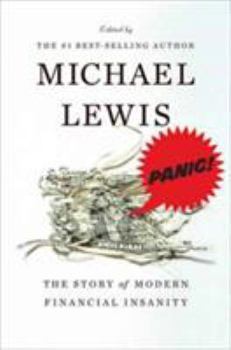

Panic: The Story of Modern Financial Insanity

Select Format

Select Condition

Book Overview

When it comes to markets, the first deadly sin is greed. Michael Lewis is our jungle guide through five of the most violent and costly upheavals in recent financial history: the crash of '87, the Russian default (and the subsequent collapse of Long-Term Capital Management), the Asian currency crisis of 1999, the Internet bubble, and the current sub-prime mortgage disaster. With his trademark humor and brilliant anecdotes, Lewis paints the mood and...

Format:Hardcover

Language:English

ISBN:0393065146

ISBN13:9780393065145

Release Date:November 2008

Publisher:W. W. Norton & Company

Length:352 Pages

Weight:1.38 lbs.

Dimensions:1.3" x 6.5" x 9.5"

Customer Reviews

5 ratings

Panic! The Story of Modern Financial Insanity

Published by Thriftbooks.com User , 14 years ago

Unlike some of the reviewers, I didn't have any problem reading the "fine print" on the cover and understood this was a book edited by Michael Lewis. With that advantage, I got way more than I expected and I expected a lot from my favorite non-fiction author. All I can say about "Panic!" is "Wow!" In 365 pages I was reminded of the last 30 years of US economic instability (something most investors seem to easily forget), took a history lesson on the causes of a half-dozen financial crisis, got insight into the competence and incompetence of this country's financial leaders and corporations, gained some understanding of the complex "instruments" these criminals use to steal billions and trillions from the country and the world, and was entertained by it all. Michael Lewis didn't write this book, but his style and insight is exhibited on every page. Only Mike Lewis could find a place for a Dave Barry article on homeownership in the middle of a group of complicated economic essays. And make if fit seamlessly into the narrative.

Lesson learned

Published by Thriftbooks.com User , 15 years ago

Michael Lewis book is about the mad situation in the stock market. It is a collection of different articles over the last decade. You can find an abstract from Liar's Poker and out of the financial newspapers. It includes articles from Krugman to other well known economists. It suits the situation very well because the last hype is one of the last four crises in the stock market since the bad Monday in 1987. The participants in the stock market never learned the rule that you must change the behaviour when you lost the money. The problem is, that the players on the market doesn't act with their own money. With the new shock the rules have been changed. The government bail them out.

4.5 stars-where are the reprinted articles by Benoit Mandelbrot and Nassim N Taleb ?

Published by Thriftbooks.com User , 16 years ago

This is primarily a book of essays written by other people that Lewis has edited.The general underlying theme is that the Wall Street investment banks,aided by the commercial banks, were allowed ,going back to the late 1970's ,to avoid basic regulatory and accounting requirements ,such as borrower creditworthiness standards and accounting transparency,to leverage their debt positions in various financial markets.Adam Smith characterized these types of activities as those carried out by "projectors"( Keynes's speculators and rentiers).Why was this allowed to happen ? The answer is that the regulators were , in fact,opposed to the regulations that they were supposed to enforce.All of the regulatory agencies over the last thirty years have been stocked with believers in the " Efficient Market Hypothesis"(EMH).There is not a shred of empirical,historical,or statistical support for this theory ,which is practically identical to the artificially constructed models of Ptolomaic astronomy.EMH argues,on completely a priori grounds,that there can be no such thing as a speculative bubble because all possible relevant knowledge is known by market participants in the aggregate.There is no ambiguity,vagueness,unclearness,conflict in,or uncertainty in the information and data used by the market to assess prices.This leads inevitably to the claim that some version of the normal probability distribution is applicable. Benoit Mandelbrot has demonstrated repeatedly ,since the late 1950's,that the time series data sets are not close to being normally distributed.The Cauchy distribution has a much better fit to the time series data on prices.N N Taleb has demonstrated,as J M Keynes did before him,that single ,unique events and infrequent events,which are endogenous to the financial and economic system,have at least as big an impact,if not greater, as frequent events do .There are no selections from these authors in this book.In fact,it appears that there is no references to these authors in any of the essays.Both Mandelbrot,starting in the late 1950's and Taleb,starting around the late 1990's, have made seminal contributions explaining the severe dangers of allowing Wall Street investment banks to engage in the speculative types of behavior discussed in this book.Hopefully,in a future edition,Lewis will rectify this lacuna and put in at least 2 -3 articles written by them.

Who cares that Michael Lewis didn't write all of this?

