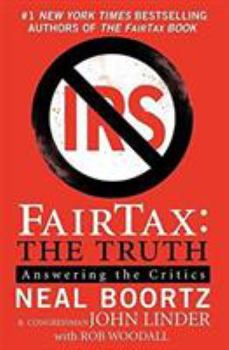

Fairtax: The Truth: Answering the Critics

Select Format

Select Condition

Book Overview

In 2005, firebrand radio talk show host Neal Boortz and Georgia congressman John Linder created The FairTax Book , presenting the American public with a bold new plan designed to eliminate federal taxes and the IRS, jump-start the U.S. economy, bring back lost industries and jobs, and recapture billions of untaxed dollars hoarded by criminal and offshore businesses. Their book became an immediate #1 New York Times bestseller, propelling a powerful...

Format:Paperback

Language:English

ISBN:0061540463

ISBN13:9780061540462

Release Date:February 2008

Publisher:William Morrow & Company

Length:272 Pages

Weight:0.56 lbs.

Dimensions:0.7" x 5.5" x 8.0"

Customer Reviews

5 ratings

A must read. PERIOD

Published by Thriftbooks.com User , 16 years ago

Just look at the reviews who give it one star. Claiming lots of attorneys and IRS employees will loose thier jobs. Basically the reviewers are saying, ME,ME, ME. What about being fair? This book sums it up in one simple go. So some attonerys will loose there jobs. Some IRS employees. What about the small businesses who have been put out of business by the IRS in error. Or the small business owners (2007 it was 23)who were so stressed out by IRS audits that they killed themselves. 15 of those had done nothing wrong. It will save the planet as we dont need to keep copies and tons of paper.

Useful or not, some more comments

Published by Thriftbooks.com User , 16 years ago

First off, I'm actually going to write a review of the book as a book (which is what the section is really for). Then I'll add to the other commentary. *** I enjoyed this book, just as I did the first FairTax book. It is nice read, and I enjoy Boortz's writing in particular. Probably one of the biggest flaws of the book is the extreme length of what is probably the most important chapter in the book: that is, the chapter that deals with what the authors consider legitimate criticisms to address. Even as an ardent reader and supporter of the FairTax, getting through this chapter was a bit tough. Surely they could have broken it up a bit. There is nothing abstract in the book. Examples are clear cut and well explained. Having the footnotes in there also really helps, as the authors have highlighted for you, the reader, the same things they read. All in all, a good read, and highly recommended to both those who support the FairTax and even those who don't. For those that do, this will clear up the major issues, and give you, as the authors say, the ammunition you need to refute some of the claims. For those that don't support the FairTax, you'll have a better understanding of your enemy's idea. *** Boortz and Linder "ignore" the reviews by various organizations that alter the FairTax in some way. In other words, these organizations established guidelines for their reviews of proposed tax plans that change how the FairTax would work. Imagine it like this: an independent organization is going to rate every car on the road in terms of safety features, but in their guidelines, they state that solid steel bars running down the sides of a car shouldn't be considered. My car, and all the others like it, take a hit in those safety ratings. Why? Because someone decided to cut out an important feature. The FairTax only deals with Federal income taxes. Excise taxes, such as those levied on alcohol and tobacco, will likely still be there. Asides from almost always being state mandated taxes, excise taxes are exclusive (that is, they are not reflected in the price you see at the counter; you see it only after it is added at the register). Any tax levied by a state, whether it be on income or your various property and licenses, is still valid. The FairTax does not deal with the 50 individual states and taxes they choose to levy. The thing that will stop Congress from raising the tax rate is the collective displeasure of the American people. Right now, tax increases (when they do occur) often only impact the rich because the current tax code allows politicians to selective target groups with tax breaks and increases. Implement the FairTax, and everyone is paying the same rate (though, as I'll address soon, not the same amount); now Congress would be trying to raise the tax burden of every American. That's a sure fire way to find yourself booted out of office. Pay as you use items (phones, vending machines, etc) already have embedded taxes factored into the

This is a ten star read my friends

Published by Thriftbooks.com User , 16 years ago

If you didn't get (grasp) the Fair Tax idea in the first book, or if you listened to the fearful, or the misinformed, or those who have no understanding of how the economy works and how the present tax system acts as a brake on the economy, then Fair Tax: The Truth: Answering Critics by Neal Boortz and John Linder is a must read for you. In fact this should be required reading on the part of every American who considers himself literate. One by one, the questions are answered in a logical, calm manner. The misunderstandings and intentional misrepresentations are taken on by Boortz and Linder in a point by point response. While I do have disagreements from time to time with Mr. Boortz when I listen to him on the radio I am 100% on the same page with him on the tax issue. His and John Linders system makes so much sense I can't see how anyone doesn't get it. This isn't just a rehash of the first Fair Tax book either. There is new information contained in Fair Tax: The Truth. Well done Neal and John.

