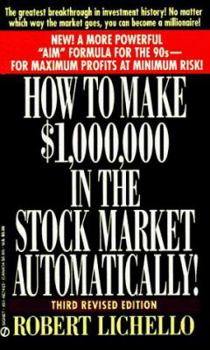

How to Make 1,000,000 Dollars in the Stock Market Automatically

Select Format

Select Condition

Book Overview

In the third edition of this bestselling book--in print since 1977--Lichello provides a revolutionary investment method that overcomes the vagaries and risks of both the market and individual judgement. Automatic Investment Management (AIM) is designed to work in any kind of market with any size investment.

Format:Mass Market Paperback

Language:English

ISBN:0451174534

ISBN13:9780451174536

Release Date:July 1992

Publisher:Signet Book

Length:288 Pages

Weight:0.35 lbs.

Dimensions:0.8" x 4.2" x 6.8"

Customer Reviews

4 ratings

AIM works! Don't talk unless you've tried it!

Published by Thriftbooks.com User , 25 years ago

The investment method in this book is sound and it works. It is truly sad that there are so many people out there who find it so easy to say it doesn't make sense or that it doesn't work when they've never tried it! Those who say that the "sell on the way up, buy on the way down" strategy doesn't work suggesting that you need to ride the peaks have never invested in the real world. Who can know with 100% accuracy when a peak has been reached and who can sell exactly when the peak is reached 100% of the time? Nobody. The strategy helps guarantee profits while providing a high level of protection against catastrophic loss. Like any intelligent investor knows, you invest for the long term not for the short term. So AIM requires patience - nothing new here. You also need to choose your stocks well but even if you don't AIM will still keep you from making a complete idiot of yourself. In my case, I chose a stock, from a solid company, which has ended up varying very little but even here AIM helped me come out ahead. If you are seeking a method which will help you invest your money with relative safety while still making money read and re-read this book and look into AIM but most importantly apply it.

AIM for Asset Management

Published by Thriftbooks.com User , 25 years ago

I first read this book when I was 17, when it was in its first edition. 22 years later, with a massive change in market trends, I can STILL see its immense value. Anyone who saw lump-sum holdings PLUMMET during the '88 panic (Dow dropped 500 in that one and risk venture capital became VERY scarce for awhile) should be kicking themselves over AIM not putting away cash for for them prior to that cold, hard winter of economic awakening.AIM won't tell you what to buy - there are other books out there that can do that. Nor will it, as the author notes, certainly make you a millionaire. What it WILL do, however, is keep cash around so that when the cold economic snows arrive, you can spend your money at the right time - rather than watch it dwindle at the wrong time - and repeat the process every time the market as a whole makes a macroturn. If it makes a microturn (i.e., one stock in your portfolio tumbles because of bad news), that's what Portfolio Manager is there for - to account for the loss so you can protect against further loss. Do you have to buy the same stock you took the loss in? Or is there a better opportunity elsewhere? That's what investor research and choice-making is about. AIM's not a stock screener. It's an asset guard, and a VERY good one!

The book and the strategy take patience but they work.

Published by Thriftbooks.com User , 25 years ago

This book is wordy but, in my opinion and experience, the AIM algorythmn works. Many of the comments about the market must be taken in the context of the late 1960s to early 1980s period when the stock market was an unpleasant place to invest. Who can tell when the market will again disappoint for years? AIM will work in both good and bad markets. This system beats emotional investing. It eliminates the need to identify market tops and bottoms and makes the best use of whatever price changes your investment throws at it. As long as you can trade inexpensively and select stocks with good fundamentals and relatively high betas, AIM will work for you. I rate this book 5 stars because, for the first time in my life, I am able to invest and trade effectively.

Fall of 1998 proved AIM's worth to long term investors

Published by Thriftbooks.com User , 26 years ago

If anyone is still skeptical after the massive market bashing that we had between the beginning of August and the middle of October, they haven't fully explored what AIM would have done for them. In that period, my own cash reserves were drawn down from about 35% to about 5% while I bought up huge quantities of underpriced stocks and funds. Then, my account rose in total value about 18% in October alone. I've already returned many of my AIM accounts to a 30% Cash Reserve level. Thank you AIM and Mr. Lichello!! AIM is portfolio risk management, plain and simple. It automatically adjusts asset allocation between equity and cash to protect profits in rising markets and then reinvest the proceeds when the market is falling. An AIM users group can be found by using a search engine and the work "LICHELLO" if you care to hear what other AIMers have accomplished. Good luck and AIM High!