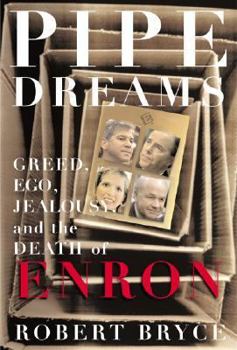

Pipe Dreams: Greed, Ego, and the Death of Enron

Select Format

Select Condition

Book Overview

After the shocking collapse of Enron in fall, 2001 came an equally shocking series of disclosures about how America's seventh-largest company had destroyed itself. There were unethical deals, offshore... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:158648138X

ISBN13:9781586481384

Release Date:October 2002

Publisher:PublicAffairs

Length:416 Pages

Weight:3.70 lbs.

Dimensions:1.3" x 6.6" x 9.6"

Customer Reviews

5 ratings

Uber-Execucrats Get Stomped

Published by Thriftbooks.com User , 20 years ago

Out of many books available on the Enron travesty, this one probably offers the most bang for the buck with its fast-moving and incredibly informative structure. Bryce has sufficient skills as an investigative journalist and provides a healthy mix of history, finance, and politics, allowing the general reader to understand what happened with that ridiculous corporate house of cards at Enron. Bryce's main theory is that the company was done in by a lack of hard cash, as just about all of its revenues were long-term contractual deals in which cash would actually come in slowly and periodically, although the "revenues" could be claimed immediately through preposterous over-use of "mark-to-market" accounting. Meanwhile, greedy executives who set up such deals were paid millions in hard cash bonuses immediately, long before a single cent of actual cash was made for the company. This in turn led to preposterous deal-making shenanigans that were little more than schemes to cook the books and claim profits, such as a bizarre web of tax havens and false subsidiaries set up by the crookedest executive of all, Andy Fastow.Bryce's cash-centric theories on the Enron downfall are open to scrutiny by financial experts, and could possibly be shot down, but that doesn't affect the quality of the book's condemnation of the Enron executives and the suffering they caused for employees and investors. Bryce has a wonderfully biting and sarcastic writing style that leads to some unexpected chuckles, with quips like "there's no sex in laying pipe," "Texas-sized sphincter," and my personal favorite "uber-execucrat" (referring in particular to Enron's purchased statesman Henry Kissinger). Bryce should probably take some heat for his treatment of the women in Enron's upper ranks who may have gotten to the top by less-than-wholesome means, especially Rebecca Mark, who nevertheless blew away a few billion dollars. Bryce is generally harsh in his portrayals of all the guilty executives - from the unscrupulous Fastow and the self-worshipping Jeff Skilling to the utterly incompetent Ken Lay. But these greedy plutocrats, who pocketed tens of millions for their personal fortunes while ruining the lives of thousands of employees and sticking investors with billions in losses, deserve harsh treatment. That's just the beginning of the punishment they deserve. (...)

Priming the Enron Pump

Published by Thriftbooks.com User , 21 years ago

Penn Square was peanuts. Robert Bryce's witty racountement of the rise and fall of Enron reminds this reader of Mark Singer's equally entertaining tale of the itty-bitty shopping center bank in Oklahoma City that went bust and took the Western Oklahoma Oil Boom with it.Bryce's book, with introduction by Molly Ivins, is as eminently readable and well organized as Enron was not. It starts and ends with sympathetic folk - those drug down in the Enron muck. Along the way, the reader meets the Politicos, the Pie (or is that Energy?) In The Sky Wheeler-Dealer Traders, "the Divine Miss Mark," Fast Andy Fastow, Snakey Skilling, and Kenny-Boy (President G.W.'s endearing nickname for his Buddy) Lay. Fans (if any) of Senator Phil and wife Wendy Gramm will not be amused by this foray through the Swamp that was Enron. This is an essential Enron primer, complete with footnotes, Index, and explanations of "Mark to Market" accounting that even us "Liberal Arts" majors can understand. I urge you to BUY this book. Borrowing the library's copy is not recommended, as one should not write the outraged tirades that this book is sure to produce in the margins of Other People's Books.