Published by Thriftbooks.com User , 16 years ago

(Memo to those who do: I heard yesterday that he may be at work on a new book right now, so don't get too mad about your current disappointment...) As other reviewers have noted, this is NOT by Michael Lewis. Rather, the same guy who gave us Liar's Poker: Rising Through the Wreckage on Wall Street and The New New Thing: A Silicon Valley Story has worked through a variety of sources in search of the best reportage on past financial market panics. At the time Lewis was toiling on assembling this (the last story in the anthology is dated in January 2008), it must have been hard to imagine how topical this would become. Certainly, the readings offer clear insight, from many different points of view, on how financial manias emerge, grow, build and then burst, triggering, yes, panic. In light of the events of the last six months or so, this book arrives right in time to give us a framework within which to ponder our current plight. And in some ways, I'd rather have this anthology than a book by Lewis himself -- no single viewpoint is going to give any reader a firm handle on this complex topic. I particularly appreciate Lewis's eclectic sourcing. He goes to humorists like Dave Barry as well as outstanding business reporters like Roger Lowenstein and Greg Zuckerman to obtain insight into the phenomena that we are all seeing played out before our eyes today. Joseph Stiglitz opines on the aftermath of the Asian Crisis in a piece pulled from "Project Syndicate"; he includes blog entries and statements by politicians. He has reproduced Jack Willoughby's classic financial reporting effort on the rate at which dot.com companies were burning through cash, published by Barron's in March 2000 -- just as that market was about to turn very sour indeed. This is a very valuable contribution to the relatively scanty ranks of accessible business/financial reporting. For those who don't scour the busienss press daily, it will provide them with insight into the way financial markets normally work and what kinds of factors can lead to them becoming distorted. Even those familiar with the way Wall Street works should find this both intriguing and useful, reminding us that there really is no such phenomenon as "it's different this time." The one element of this collection with which I would quibble is the implication that we can learn enough from past mistakes not to repeat them. While I do believe that we should have been able to learn more from past manias about spotting a mania in development (i.e. Alan Greenspan should be ashamed at not having recognized the implications of the real estate asset bubble as it took shape), each mania (like each rogue trader) arises in different circumstances and finds its own trajectory. In this context, it would have been interesting to see a greater focus on attempts to improve risk management models -- the art of trying to prevent periods of irrational exuberance turning into manias and panics.

Bursting Bubbles

Published by Thriftbooks.com User , 16 years ago

I have to admit, I read the Dave Barry segment first. In it I learned that there are three proven techniques guaranteed to lose you money in real estate: Buy an old house, buy a new house, or get a mortgage. After I finished laughing about OHDD (Old House Delusion Disease), I moved on. This anthology has a simple idea: "to re-create the more recent financial panics, in an attempt to show how financial markets now operate." Each of the four parts of the book has articles written during the heat of the crisis, and more penned afterwards about the causes and effects and repercussions of the event. Part I examines the stock market crash of 1987. Part II looks at the Asian currency crisis of 1999 which triggered the Russian government bond default that brought down the hedge fund Long-Term Capital Management. In Part III the Internet bubble bursts. Lastly, and most poignantly, Part IV delves into the current subprime mortgage debacle. A segment by Peter S. Goodman of the New York Times titled "This is the Sound of a Bubble Bursting" sobered me up. Written at Christmas time 2007, this article is all about the real estate bust in Cape Coral, Florida, on the mainland near where I live. Goodman gives example after example of people losing everything, of communities gone dark after being abandoned, and the crime rate rising in these darkened neighborhoods. The only good news for Elaine Pellegrino's family, who haven't paid their mortgage for four months, is "the courts are so stuffed with foreclosures that they assume they can stay for a while." This is scary, depressing stuff, but the writing makes the big picture clear. I highly recommend Panic to any grownup who wants to understand what has happened in our financial world. You might want to have a Dave Barry book nearby to cheer you up afterward. (A handy glossary in the back deciphers financial terms for readers that don't know their Derivatives from their Ninja Loans.) Here's the chapter list: Introduction: Inside Wall Street's Black Hole Part I: A Brand-New Kind of Crash 1. Stephen Koepp, "Riding the Wild Bull" 2. Scott McMurray and Robert L. Rose, "The Crash of '87: Chicago's `Shadow Markets' Led Free Fall in a Plunge That Began Right at Opening" 3. From the Brady Commission Report 4. Tim Metz, from Black Monday: The Catastrophe of October 19, 1987 ... and Beyond 5. Michael Lewis, from Liar's Poker: Rising through the Wreckage on Wall Street 6. Stephen Labaton, "The Lonely Feeling of Small Investors" 7. Richard J. Meislin, "Yuppies' Last Rites Readied" 8. Eric J. Weiner, from What Goes Up 9. Lester C. Thurow, "Did the Computer Cause the Crash?" 10. Terri Thompson, "Crash-Proofing the Market; A Lot of Expert Opinions, but Few Results" 11. The Economist, "Short Circuits" 12. Robert J. Shiller, "Crash Course: Black Monday's Biggest Lesson -- Don't Run Scared" 13. Franklin Edwards, from After the Crash Part II: Foreigners Gone Wild 14. Reed Abelson, "Mutual Funds Quarterly Report; The Forecast L