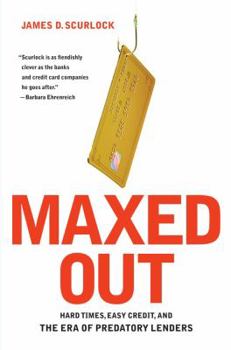

Maxed Out: Hard Times, Easy Credit, and the Era of Predatory Lenders

Select Format

Select Condition

Book Overview

In this shocking and illuminating road trip through an America ravaged by debt, award-winning film director James Scurlock examines our multitrillion-dollar addiction to easy credit in all of its... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:141653251X

ISBN13:9781416532514

Release Date:March 2007

Publisher:Scribner Book Company

Length:248 Pages

Weight:0.95 lbs.

Dimensions:1.0" x 6.2" x 9.2"

Customer Reviews

5 ratings

Proud Deadbeat and Freeloader...

Published by Thriftbooks.com User , 16 years ago

...off of MasterCard :) As I was finishing Maxed Out, I received my statement for my single credit card, which I am proud of having paid of the entire balance over the past six months. What do they do? Tack on a whopping $0.96 cent finance charge! I just have to laugh. As tempting as it is, I finally decided not to mail them 96 pennies accompanied with a snapshot of my hand flipping them the bird. On the few occasions I have no choice but to deal with the teller at my bank, I get a robotic sales pitch for the same $%^# card I already have. More than once I've told this drone, "I already have it; you ask me that every time. I'm paying off the balance and not using it until after that." This book has confirmed what I already suspected: that's exactly what the finance industry does not want to hear. Because lenders are loaning to people who can't afford to pay it back (and they try every way possible to make sure we can't ever do so), our economy is going fast down the sewer, and the repercussions that James Scurlock describes are flat-out frightening. Bankruptcy rates are higher now than during the Depression? WTF? If that isn't a wake-up call to the banking industry to stop preying on people with offers of "easy" credit, then nothing will be. The suicide-riddled stories of how college students fall into this "bear trap" particularly burn me up. I work at a community college, and the credit card vultures periodically set up a table right in the student center. When I pass by, I sometimes have to restrain myself from pulling the 18-year-old freshmen away from it and giving the slimy salesmen a piece of my mind. I'd never really do that, but I fantasize about it. It's a pretty simple concept, college kids: If you don't have a job with a reasonable paycheck, DO NOT get a credit card. End of story. Who cares about the latest gadgets you think you have to have? Grow up and start thinking about your future instead, and debt can very easily wreck it permanently. I think this book should be required reading in freshmen-level college classes, and I very highly recommend it to everyone. It's a splash of ice water in the face about a very serious problem, and it seems the only way to solve it is by collectively telling the banks, corporations, and government "Enough!"

Eye opening

Published by Thriftbooks.com User , 17 years ago

Very interesting read. You can learn a lot about the practices of lenders and get a quick snapshot of common americans, who are totally baffeled by credit terms, but totally driven by the need of money. Some stories deserved their fate, but some, as the stories described them, are victems of a lending system that preys on the ignorant with legal talk and slight of hand mathematics. You'll learn lessons that will protect yourself.

Debt as a Product.

Published by Thriftbooks.com User , 17 years ago

I am 80 years old and yet I have never thought about debt as a product or the way it has been promoted in this country. I am of the old school and very rarely have ever paid any interest on my credit card accounts or "buying on time". My wife and I have owned our own home ever since we bought our first home in the late 50's with a GI Loan for 4.5%. With a few instances we have never had much debt and then it was for brief periods. We have had home mortgages, but we consider that "good" debt. We have taught my children about our thoughts on debt and especially credit cards and how insidiously tantalizing they were and are. We have requested that both our children read our copy of this book as a way of changing the way they also think about debt.

Not perfect, but rings much-needed alarm bells

Published by Thriftbooks.com User , 17 years ago

"Maxed Out" is a scary book, especially if you have children or if your income is at all precarious. (Hey, wait a minute - that's most of us, isn't it?) As other reviewers have noted, it is not the book it might have been. There are few details and virtually no statistics - in fact, there isn't even an index. (And why on earth not? It would make it so much easier to dig out the many interesting facts and anecdotes that Scurlock shares with us). But that's OK. This is not an academic survey, or a consumer report. It's quite simply a wake-up call - a shrill, insistent alarm bell. Scurlock warns us that the credit card industry, and the banks that run it, are Not Our Friends. On the contrary, they want us to get into debt up to our eyeballs, and keep making minimum payments on maxed-out accounts until we die. (Even then, they may hire shady "collectors" to harass our nearest and dearest, trying to get them to pay up even if they are not legally responsible for the debts). Did you know that credit card companies (i.e. your friendly bank) refer to people who pay off their bills on time every month as "freeloaders" and "deadbeats"? Or that anyone can get multiple cards and vast amounts of credit, even if they don't have enough income to justify a single low-limit card? (Or, indeed, any income at all). Or that a "preferred customer" means someone "willing to make minimum monthly payments forever"? Or that the US Bankruptcy Reform Act of 2005 was written by the banks, and that its main purpose is to make it harder for individual consumers to go bankrupt and thus get a fresh start? Or that the two main markers for those most likely to go bankrupt in the USA, in the 21st century, are being female and being a mother? Scurlock's analysis, while hair-raising, is convincing, and fairly well documented. (As well as being supported by experts such as Elizabeth Warren, author of "The Two-Income Trap"). He argues that the traditional way for banks to make money was by borrowing from individual depositors, and lending to companies; whereas today, banks have discovered that they can make more money faster by lending to consumers instead. How many of us have seen a relative or friend stumble into the "bear trap" of debt - drifting into larger and larger balances, paying more and more interest, until one day they realise there is no way back? I finished this book with a hard, icy feeling in my stomach. It had struck me that, whereas I had always thought that banks were just huge, unfeeling businesses that were indifferent to our welfare, they are actively hostile. Sad but true: the banks are our enemies. If you doubt that, read this book in conjunction with Joel Bakan's "The Corporation: The Pathological Pursuit of Profit and Power".

The Financial System is Blinking Red

Published by Thriftbooks.com User , 17 years ago

What "An Inconvenient Truth" did for Global Warming, "Maxed Out," the book and the documentary should do for America's impending debt crisis. Author and moviemaker James Scurlock sounds the warning about credit card companies' predatory lending pratcices, but he also makes a larger and much scarier statement about America's addiction to debt and how it may well cause a major societal breakdown sometime in the near future. All of this comes from a Wharton Business School graduate and former (Daddy) Buch campaign worker who quite obviously has had his eyes opened as to the crisis America will soon no longer be able to deny. Particularly unnerving are the quotes Scurlock digs up from various political leaders which show how clueless they really are about even the basics of how America's financial system works. Whether you read the book or see the movie, "Maxed Out" contants an imporatnat message we all should heed.