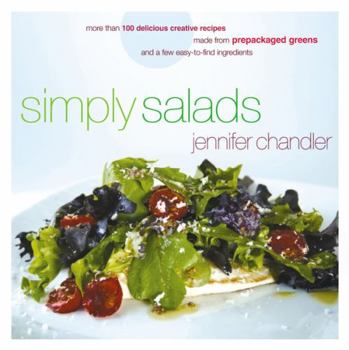

Simply Salads: More Than 100 Creative Recipes You Can Make in Minutes from Prepackaged Greens and a Few Easy-To-Find Ingredients

Select Format

Select Condition

Book Overview

From bag to table, healthy salads have never been easier. You've always known that eating green could be healthy, and now it's easier than ever. With the abundance of supermarket selections of prepackaged greens, you can create a restaurant-style salad'along with a fabulous dressing'in your own kitchen. Before bagged blends, a salad with four different types of lettuces was unheard of. Now there are more than fifty different combinations of lettuces, packaged in just the right size, from which to choose. Think beyond iceberg and romaine. The more than one hundred salads and dressings in Simply Salads are colorful, gourmet, and surprisingly simple to prepare. Whether you're looking for the perfect complement to a main dish or you want a salad that can stand as an entr e, you'll find the perfect salad, including such winners as: Asian Salad with Ginger Dressing and Wasabi Peas (page 4) Jalape o Chicken Salad with Avocado Dressing (page 40) Crawfish Salad with Spicy Cajun Remoulade (page 106) Cheese Tortellini Salad with Sun-Dried Tomato Vinaigrette (page 172) Memphis Mustard Cole Slaw (page 223)

Format:Hardcover

Language:English

ISBN:1401603203

ISBN13:9781401603205

Release Date:January 2007

Publisher:Thomas Nelson

Length:249 Pages

Weight:2.01 lbs.

Dimensions:0.9" x 8.0" x 8.1"