The fair tax defended

Published by Thriftbooks.com User , 16 years ago

This book is much needed. Most people I hear speak ill of the fair tax do not exhibit the faintest glimmering of a rudimentary understanding of it. In serious academic debate, to badmouth something you first fail to accurately portray is laughed at; in politics it's standard procedure. It's called the straw man fallacy: to attack a caricature of a position instead of the position itself. Such an argument is fallacious because a refutation of a caricature can never be more than a caricature of a refutation. This book clears up many misunderstandings, the most common coming from all these idiots running around shouting that "If the fair tax is passed everything will automatically become 27% more expensive!" This is not true, at all. Why? Because products already contain concealed in their list price what is approximately a 27% hidden (or "embedded") tax. If the fair tax is passed this will be removed and replaced with a transparent 27% sales tax. Thus, most products will cost the same as they did before. The fair tax will also, in one fell swoop, wipe out almost all under-the-table, shady dealings. The "underground economy" will automatically disappear. No more will strippers, prostitutes, thieves, drug dealers (and yes, waiters) get to avoid paying taxes by not declaring their cash income. Also, in one fell swoop, Hey Presto! all illegal immigrants will instantly have to start paying their fair share. If you think this in-and-of-itself wouldn't cut down on illegal immigration you're nuts. When the fair tax is properly understood one can see that it is also entirely false that it will harm poor people. How? Poor people will receive a prebate under the fair tax system, meaning, they won't pay taxes at all! Further, if you spend more than the cutoff for the prebate, THE REASON THAT THE FAIR TAX IS IN FACT "FAIR" IS THAT UNDER IT YOU AND ONLY YOU WILL DECIDE HOW MUCH YOU PAY IN TAXES. No more will lofty third-party decision makers who do not have to suffer the consequences of their own inept policies get to decide for you. If you don't want to pay a bunch of taxes then cut down on your consumption. If you want to save money and keep what you earn then don't go blow your earnings on a bunch of crap you don't need. Boortz is good at pointing out that poverty as it exists in America today is a behavioral problem. A few decades ago a top USSR reporter and a USA reporter changed places in a "cultural perspective" piece. When the soviet reporter toured some of the worst neighborhoods in the USA in order to do a piece on American poverty, what was his conclusion? That there is no poverty in America! What? No poverty in America? Not really. The average person who lives below the poverty line in America has a refrigerator, a car, air conditioning, a cell phone, a microwave, cable TV and a DVD player. In the average below-poverty household in America people have more square feet per person than the average middle and upper-middle cl

Great Follow up book! If you still don't like the idea after this one then you have problems...

Published by Thriftbooks.com User , 16 years ago

I have a degree in economics and I spent almost 7 weeks in college working with the economic effects of tax policy! Fair-Tax is awsome!!! This is the best book by far on this topic, far better than the first one explaining the entire concept. Just as with anything else in life, if you are to have an educated opinion on anything, you must first fully research the facts revolving around what you want to talk about. Unfortunately this is not what the pundits, critics, and media surrounding the Fair-Tax have done. 95% of people against the Fair-Tax don't fully understand or have not properly researched this topic before opening their mouth. And the other 5% of people against the fair tax are against the Fair-Tax because they want the government to have a vice grip on the America Public and Private sector in some way, shape or form. What you really need to do, is just to borrow this book, and read the last chapter. I do want Boortz to get #1 on the best seller list, but for those of who do not want to spend the proper time to educate themselves as they should in this matter, should look to the final chapter. This gives a perspective view of what life would be like if you lived under the fair tax. If you read the last chapter and still are in favor of the Federal Income Tax when you are done, you clearly cannot grasp the full benefit of the Fair Tax to yourself, your loved ones, your friends, your company (or your employer), and your country. I bought about 30 books to give to people when the first book came out, I am sure I will do the same this time. Andy, Atlanta, Georgia