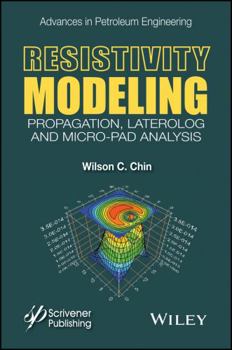

Intergrated Fluid Invasion and Electromagnetic Models for Resistivity Logging

Resistivity logging represents the cornerstone of modern petroleum exploration, providing a quantitative assessment of hydrocarbon bearing potential in newly discovered oilfields. Resistivity is measured using AC coil tools, as well as by focused DC laterolog and micro-pad devices, and later extrapolated, to provide oil saturation estimates related to economic productivity and cash flow. Interpretation and modeling methods, highly lucrative, are shrouded in secrecy by oil service companies - often these models are incorrect and mistakes perpetuate themselves over time.

This book develops math modeling methods for layered, anisotropic media, providing algorithms, validations and numerous examples. New electric current tracing tools are also constructed which show how well (or poorly) DC tools probe intended anisotropic formations at different dip angles. The approaches discussed provide readers with new insights into the limitations of conventional tools and methods, and offer practical and rigorous solutions to several classes of problems explored in the book.

Traditionally, Archie's law is used to relate resistivity to water saturation, but only on small core-sample spatial scales. The second half of this book introduces methods to calculate field-wide water saturations using modern Darcy flow approaches, and then, via Archie's law, develops field-wide resistivity distributions which may vary with time. How large-scale resistivity distributions can be used in more accurate tool interpretation and reservoir characterization is considered at length. The book also develops new methods in time lapse logging, where timewise changes to resistivity response (arising from fluid movements) can be used to predict rock and fluid flow properties.