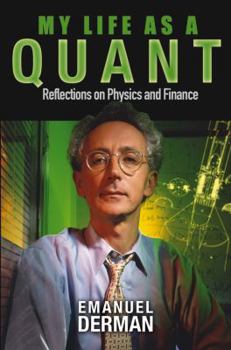

My Life as a Quant: Reflections on Physics and Finance

Select Format

Select Condition

Book Overview

In My Life as a Quant, Emanuel Derman relives his exciting journey as one of the first high-energy particle physicists to migrate to Wall Street. Page by page, Derman details his adventures in this field--analyzing the incompatible personas of traders and quants, and discussing the dissimilar nature of knowledge in physics and finance. Throughout this tale, he also reflects on the appropriate way to apply the refined methods of physics to the hurly-burly...

Format:Hardcover

Language:English

ISBN:0471394203

ISBN13:9780471394204

Release Date:September 2004

Publisher:Wiley

Length:292 Pages

Weight:1.12 lbs.

Dimensions:1.2" x 6.3" x 9.1"

Customer Reviews

5 ratings

An interesting career path

Published by Thriftbooks.com User , 18 years ago

This book is not for those interested in learning quantitative finance. Rather, it is a memoir written by a physicist who came to finance relatively late in life. There is some poignancy in Derman's transformation from theoretical physicist bent on a life in academia (where he hoped to make groundbreaking discoveries about elementary particles) to mid-level employee of one of the world's great financial institutions (Goldman Sachs). Although he was undoubtedly well paid for the skills he brought to the financial markets, Derman's story is tinged with sadness about the loss of an ideal. The book is particularly valuable for the insights it provides about the inner workings of a major investment bank, and in particular about the role played by the "quants" in the development of new products and trading strategies. It also provides some perspective on the development of quantitative finance as a practical discipline; and it makes clear that quantitative skills, while important to a successful career in a major financial institution, generally take a back seat to salesmanship, practical trading skills, and internal politicking. Those with a liking for pure mathematics will have to grin and bear Derman's critical comments about mathematical rigor and economic theory.

A memoir for either a quant, a quant-to-be, or a quant-wannabe

Published by Thriftbooks.com User , 18 years ago

The first thing this book strikes me so much is how frank and to certain extent self-criticising the author is on his life from a doctoral student in the Physics Department of Columbia Univ., to a post-doc scholar, to Bell Labs, then to the Wall Street. Among a good number of books allegedly about lives on the Street, this one with its plain-speaking, matter-of-fact narration definitely offers me a refreshing sensation. For example, the author states flat on how he rode down continuously descending expectations in career from an enthusiastic Ph.D. student who had dreams of groundbreaking discoveries in theoretical physics down to a junior professor in a public college running between jobs to an unremarkable researcher at Bell Labs. The author lays out lucid descriptions about the works with financial models he had done. Yet unlike most others on similar topics, he goes on to explain to the readers what inadequacies/weaknesses those models have. A few personal friends of mine came through their doctoral degrees in physics around the same era before quants became ubiquitous on the Street. To a good sense I can relate how all their lives shared the similar paths of seeing their zests of a career in science being depressed by the harsh reality of seeking a stable teaching/research job after the migrant post-doc years. The author presents to us his own path in a most poetic way.

1000 Millidermans!

Published by Thriftbooks.com User , 19 years ago

A great book for anyone with an interest in Physics, Programming, or Finance. You will accompany Emanuel Derman in his journey to NYC as a young, enthusiastic PhD student, wander around the US and UK with him as he jumps from one postdoc position to another, have a feel of what is like to abandon a research career for a "business" job at Bell Labs "penal colony" and finally enter the secret doors of the money temples in Wall Street. You will find interesting remarks and reflections on the life of academics, programmers , quants and traders and get a glimpse of interesting characters like the nobel prize winner and Columbia Physics dept Emperor T.D. Lee and Wall Street legend Fisher Black. (yes, the Black-Scholes equation guy). It is a fascinating read, but still quite depressing...one cannot avoid the question: "why didn't Dr. Derman manage to stay in Academia"? Watching the steady decline of his enthusiasm and the gradual curbing of his hopes while he progresses through his PhD and postdocs makes a clear pictures of how helpful and nurturing academic life can be to the ones who dare to choose it. Isolation, extreme competition, lack of decent working opportunities and conditions and the need to "produce something" to sustain his academic career slowly disoriented and disgusted a truly passionate, talented and enthusiastic young physicist to the point that he found the business, money crunching world more intersting and pleasant! This paradox clearly and sadly illustrates how the "publish or perish" routine has deformed the beauty of research and academic life.

