The Misadventures of Rufus the Rat: When Curiosity Goes Too Far

Related Subjects

LawCustomer Reviews

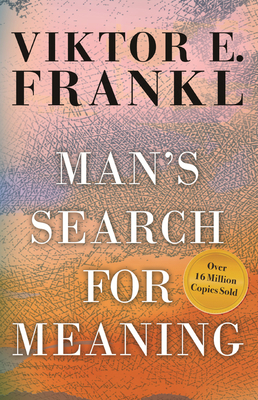

Rated 5 starsExcellent Text

Simply an excellent little book, concise and written in a very clear format. Indeed, not making just one of the many mistakes the author comments upon could save your business thousands in taxes, fines and penalties.

0Report

Rated 5 starsGreat book - concise and helpful

This book outlines 76 ways that small businesses often get in trouble with the IRS. A lot of these mistakes are very tempting to make -- in fact, one can argue that it's the tax law that's the problem in many cases, not the business practice. Nonetheless, the author makes clear the IRS position on these mistakes, and shows how damaging the mistakes can be when the IRS wins in tax court over the business owners.Every small...

0Report

Rated 5 starsInsightful Info about All Areas of the Tax Code

All around great advise that covers practically every area of the tax code for a small business. My accountant can always answer a specific question but he has never put all my posible tax issues into one big picture. This book does that! It covers all the major areas of the tax code such as paying employees vs. contractors, entertainment and meal expenses, retirement plans, loans, and S-Corporations. In all these...

0Report

Rated 5 starsTrustworthy tax advice without the meter running

As sole proprietor of a small business for over twenty-five years I thought, as others may, that I was reasonably familiar with the tax minefield. But was 'reasonably familiar' really good enough? Was I missing anything? The advice Michael Savage offers in his book has given me a measure of security I never imagined possible without a face to face meeting with a tax attorney. Mr. Savage prepares the small business...

0Report

Rated 5 starsA must-read for small business owners

This is a book that will save you pain and heartache in any battle with the IRS or state taxing authorities. Learn about the expensive mistakes you can make trying to take shortcuts in managing payroll and other tax related expenses.If you hire people, if you claim T & E deductions, if you try to maximize the benefits of owning a business, take a few minutes to read Savage's relevent insights.The book is set up as an easy...

0Report