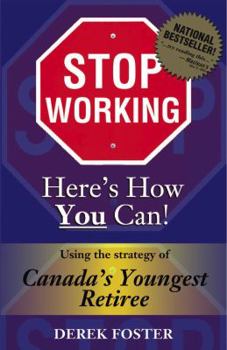

Stop Working : Here's How You Can!: Using the Strategy of Canada's Youngest Retiree

Retire young and enjoy it - Canada's youngest retiree explains how in this book This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0973696001

ISBN13:9780973696004

Release Date:January 2005

Publisher:Foster, Underhill Financial Pr

Length:180 Pages

Weight:0.65 lbs.

Customer Reviews

1 rating

Pick the kind of retirement you want

Published by Thriftbooks.com User , 16 years ago

I've read Derek Foster's book "Stop Working, Heres how you can". Personally, I think it's a good beginner book for someone who is interested in investing, retiring at some time in their life and wants a relatively safe way to invest their money. I thought Mr. Foster made it pretty clear what kind of retirement he was talking about, having a few vacations a year, perhaps working part time, (perhaps not) and having some money coming in to cover the bills and pay for those vacations. More importantly, to have the CHOICE of what you want to do. For many right now, they have absolutely NO choice in their life. They have to work, every day, sometimes two or three jobs in order to make ends meet. As for the previous reviewer who stated that this is not 'sailing-my-yacht-in-the-south-of-france" type wealth, all you need to do is wait longer. If you setup an spreadsheet, you can see that the wait between 'low income replacement' investment size and 'S-M-Y-I-T-S-O-F' type of investment size is not that much. One you get past the 15-20k per year returns, the money REALLY starts compounding. What the author does do is tell you how he invested his money so he could reach a point where he could do what he wanted to do. Isn't that what investing is all about? "Stop Working" also talks about 'simplifying' your life so you can free up some money to invest. The simple fact is that most Americans, (Canadians as well) spend every dime they get and live paycheck to paycheck. They often purchase things they don't really need, and can't really afford. They go into debt to fund a more extravagant lifestyle. They absolutely have to have that flat panel wide screen LCD TV. And put it on a credit card at twenty-four percent interest, then pay monthly payments. In the end they wind up paying three times the cost of the TV to a credit card company. Canadians and Americans need to simplify their lives and start living within their means. Sooner or later the price tag for this behavior will come due and it's going to be a very high price indeed. Unfortunately it will impact more people than just the ones who lived beyond their means. But those who have saved for a rainy day will be far better off than those who didn't. It's not just me who is saying this. A lot of people are getting very concerned, including Warren Buffett. Anyways,... The best part of this type of investing is you never have to sell your nest-egg to fund your dream. This is the basic premise of the book, that you purchase investments that will give you money every year, four to twelve times a year. Because you invest in businesses that are healthy and growing, they increase the dividends every year. So you get paid more, every year. And as you get paid more every year, you are re-investing those dividends in more stocks that give you more dividends. So on and so forth. This method is tried and true and works. This method is one of the safest equity investing methods. This method is supported by a lot of re