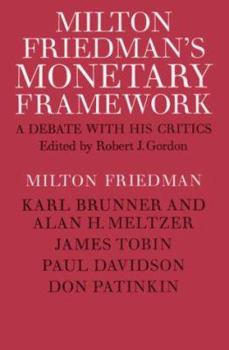

Milton Friedman's Monetary Framework: A Debate with His Critics

Select Format

Select Condition

Book Overview

In response to widespread interest in a formal complete statement analyzing aspects of the money-income relationship and clarification of his quantity theory, Milton Friedman in 1970 published "A Theoretical Framework for Monetary Analysis," and a year later "A Monetary Theory of Nominal Income," both in the Journal of Political Economy. A combined version of these essays, first published by the National Bureau of Economic Research, begins this volume. Because his statement was important and controversial both as a commentary on the history of economic thought and as a theoretical contribution in its own right, the Journal of Political Economy in 1972 presented critical reviews from noted monetary theorists, including Karl Brunner and Allan H. Meltzer, James Tobin, Paul Davidson, and Don Patinkin. Their studies, which are printed in the present volume, focus on substantive issues, covering a variety of topics. All of their major points are discussed in Friedman's reply, which clarifies and expands upon his original themes and introduces interesting new material. Thus the synthesis of his two articles, the critical comments, and his response, together with an introduction by Robert J. Gordon, are combined in one volume for the convenience of scholars and students.

Format:Paperback

Language:English

ISBN:0226264084

ISBN13:9780226264080

Release Date:May 1975

Publisher:University of Chicago Press

Length:199 Pages

Weight:0.66 lbs.

Dimensions:0.5" x 6.0" x 9.0"

Customer Reviews

1 rating

Friedman never grasped Knight's uncertainty -risk approach

Published by Thriftbooks.com User , 21 years ago

Meltzer edited this collection of essays containing Friedman's most up to date exposition of his macro model and a series of comments from other macroeconomists such as James Tobin,Paul Davidson,Don Patinkin and Meltzer himself in the 1972-74 time period.The major problem in these essays is the failure of all the above mentioned economists(Davidson mentions the distinction frequently,but unfortunately adopted a misinterpretation of Keynes's approach to uncertainty based on the views of G L S Shackle,which are in fact a very special case of Keynes's own approach as originally specified in chapter 26 of Keynes's 1921 classic, A Treatise on Probability) to grasp the central theoretical role played in Keynes's General Theory of the clearcut distinction between risk and uncertainty.This is surprising since Friedman was certainly familiar with Knight's classic Risk,Uncertainty and Profit.Nevertheless,Friedman appears to have rejected the distinction maintained by both Knight and Keynes in favor of the subjectivist approach of Leonard J Savage,who,although discussing the problem of uncertainty(which Savage called vagueness),rejected any operational role for it in his theory of decision making under risk. The confusions of Friedman,Tobin, and Davidson all show up simultaneously in their attempted discussion of the technical details of Keynes's Theory of Effective Demand as modeled by Keynes in chapter 20 of the General Theory.Chapter 20,and the additional analysis contained in chapter 21 of the General Theory,contains the analytic core of Keynes's major innovation in the General Theory,his incorporation of expectations and uncertainty into the microfoundations of entreprenuerial decision making and the subsequent aggregation of this micro model into the macroscopic D-Z model,which Keynes had briefly introduced in a beginning chapter of the General Theory,titled"The Principle of Effective Demand".It is clear from a reading of pages 143-157 that Tobin,Friedman,and Davidson do not understand how to derive Keynes's original D-Z model.Simple integration of Keynes's derivatives ,either on pp.55-56,ft.2 or on pp.282-285 of the General Theory ,would reveal that D=pO and that Z=P+wN.Friedman fails to realize that the p in D=pO IS DEFINED BY KEYNES AS AN EXPECTED PRICE. Another error committed by Friedman is his failure to recognize that the mathematical expression p=[D/W.W]/O IS EQUAL TO EXPECTED MARGINAL COST.Practically all of Friedman's footnote 15 on pp.156-157 of this book is erroneous.None of these erroneous results were challenged by either Tobin or Davidson.Keynes's Z FUNCTION IS COMPLETELY ELIMINATED IN FRIEDMAN'S ANALYSIS.Despite the large number of errors,this reviewer recommends that this book be purchased.A study of these errors is very instructive.