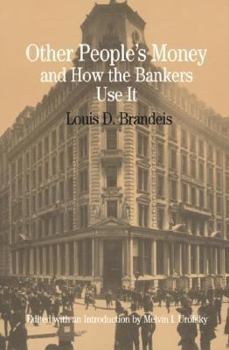

Other People's Money and How Bankers Use It

Select Format

Select Condition

Book Overview

Louis D. Brandeis was a Supreme Court Justice and a patriot. He wrote "Other People's Money and How Bankers Use It" to warn the American people about the greedy bankers that control the United States... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:031210314X

ISBN13:9780312103149

Release Date:March 1995

Publisher:Bedford Books

Length:168 Pages

Weight:0.44 lbs.

Dimensions:0.3" x 5.5" x 8.3"

Customer Reviews

3 ratings

A must-read: 80 years later, most everything Brandeis said about banks is still true.

Published by Thriftbooks.com User , 15 years ago

This is a book that we all ought to be reading right now. Today, investment banks' primary mode of self-defense is to argue that capitalism needs them. Brandeis argues vigorously to the contrary, and it's not at all hard to carry his arguments from the nineteen-teens directly to now. When we tip our hat to bankers, we typically honor their role as intermediaries: they direct money from depositors to valuable investment opportunities. Most depositors cannot be expected to evaluate the claims of businessmen, so bankers function as a vehicle for judging risk and establishing reputations. Hence the now-famous dialogue between J.P. Morgan and Samuel Untermyer: 'Untermyer: "Is not commercial credit based primarily upon money or property?" Morgan: "No sir. The first thing is character." Untermyer: "Before money or property?" Morgan: "Before money or property or anything else. Money cannot buy it...because a man I do not trust could not get money from me on all the bonds in Christendom."' You will presumably find few people today who view bankers as this sort of lantern-jaw-held-steady, coldly-responsible übermenschen. On the other side of the risk-judging coin, bankers are supposed to finance the little guy. The entrepreneur just starting out who needs a few dollars at the right moment -- this man is capitalism's hero, and he's the one to whom bankers are supposed to direct money. As the entrepreneurs' hero, the banker is supposed to be our hero as well. Think again, says Brandeis; bankers only give money to enterprises which have proven that they hold no risk whatsoever. In an absolutely devastating chapter entitled "Big Men And Little Business" (search ahead in that link for "Chapter VII"), Brandeis gives example upon example of how America's rise to industrial might owed nothing to the bankers. In fact, J.P. Morgan's main job was to combine pre-existing businesses -- on which inventors had toiled thanklessly for years -- into monopolies (the famous "trusts"). It was news to me that the House of Morgan was responsible for the behemoth known as General Electric. And I was floored by Brandeis's description of Morgan's role in forming AT & T, the short version of which is that entrepreneurs nearly bankrupted themselves to fund Alexander Graham Bell, Western Union tried very hard to kill the new technology, and Morgan only came along decades later after the phone's fate was secure. So we don't need "the great banks" to keep capitalism churning. It gets worse, says Brandeis: the "great banks," in their mania to form monopolies, destroy businesses along the way. A lot of Brandeis's anger in Other People's Money comes from his fight against the Morgan acquisition of the New Haven railroad, which larded the New Haven up with debt that it couldn't support, and eventually led to its collapse -- reminiscent, today's reader will note, of the 1980s' leveraged-buyout craze. "Was there ever a more be-bankered railroad than the New Haven?" as

Other Peoples Money...

Published by Thriftbooks.com User , 15 years ago

That this book was written nearly 100 years ago makes it somewhat harder to read due to style and useage differences. However, this is a small caveat. What I found rather unnerving was how much of what Justice Brandeis said then about a different crisis, sounded like it could have been written about our current financial crisis. I would recommend this book to anyone who has an interest in the financial history of the country. And to anyone who enjoys an excercise in "the more things change...".

Distressingly familiar

Published by Thriftbooks.com User , 15 years ago

I have been reading dozens of books within the past 2 years on investing and the stock market / US business history. I read this book after Galbraith's The Great Crash 1929 [really excellent!] and am currently reading Josephson's The Robber Barons [also excellent]. All three of these books are over 50 years old, and can seem dated in their prose style [not a problem for me - maybe since I am also over 50], but the material is very fresh and timely, if a bit depressing. The rigging of our financial system to fleece the many in favor of the few did not start in the dot.com era or with the junk bond kings. I highly recommend the edition of Other People's Money edited by Urofsky because his introduction adds a great deal to this slim volume which began life as a series of even shorter magazine articles. Overall, Distressingly familiar [even many of the names have not changed after 100 years]!