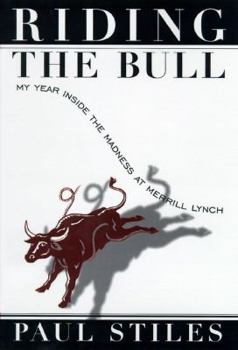

Riding the Bull:: My Year in the Madness at Merrill Lynch

Select Format

Select Condition

Book Overview

The author tells how he left small-town life for a harrowing year at Merrill Lynch, where he learned the methods--and the back-stabbing--behind the madness of Wall Street and found himself changing... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0812927893

ISBN13:9780812927894

Release Date:January 1998

Publisher:Crown Business

Length:323 Pages

Weight:0.60 lbs.

Dimensions:1.1" x 6.5" x 9.6"

Customer Reviews

5 ratings

By the Horns

Published by Thriftbooks.com User , 19 years ago

Every now and then you come across a really inspiring rags-to-riches tale of Wall Street, a story of a streetwise poor kid full of ambition, raw brains, and moxie, who risks it all, works like a demon, and makes big money in the financial jungle. This is not one of them. Paul Stiles, Harvard grad, smart dude, worked at the National Security Agency for five years: by about 1994, he'd decided "good enough for government work" wasn't good enough for him. North of his little cottage near Annapolis, the trenches and bunkers of Manhattan, a great battle---fought with derivatives, and tranches of collateralized debt, and high-yield instruments of death and destruction---was being fought: a war with, potentially, far greater ramfications for the United States than all the post-Cold War subterfuge for pennies wielded in Washington DC. So he did what all of us Wall Street hopefuls have done, once upon a time: he road the shuttle north, an interviewed like a banshee. The first thing you'll pick up in "Riding the Bull" is the verve of the writing: Stiles has a gift for words, for framing a scene, for setting up Manhattan in the mid-nineties, in the heat of the Bull Market, and Stiles---after the agony of inquisitorial, mercurial, stress-driven interviews masterminded by the newest lords of the manor, the calculus-fuelled quants---secured a plum role in emerging markets debt at Merrill Lynch, whose sigil and symbol---the rampant bull---was emblematic of that intoxicating, wild-eyed age. Stiles, then, is an alien---or an ape, your choice---in this brave new world of bond trading, the Mexican sovereign crisis, the convergence of High Finance, High Octane, and Super-Duper international skullduggery. Oh, with a little aside on the craziness of trying to settle down in Brooklyn, New York, 20th century, on a pittance of 100 grand a year. Sheesh. Now: as I said, Stiles has a gimlet eye: of his work in the trenches at Merrill, as he was handed a nasty, thankless assignment as, effectively, a minister without portfolio, a trader without a country, a hapless Gringo amid the so-called Latin Mafia that ran the South America debt operations---how he tried, failed, tried again, and got sacked---trying to carve out his own little kingdom in the jungle of the Bull. It's fun reading. It's scandalous, witty, engaging, capable of beoing devoured on a red-eye flight from Boston to LA, and consummately engaging. Moralistic? Possibly. Stiles nails the pyschology of Manhattan, the city that grows up, not out. An island with skeletal coastal development? Go figure, in a place where the eyes look to the sky, not to the sea. Some might complain that a one-year tour of duty on Wall Street hardly qualifies for the jeremiad that is "Riding the Bull", but I disagree: in the wake of Enron, Tyco, Worldcom, Adelphia, and countless other Wall Street turmoils, "Riding the Bull" is a merciless little piece of pungent journalism, a fly-on-the-wall in America's boardrooms wher

Much More Than I Expected

Published by Thriftbooks.com User , 24 years ago

I disagree with many of these reviews, but this is understandable. Many of these readers had the wrong expectations. When I read this book I was surprised by what I found. This book is about a man who goes to Wall Street and realizes that there is more to human life than serving what he calls the Market. It is an awakening for him, as a young man, and he tries to identify why it is that such important insights into life have been hidden, what other messages he has unwittingly accepted from his (American) society. This is a difficult topic for anyone to explore, especially first hand. I agree the author reaches his limit at the end, but the trip there is worth taking. As a European Catholic, rarely have I read an American author who so clearly sees the problems with his own capitalist excess and its impact on the soul. Unfortunately, there are many who have not reached this level of awareness, and some are found in Mr. Stiles reviews. The tragedy is that such an honest book of the human spirit should be lost among books on finance, where it is judged by those who are predisposed not to understand it.

My experience is very similar to those of Stiles

Published by Thriftbooks.com User , 26 years ago

I recommend this book to anyone who is thinking of becoming a trader. My experience with Morgan Stanley in Hong Kong are very similar to those of the author's, and with all the other associates I talked to, it seems that it is more a common practise than a mismanagement to neglect newly recruited analysts and associates, especially those who do not have contacts high up in the firm. I am pleased to find out I am not the only one who is working for a top investment bank and deeply depressed, broke and hated every minute of it, and finally someone write a book about it.

An accurate potrayal of Life on the Street

Published by Thriftbooks.com User , 26 years ago

Having worked as an analyst in investment banking, I can sympathize with Paul Stiles' experience. The "sink or swim" mentality is pervasive in the industry due to the manic pace of the Market which either toughens your exterior or rapidly brings about disillusionment. Mr. Stiles descriptively and compassionately recounts a telling tale, one that has been repeated by many liberal arts majors who have compromised their true interests and happiness for the lure of the almighty dollar on Wall Street. For those "hungry" college and business school graduates in search of wealth and success, let Mr. Stiles' message be a lesson in cost-benefit analysis.

heart felt and frightening, actually

Published by Thriftbooks.com User , 26 years ago

... The author was not naive as some reviews have said, but too principled and idealistic for the shenanigans of Merrill Lynch bond trading. It's true he had taken on the heady challenge, but what he met was beyond his wildest imaginings. His expectations of even a little job training were never met. One senses how truly lost he was in this deceitful and morally ambiguous environment. What the hell was expected? What was the game? On the one hand, you can learn a lot about daily life on the bond trading floor. On the other hand, having been in the corporate life myself, I recognized some similar behavior and wished I could have read this book prior to those experiences. I was more lost than Mr. Stiles and just as infuriated. Anyone planning to go to the corporate wars will be forewarned by reading this book. Let it be a lesson to those who think corporate tigers could run the world better than politicians. For awhile, Stiles played the game and made $1 million for the company and may have enjoyed the heady success of that time, but overall it wasn't worth it. I liked the format. Just when I'd had enough of technical market information and bad behavior, Stiles shifts to more personal things--finding an affordable, livable place within commuting distance of Wall Street; a visit to the city by his parents and a heart-to-heart talk with his father; a desperate altercation with his equally stressed career wife; and walking The Beast, their Jack Russell terrier. Read this book and have your eyes opened to what really goes on where greed is king. Stiles was there when the Mexican peso was devalued. He reveals the inside scoop on the Orange County debacle. This is good stuff. And well-written, too