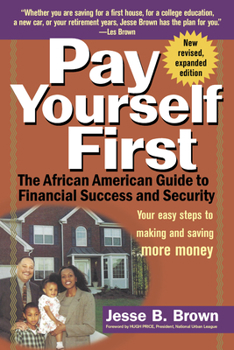

Pay Yourself First: The African American Guide to Financial Success and Security

Select Format

Select Condition

Book Overview

How do we help make black America better? Jesse Brown reminds us that we gain financial success and security when we pay ourselves first.-Tavis Smiley, author of How to Make Black America Better: Leading Black Americans Speak Out Jesse Brown's commonsense approach is a surefire way to watch your money grow.-Myra J., The Tom Joyner Morning Show Achieve your financial freedom with step-by-step instructions from award-winning investment...

Format:Paperback

Language:English

ISBN:0471158976

ISBN13:9780471158974

Release Date:October 2001

Publisher:Wiley (TP)

Length:208 Pages

Weight:0.95 lbs.

Dimensions:0.6" x 6.1" x 9.1"

Customer Reviews

5 ratings

A Good Reinforcement of the Financial Basics

Published by Thriftbooks.com User , 18 years ago

This book does a very good job of divulging some very disturbing financial trends that, while on the one hand are not limited to African Americans, on the other hand they tend to disproportionately affect African Americans. The target demographic of this book appears to focus in particular on African American women, primarily the single female with one or more dependents. The book is written to a lesser extent with other demographic sub-groups in mind. That said, the book is nonetheless a very useful introduction to the subject of money matters, which sadly is a topic in dire need of discussion within the African American community. The book contains a number of good points, the best of which are the following: knowing where your money goes and having a goal, using time to your advantage (as opposed to letting others use time against you, like most of us do), developing an emergency fund before you begin saving and investing (which too few of us do, even if we do save and invest), emphasizing the importance of credit, credit ratings and the wise use of credit, paying cash for most of your purchases, presenting the perils of being dependent on a person or institution for some or all of your livelihood, unlearning bad money habits and learning good money habits, and reminding the reader that not taking control of one's destiny has dire consequences. To be honest, the book also has a number of key demerits. First, the author's financial compounding examples do not factor in mutual fund expenses and taxes. Second, contrary to what the author believes, buying a house is not always the wisest investment, even though (and this is generally speaking) houses usually appreciate in value (he also neglected to discuss the hidden expenses associated with a house). Third, for someone who spent a lot of time railing against excessive credit card use and advocating for the use of cash to pay for purchases, it seems odd to me that he never once discussed the use of debit cards and other pre-paid cards. Fourth, his information on contribution limits to tax shelters like the IRA and 401k are woefully out of date, but then, given that the book was last printed in 2001, the author may be forgiven for this (and perhaps should pen a revised edition). Fifth, the author contends that liquidity is both expensive and disruptive to the best plans- this is typical business school financial non-sense (ask Mr. Warren Edward Buffett about how he feels about having 45 billion dollars of liquidity) as it panders to the erroneous notion that one should have all his or her capital put to work earning some specified return. Most of us keep our funds in cash because for one, given the daily insults we suffer, we may not know what is coming at us next, and second, many of us are still woefully ignorant of ways to put our hard earned money to work. As such, someone truly concerned about African American financial health would not utter such silly remarks. Finally, Brown is

TURNING DREAMS TO REALITY

Published by Thriftbooks.com User , 20 years ago

Living paycheck to paycheck I thought that there was no way to save any money for our future. PAY YOURSELF FIRST helped me realize that I can reach my goals and dreams with just alittle sacrafice. Now I'm well on my way to reaching my first goal; a family vacation!

On the Road

Published by Thriftbooks.com User , 23 years ago

I met Mr. Brown at the black expo in chicago, purchased his book and I am now on my way to financial freedom!

Down to Earth

Published by Thriftbooks.com User , 23 years ago

I like the way you explained your investment strategies. Thank you for presenting yourself in such a way that people can benefit from your experience and trust your advice. adrienne

Things don't Just Happen

Published by Thriftbooks.com User , 23 years ago

Thanks for writing this book. Your introduction to my life is quite timely. Things don't just happen, they happen Just. (Smile) Keep up the good work! Your contribution to life and our community is a great and needed work, thanks!Sonya Harris