HOW TO FAIL IN BUSINESS WITHOUT REALLY TRYING

Published by Thriftbooks.com User , 21 years ago

This is a very readable account. The text opens stating, "My premise throughout this book is that Enron's failure wasn't due to faulty accounting or poor regulation.... Rather it failed because key leaders at Enron lost their moral/ethical direction at the same time that the company was making multibillion-dollar bets on fatally flawed projects." The author asks" Why did a seventy-six year old pipeline company with rock-solid cash flow and reliable earnings suddenly flame out in a maelstrom of accounting irregularities, fraud and skullduggery."After a brief three-chapter history of Enron, the author develops his thesis that "Enron failed because its leadership was morally, ethically and financially corrupt," showing how deal-focused management took one of the most profitable companies in Houston into bankruptcy. The author, Robert Bryce, a Texas investigative journalist, interviewed over 200 individuals, and researched countless documents, including nineteen SEC filings for this book.The text discusses the major players in the context of their work, their abilities, Houston society and their work-place relationships. Many former Enron people blamed Ken Lay stating ".... he flat couldn't judge people and said he became blinded to other people's faults. One Executive said Lay 'never understood that the pipelines that are paid for and power and processing plants that are mostly paid for, were the way to make money."The harshest accounts concern Jeff Skilling and Andy Fastow. Skilling, who became president in 1997, was called by one executive" the smartest son of a bitch I've ever met." However, "Skilling was not a manager, he was a deal maker. Exotic financing schemes and the deals that came with them excited Skilling." The text notes, " When it came to strategy and starting businesses, Jeff Skilling was a genius. When it came to understanding the importance of cash, he was dumber than a box of hammers."Skilling conceived the idea of a Gas Bank where gas producers were "depositors" in an imaginary bank while gas consumers were the "borrowers." The Gas Bank was a turning point for Enron and made money. However, Skilling felt that accrual accounting was inadequate and changed to mark-to-market accounting for gas trading. Revenue growth then became more important than cash, which eventually put Enron in a cash crisis, giving birth to off-balance-sheet accounts. Enron started down a slippery ethical slope and no one in authority seemed to care. Bryce states CFO Andy Fastow was not suited for his job. He knew how to set up dozens of off-balance-sheet entities, but he didn't understand the company's overall finances. "Fastow's special-purpose entities became a fast-and-dirty way for Enron to manufacture additional revenues in a big hurry. Fastow's off-the-balance sheet entities gave Enron the ability to do deals quickly."The book notes that making deals was enormously profitable to the managers who conceived the deals because these managers were paid fabu

Ali Baba and His Thieves

Published by Thriftbooks.com User , 21 years ago

Okay, we all knew that the Enron scandal was noxious, and we knew that there was substantial governmental complicity. However, the degree of bald faced corruption and theft pervading all aspects of the commodities and trade professions and the extensive government acquiescence, if not compliance, which Bryce describes stagger the imagination. This is a thorough, well documented study of the Enron scandal, from the corporation's early origins. While extensive, and depressing, Bryce alleviates it with sardonic depictions of the unvarnished vulgarity of the senior management feeding at the Enron trough. Bryce is fair in that he gives the Clinton Administration its due for facilitating the depradations of Enron; however, while resisting the effort to go for the jugular, he makes it clear that the greatest beneficiaries of Enron's largesse were Republicans, particularly the two Bush administrations. He reserves most of his vitriol for Senator Phil Gramm and his wife, who were undeterred at any time by ethical concerns about their undisguised conflicts of interest in judgements on regulations benefitting the corporation that was filling their pockets.Bryce provides a number of tutorials on accounting and trade and commodity practices that help the "lay" person understand how the transgressions were allowed to occur and mushroom. Reading "Pipe Dreams" you wonder first why the many members of the Enron management aren't in prison, much less the obscenity of their being able to loot the company and retain their obscene fortunes. It is incredibly disillusioning, and you are left with an increased sense of impotence, yet your outrage is alleviated by Bryce's biting sarcastic wit.

Compelling, informative and readable!

Published by Thriftbooks.com User , 22 years ago

The author clearly went to exhaustive pains to research the facts and produced a book that not only explains the history and evolution of the Enron disaster, but did it in such a way that anyone can follow. On top of that his approach to the subject matter turns this educational text into a real page turner. I couldn't put it down and have gone back to read parts over and over. Finally having been an Enron insider for several years I can tell you - HE GOT IT RIGHT! This is a must read.