An enjoyable and information book

Published by Thriftbooks.com User , 20 years ago

I normally do not read biographies, and I don't think I have read an autobiography since I was forced to read one in high school. Most autobiographies are simply exercises in celebrating the successes of a great life. I chose this one because Derman has always been a fascinating person. One of the first physicists to make it big on Wall Street, he's best known as co-creator of the Black-Derman-Toy term structure model and the Derman-Kani volatility smile model. I had read his finance research, some of his lighter reading, and had met him. I knew he wasn't one to gloat. This book delivers everything I expected. Offering fascinating insights into the culture of organizations he has worked for, such as Goldman Sachs, Bell Labs, Salomon Brothers, and the crazy world of academic physics, Derman takes us on an exciting trip through a career that parallels the emergence of finance as a scientific discipline on both Wall Street and in academia. What fascinated me the most is how he describes his achievements in very modest terms, carefully explaining what he discovered but without trying to make you think that his findings changed all life on earth from that point forward. And he is remarkably candid about his mistakes, which humanize this book in a way rarely seen when someone is telling their personal story. If you're interested in finance, physics, academia, or you'd just like to read an autobiography the way it ought to be written, this book is for you.

The Human Side of Quantitative Finance -- Great Read!

Published by Thriftbooks.com User , 20 years ago

The book commences with a history of physics that is reminiscent of "The Elegant Universe" by Brian Greene. From Newton to Maxwell to Einstein and beyond, Derman discovers the great theories of yesterday and finds himself in the middle of a seven year marathon to a PhD and the launch of his academic career. The struggle for intellectual purity and the distain for applied work abound in Derman's academic environment and the pressures of achieving greatness are pronounced in a place where genius is a commodity. In a leap of faith, Derman decides to return to New York to spend more time with his family and to surrender to what he considered a less dignified job. Lost in the Dilbert-esque hierarchies of the Bell Labs, Derman discovers the joy of programming, while submerged in office politics. After numerous attempts of beating the currents, Derman finally reaches the shores of Wall Street and is relieved to find an avant-garde environment, where meritocracy is no longer a foreign word. The initial period of awakening takes place at Goldman Sachs, where he is mentored by Fischer Black, one of the great financial practitioners of our time. Derman is immediately impressed by Black's pragmatic style and intuitive quest for simplicity. Black's influence becomes evident in the lucid and accessible description of the famous Black-Derman-Toy interest rate model and the subsequent elaborations on local volatility models that are at the foundation of more exotic instruments (which cannot be accurately priced using the overly simplistic implied volatility provided by the Black-Scholes-Merton model). The author discusses the process of deriving original models and emphasizes that the elegant stochastic calculus derivations of these models are deceptively simple and make it difficult for students to fully appreciate the amount of effort that went into developing the initial embodiments -- what seems obvious now was once heavily debated. Armed with the recently acquired knowledge, Derman accepts a new challenge at Salomon Brothers, doubling his compensation in the process. Unfortunately, the unhealthy competitiveness at Salomon forces him to reconsider quickly and he returns to Goldman after an undeserved layoff. The roundtrip allows Derman to develop an appreciation for the collaborative environment at Goldman. Throughout the book, the interactions with family members, professors, bosses, traders, programmers and sales people are both amusing and enlightening. Derman succeeds in blending physics, finance, and human emotion in this masterful and entertaining autobiography.