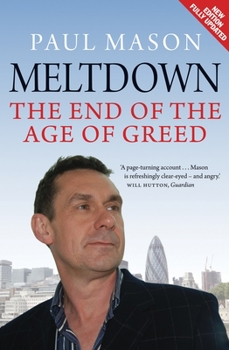

Meltdown: The End of the Age of Greed

Select Format

Select Condition

Book Overview

Meltdown is the gripping account of the financial collapse that destroyed the West's investment banks, brought the global economy to its knees, and undermined three decades of neoliberal orthodoxy.... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:1844676536

ISBN13:9781844676538

Release Date:November 2010

Publisher:Verso

Length:288 Pages

Weight:0.70 lbs.

Dimensions:0.8" x 5.1" x 7.8"

Customer Reviews

4 ratings

Deserves Great Review

Published by Thriftbooks.com User , 15 years ago

The title is of course wrong - There will never be an end to greed, and the idea that this represents the end of an age is now highly dubious. Still, the combination of on-the-spot journalism and great intellectual command makes this slim book a marvelous read and achievement. Paul Mason is a fine writer, and strong thinker, and since this was one of the most incredible economic happenings of all time, we need his voice to make sense of what is going on around our ears.

Superb insights about the global financial crisis

Published by Thriftbooks.com User , 15 years ago

I think there's no better book in the market than this one about the current global financial crisis, and how it developed. Just buy it. Then savor it.

Handy Digest

Published by Thriftbooks.com User , 15 years ago

Mason's brief work (170 pps.) presents an incisive digest of a global meltdown that came with the kind of suddenness that left many of us asking, "What happened?". The first few chapters provide a week-to-week account of the meltdown itself, a helpful timeline of how the crisis unfolded. The next section looks at the more remote background events and assumptions behind the crisis, chiefly deregulation and neo-liberal policy. The last part may be the most challenging by examining the structure of neo-liberalism itself, mainly from the critical standpoints of Kondratieff and Minsky. The general conclusion is that neo-liberal policy is dead for the foreseeable future, and a more "socialized" banking system recommends itself as the best and perhaps only solution. He writes in mid-February, 2009, and as of this moment in August, the Obama administration shows no sign of a major bank overhaul, let alone a successor model to neo-liberalism. By Mason's lights, this means a prolonged slump with a very murky future. Be that as it may, the book is a succinct and timely account for the layperson, and I particularly appreciate the inclusion of a glossary of terms. I sometimes think these high-level train wrecks occur because the general public is excluded by the arcane terminology of finance itself. Worse, it's the same public who then pay the price by having to survive amid the debris.

Powerful account of the crisis

Published by Thriftbooks.com User , 15 years ago

Paul Mason, the economics editor of BBC Newsnight, has written a powerful study of the crash. He surveys the financial meltdown, the decade that led to the disaster, and the life and death of neo-liberalism. Gordon Brown told us in June 2007 that deregulating Britain's banks would be `the beginning of a new golden age'. The bankers lied that they took high risks so they deserved their high rewards. But they took the profits from industrial production and put them into finance, not back into industry: "the end result is that profits are funnelled from ordinary savers into the pockets of the rich." The bankers created the credit bubbles in dotcom, housing and commodities. Speculators bought technologies, houses, oil, rice, wheat and soya, until all the bubbles burst, laying waste those parts of the real economy. After the financial crisis, the governments bought the banks' debts as dearly as possible, so as not to penalise them, running up huge debts and printing money, to save the banks, whatever the cost to the economy. There are $10 trillions' worth of toxic loans, only $1 trillion of which has been written off so far. The world's workforce has doubled since 1979 to three billion. This huge supply of labour has tilted the balance of power from labour towards capital. So now we need to fight smarter for higher wages, and for a different economy. To do so, workers will have to reject what Mason calls the `low-level, non-ideological, anti-political culture' of the anti-globalisation movement. He points out, "In the same month that half a million American workers would lose their jobs, the main focus of the Non-Governmental Organisations leaflets was `Don't forget aid to Africa'." We should reject the NGOs' slogan `Think globally, act locally'. We have to act in our nation-states, in our national unions. Mason observes, "Capitalism's tendency has been to expand the power of the market: to push for the maximum freedom for market forces and the destruction of all ties - family, clan, nation and class - not based on free exchange." So we have to save our nation and our class from destruction by the capitalist class.