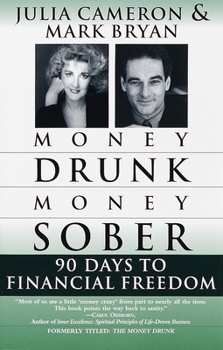

Money Drunk/Money Sober: 90 Days to Financial Freedom

Select Format

Select Condition

Book Overview

In a society where it is often easier to discuss sex than money, many of us have hidden issues about personal finances. But when fending off bill collectors, begging for salary advances, or borrowing from relatives becomes a way of life, unresolved money problems can lead to enormous stress and destroy relationships, careers, and lives. Do you recognize yourself or someone you love in any of these descriptions? THE COMPULSIVE SPENDER Do you buy things...

Format:Paperback

Language:English

ISBN:0345432657

ISBN13:9780345432650

Release Date:February 1999

Publisher:Ballantine Books

Length:240 Pages

Weight:0.48 lbs.

Dimensions:0.5" x 5.1" x 7.9"

Customer Reviews

5 ratings

Change your Mind & Change Your Cash flow

Published by Thriftbooks.com User , 17 years ago

This book goes on to describe 5 different money drunks Among them is the poverty addict, who is addicted to poverty. Usually this kind of person subconsciously feels that in order to be a good person or to be spiritual they must suffer. Then there's the Big Deal Chaser. This person goes from business start up to business start up looking for "THE ONE" to fix it all. They have the subconscious belief of "when I'll get rich I'll show'em all". Then there's the Maintenance money drunk. This person has let go of their dreams to "get a real job" or to get a job that pays the bills. They don't believe in "fairy tales". I think we have let ourselves have a distorted view of money. Religion doesn't help. Sayings like "money is the root of all evil" or "the rich are getting richer while poor are getting poorer". Even wealthy and rich people can be poverty addicts, feeding into the thinking that there isn't enough money to go around for everyone. Most likely you'll find yourself being a little bit of all 5 money drunk types with maybe a concentration in one or two. Between the poverty addiction and the big deal chasers, I think most of us are afraid to really evaluate our relationship with money and really let ourselves have a spiritual relationship with money. (Spiritual and money ...huh?? does that even exist? YES!) This book makes you realize that no matter if you win the lottery or get more money coming in, if your inner feelings towards money are not balanced, you will most likely create situations that will suck you dry financially. (Bills, credit, debt, etc) Cliches such as "money isn't everything" may pop into your mind, but when the topic of family comes up people don't say "family isn't everything" or when the topic of health comes up people don't say "health isn't everything". When the topic of electricity comes up , people don't say "electricity isn't everything". I think money has gotten a bad wrap due to a variety of things we've been taught including religion teaching that wealth is bad. Money is like electricity. You can use it to warm your home and cook a good meal for your friends and loved one....or you can use it to COOK YOUR FAMILY. That doesn't make electricity good or bad. Electricity just is. Money is the same way - it just IS. I recommend this book to anyone, especially those who are spiritually inclined. We all owe it to ourselves and to our loved ones to be wealthier! In my opinion we ALL deserve to have the finer things in life!

Change Your Mind About Money!

Published by Thriftbooks.com User , 18 years ago

As a therapist and seminar leader on money issues, I love their "Are You A Money Drunk?" quizzes. They help explain and re-orient the underlying attitudes and beliefs that fuel a bad relationship with money. The book offers a foundation of healing for people who think they cannot control their spending, and are using money as a drug.

Thank you!

Published by Thriftbooks.com User , 22 years ago

It's obvious that Mr. Bryan and Ms. Cameron know what they are talking about from page one, and, thank goodness, they have been able to explain (to me) my own lifelong struggle with money handling!!! Now, with insight into the origins of my money dilemma, I have been able to make my money work with my life for the first time! Whew! What a great relief!!! I understand now that this is a learned behavior, and yes, I used money to "fill in the blanks" that I thought I had. Now I realize I really don't have any "blanks", that I'm really quite marvelous in many ways (why haven't I been able to see that till now?)! I just had this painful and debilitating old habit I'm now glad to be rid of for good. So, BRAVO, Cameron and Bryan...and many, many thanks!!!

Got me out of debt!

Published by Thriftbooks.com User , 24 years ago

I was given this book by my mother when I said at one point that no matter how much I made I seemed to owe even more. My husband and I owed so many thousands of dollars on high-interest credit cards that I thought 25 years would pass and we would still not be out of debt. It is now three years later and not only are we out of debt, but we have a good start on retirement savings, an emergency cushion in the bank, and we are about to buy our first house -- all things that I never thought we'd be able to do. This book first describes different types of money "addictions" (you will absolutely see yourself here), and then gives you an easy-to-follow step-by-step program to get you started on your way to being fiscally responsible. I followed the program diligently and found the exercises very helpful in keeping focused, not just on my spending but on how to use our money to make Life Changes....not just home improvements. I really can't recommend this book highly enough -- it truly saved my life.

Outstanding Look at Money Addictions and Their Cure

Published by Thriftbooks.com User , 24 years ago

This book is based on a seminar series designed to work with those who have obsessions and addictions about money that are harmful. Unlike most books that address the psychological roots of money problems, this one develops a detailed recovery plan over 13 weeks that builds on programs for overcoming other addictions like alcoholism. Even if you don't have a full-scale addiction to money, you can use this program to diagnose and improve the places where you are misfocused in your thinking about and use of money. One of the many valuable insights that I took away from this book was that money addictions are often associated with other addictions like alcoholism and excessive gambling. Many people will solve those addictions with great difficulty, but still find their lives missing something due to their money addictions.One of the strengths of this book is found in the many diagnostic lists that can help you assess whether you are having or have had problems with money addiction. I certainly found myself in several chapters, and that provided useful insights to me. Here are some of the categories to watch out for: Compulsive spending (getting an emotional rush from buying things); Big deal chasing (fantasies providing encouragement for irresponsible use of time and financial resources, and the related problems of workaholism to get more money and avoid intimacy with one's family and friends); Maintenance money focus (doing work just for the money); Poverty addiction (seeing sainthood in having little money and less spending); and Co-dependency (where your relationships are based on providing money for someone with a money addiction). The 13 week recovery program is marvelous. I was very impressed. It starts with undoing your stalled thinking about money, and bit by bit helps you establish new and better habits about money.The program builds a lot on measuring how you are spending and getting money, focuses you on stopping the worst of your bad habits (like taking on more debt), and gradually refocuses you on important human issues like self-esteem, compassion, peace, spirituality, and reintroducing hope into your life. This stallbusting approach is one that should work for anyone who has hit bottom and truly wants to reform. This is a book that everyone should read and use to evaluate themselves. It should also be shared with children. Money addiction is often passed down from parents to children through sharing bad habits learned in the home. If a friend shares with you that they are in a bad way financially and need help, give them a copy of the book. It will probably do them more good than giving them money that they won't be able to repay. Live a higher quality of life from learning the lessons of this book!