hubris, greed, and a culture of doing whatever it took to make the deal; including the last-minute fire sale. There are plenty of personality vignettes, from Alan Schwartz, Bear's CEO and Jimmy Cayne Bear's Chairman to Tim Geithner, the president of Federal Reserve Bank of New York and Warren Buffett. Her accusation of Cayne's preference for bridge or smoking pot (or both) rather than going to work at Bear may be either be the titillation to sell the book or State's Exhibit One for why the environment at Bear Sterns lead to its ignominious end. It is a highly readable account, both of the failure of Bear Stern and the trading in Mortgage Backed Securities that lead to the entire market meltdown. In some ways, it is a disturbing story, with then-Treasury Secretary Hank Paulson insisting on the $2.00 a share buyout price to punish Bear for their recklessness and how many of the Bear traders and executives not only landed on their feet, but are still active in the trading community. Bear may be gone, but their spirit still lives on.