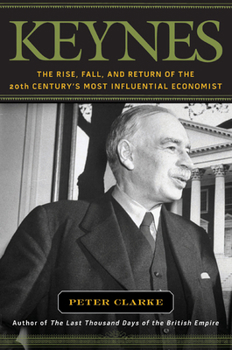

Keynes: The Rise, Fall, and Return of the 20th Century's Most Influential Economist

Select Format

Select Condition

Book Overview

The ideas of John Maynard Keynes inspired the New Deal and helped rebuild world economies after World War II --and were later dismissed as "depression economics." Then came the great meltdown of 2008.... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1608190234

ISBN13:9781608190232

Release Date:October 2009

Publisher:Bloomsbury Publishing PLC

Length:224 Pages

Weight:0.75 lbs.

Dimensions:0.9" x 6.0" x 8.5"

Customer Reviews

3 ratings

Keynesian stimulus

Published by Thriftbooks.com User , 15 years ago

The recent financial near meltdown has rehabilitated the reputation of John Maynard Keynes, says Peter Clarke. Keynes was the man, after all, who long ago said that, "When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill done," a judgment that surely seemed prescient by October 2008. The crisis produced a fiscal stimulus -- the one I am thinking of is the rush of a few publishers to quickly issue new books about Keynes. I read Clarke's because the publisher provided me a free examination copy through a LibraryThing lottery. It is less than 200 pages in the body and is definitely a good selection for readers that wish to catch-up on Keynes but do not have either the time or the stamina for Robert Skidelsky's full three-volume biography (published between 1994 and 2001). Another possible new-issue choice, which I did not read, is Skidelsky's own single-volume Keynes: The Return of the Master. Clarke is a former Professor of Modern British History at Cambridge who has written two previous books about the Keynesian revolution in economics. In this new volume he covers many essentials, including an overview of Keynes' shifting reputation from 1920 to the present, biographical highlights, Keynes' economic policy ideas, and core elements of his economic theory. In an epilogue he considers how Keynes' insights have been put into practice (or not) in both Britain and America and how we can still benefit from his thinking. Keynes once remarked that an effective economist must also be a "mathematician, historian, statesman, [and] philosopher" and "must understand symbols and speak in words." He describes himself. He was a notable public figure from the appearance of his The Economic Consequences of the Peace (1919) until his death (1946), a skilled writer and arguer for his positions, often a representative of his country in international economic negotiations. He was a central figure in the Bloomsbury group, broadly engaged in the arts and generous in his support. In the end he was a highly successful investor, though his fortunes fluctuated wildly at times. Clarke gives special emphasis to how Keynes' ideas developed from 1929 through the 1936 publication of his magnum opus, The General Theory of Employment, Interest and Money. He recounts in some detail Keynes' participation and influence on the Committee on Finance and Industry (1929-1931), a group appointed by the British government to provide policy guidance to deal with the depression. Beginning in 1931, Keynes also participated with a discussion group at Cambridge known as the "Circus," including both established and younger economists. Out of these experiences several of his core ideas took shape and matured. Clarke covers several of Keynes' key concepts in lay terms that will appeal to most readers (no need for mathematics). He claims "the seed of the Keynesian revolution in economic theory" is the recogn

A Good and Readable Biography Of Keynes

Published by Thriftbooks.com User , 15 years ago

This is a fairly short biography of Keynes, his times, and the people involved in that period. It is exceptionally well written and covers most of the key characters and events. It is a good introduction to Keynes as the man, and somewhat Keynes as the thinker. It is not strong, in any manner, on his theories or those theories which led up to his thinking. It is also not the definitive biography as is the three volume work by Skidelsky, nor is it akin to Skidelsky's latest book on Keynes and his theories. Yet is is quite readable and informative as to the times and people and is a delightful read for those new to Keynes or to those who have followed his efforts for a while. What the book does do is bring to life many of the environmental and personal forces which moved Keynes in his thinking.

Fails to explain how uncertainty differs crucially from risk

Published by Thriftbooks.com User , 15 years ago

The author is correct that there are two fundamental problems facing any society,be it ancient,medieval,or modern .The first is the uncertainty of the future and of the future rate of interest as opposed to the riskiness of the future .The second is the role of bank financed and leveraged speculators in financial markets in the creation of a continuing series of financial bubbles that leads to manias,panics,crashes,and economic downturns in the world's financial markets and countries.The author overlooks that Keynes identified the connection between the two and presented a solution that reached back to the solution put forth by Adam Smith in 1776 in the Wealth of Nations(WN).Smith's solution basically represents an amalgam of the ancient wisdom of the Old and New Testament prophets,Jesus,Plato,Aristotle,Augustine,Aquinas,and Albert the Great,Aquinas's teacher.The solution is this-Fix the long run rate of interest on money loans at a low level while at the same time preventing loans from being made to three categories of borrower:prodigals,imprudent risk takers,and projectors.These three categories are the same as Keynes's speculators and rentiers. The author is unsuccessful when it comes time to present to the reader a coherent,technical discussion of what Keynes means specifically by uncertainty and why and how it is fundamentally different from the Benthamite Utilitarian concept of risk, first put forth by Jeremy Bentham in 1787 as an attack on the WN and then adapted into standard neoclassical economics and decision theory by way of Subjective Expected Utility (SEU).He falls back on giving various quotations taken from the General Theory (GT;1936) and post GT writings of Keynes similar to the following kinds of one liners : " The future can't be calculated "," We simply do not know ",or " Uncertainty is non quantifiable ".This approach ,similar to the post Keynesian approaches of Paul Davidson,GLS Shackle,and Robert Skidelsky,leads to obfuscation and nihilism.Keynes gave the reader of the GT a very specific technical discussion that is presented on pp.208-209 and pp.304-306 of the GT.Keynes's generalization of the Quantity Equation of Exchange on pp.304-306 involves a highly technical anlysis which Keynes presented in the form of the then widely accepted elasticity analysis.I give Keynes's results here.It is up to the reader to follow through and study them.An easier explanation from the A Treatise on Probability (1921;TP) is then given below.The neoclassical system ,based on the assumption that there is no uncertainty about the rate of interest but only risk, requires that the elasticities e and ed subscript must equal 1.However,this is a special result.The general case is that the elasticiteis e and ed subscript are Keynes presented a more clearcut analysis using his conventional coefficient of risk and uncertainty,c,in chapter 26 of the TP. A very specific example of Keynes's nomlinear and non additive approach to probability in