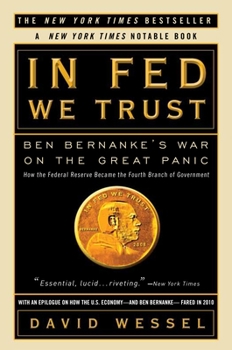

In FED We Trust: Ben Bernanke's War on the Great Panic

Select Format

Select Condition

Book Overview

"Whatever it takes" That was Federal Reserve Chairman Ben Bernanke's vow as the worst financial panic in more than fifty years gripped the world and he struggled to avoid the once unthinkable: a repeat of the Great Depression. Brilliant but temperamentally cautious, Bernanke researched and wrote about the causes of the Depression during his career as an academic. Then when thrust into a role as one of the most important people in the...

Format:Paperback

Language:English

ISBN:0307459691

ISBN13:9780307459695

Release Date:August 2010

Publisher:Crown Publishing Group

Length:352 Pages

Weight:0.62 lbs.

Dimensions:0.8" x 5.1" x 8.0"

Customer Reviews

5 ratings

Spectacular! PERIOD!!!

Published by Thriftbooks.com User , 15 years ago

Spectacular! PERIOD! Perhaps the best non-fiction financial thriller for 2009 from the mind of David Wessel, the Economics Editor of the Wall Street Journal. The essence of the book is captured in the following quote from Federal Reserve Chairman Ben Bernanke: "The only case for an independent central bank in a democracy is that it can take a longer view and do what is in the interest of the people in ways that elected politicians cannot." P. 271 Bernanke, Paulson, Geithner and Summers - Where did these guys come from? How do they think? How do/did (Paulson) they work with one another when faced with the most unimaginable economic crisis since the Great Depression? It's all here. Why? Why did the U.S. and the global economy fall into this crater. Why? Why has the Federal Reserve, The U.S. Treasury and the White House Economic Advisory team implemented the measures they have - thus far? The manner in which this work evolves makes is a contribution that can be devoured by a broad audience. It is absolutely essential reading for U.S. citizens who yearn for a vastly more informed perspective on the questions posed above. Spectacular! PERIOD!

Excellent examination of the Fed during the Great Panic

Published by Thriftbooks.com User , 15 years ago

Having watch the Great Panic (as Wessel calls it) as it unfolded and hearing all the business TV talk that went along with it, I've been waiting to read all the inevitable books that I knew would be coming out. This is the first one I picked because of the power and influence the Fed possesses. After reading this, I realize that very few people really knew how much power the Fed actually does, thankfully, possess. And while I knew already that what I see on TV isn't necessarily representative of what is going on behind closed doors, this book just helped cement that knowledge. If you are looking for an overall examination of the crisis and it's players, this isn't the book for you. There probably won't be a book for you because this crisis involved multiple players in both the private, public, and quasi-public sectors that an overall book end up being thousands of pages long. What this book does do is give an excellent examination of one the major institutions involved in the crises, how the people there dealt with what they saw and thought was happening, and how inadequate those assessments were. You get a blow by blow of the behind the scenes conversations, debates and theories on how the Fed should react. You see the major players - Bernanke, Paulson, Geithner, and Warsh - and how the interact with each other and the public. Wessel also gives some details on how the other Fed Presidents and Governor's reacted to what Big Big and his compatriots were doing. Wessel also gives some history into the Fed such as why it was formed, what powers it has been given and taken away over the years, and exactly how the Fed completely screwed up in 1929. I highly recommend this book. If you know alot about the Fed you'll get to see it in action from a behind-the-scenes point of view. If you don't know alot about the Fed, you'll get a great education into this institution and just how important it is to the US economy.

Worth every penny

Published by Thriftbooks.com User , 15 years ago

Excellent book!!!! This book is very well written and provides a detailed play by play of the historic events that unfolded over the past couple years. It puts you inside the rooms where the decisions were being made and lets you know what the big players were thinking along the way. It also sheds some light onto what decisions were good and which may have been catastrophic. This book reads like a drama novel. I would highly recommend it to anyone who feels like they missed something but they don't want to be bored or confused while they find out.

A triumph in putting together these last two years of economic chaos

Published by Thriftbooks.com User , 15 years ago

I am surprised at some of the negative reviews. This is well written anthology of the last two tumultous years, perhaps the largest economic calamity in generations. It tells who knew what, when, and what the big players (Bernacke, Paulson in particular, as well as others) were thinking, saying, and doing. It lets you know their posturing, strategy, and actions. I have a better understanding after reading this book, even though I am an avid follower of the financial markets because the book really does a good job "connecting the dots". This book would be the good basis of a television documentary series and I hope this happens. If you click on my previous reviews, you will see that I am a fairly tough grader, and I give this five stars.

Less Boring Than Dentistry

Published by Thriftbooks.com User , 15 years ago

Keynes once said that central bankers should strive to be as boring as dentists. In the past couple of years, central banking has certainly been less boring than dentistry. Observers and pundits were certainly not bored by Alan Greenspan, to whom George W. Bush bid farewell after his nineteen years of service by noting, quite accurately, that he was "the only central banker ever to achieve rock-star status". Neither Greenspan nor his successor Ben Bernanke were flamboyant characters, but they attracted a degree of public attention that underscore the importance of their role in the functioning of the US economy. And never was this role more important than during the great financial panic that forms the focus of David Wessel's book. As Bernanke commented, "We came very, very close to a financial meltdown, a situation in which many of the largest institutions in the world would have failed, where the financial system would have shut down, and in which the economy would have fallen into a much deeper and much longer and more protracted recession." The book has a strong behind-the-scenes flavor. There are lots of personal details and anecdotes on the main characters, which help to understand how they reacted in an unprecedented time of crisis. The author had extensive access to high ranking officials, including Bernanke, Paulson and Geithner, and interviewed many lower-ranking individuals "whose carriers would not be advanced by the disclosure of their names", as he puts in the acknowledgements section. Many stories or comments were not intended for the record, and there are several exclusive renderings that will change the public's perception of the crisis. Here are some examples: . Lehman Brothers could have been saved from bankruptcy on September 14, 2008, were it not for the stubbornness of the British Financial Services Authority. Paulson and Bernanke had found a British white knight as Barclays was ready to buy Lehman and to guarantee all of its liabilities. But stock-exchange listing rules required a shareholders vote and the FSA refused to grant a waiver. Barclays later bought pieces of Lehman at a much discounted price. . The US financial regulator slept while the fate of Bear Sterns was being decided. Christopher Cox, the former California congressman who was chairman of the Securities and Exchange Committee and ostensibly Lehman's regulator, wasn't privy to the 4:45 conference call that Geithner convened to settle the fate of the investment bank. Hours later, a SEC staffer sent plaintive email messages to the Treasury and the Fed, begging someone who had been on the call to contact Cox and fill him in. . Paulson convinced JPMorgan that it was paying too much, not too little, for Bear Sterns. JPMorgan's CEO was thinking of offering $4 or $5 for a share, but Paulson, who wanted Bear Sterns' shareholders to feel the pain, told him that his bidding price "sounded high" and talked him into reducing it to $2. The LA Galaxy soccer team signed