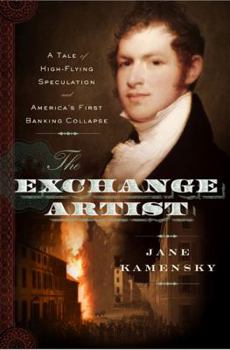

The Exchange Artist: A Tale of High-Flying Speculation and America's First Banking Collapse

Select Format

Select Condition

Book Overview

The riveting story of the country's first banking scandal in the first decades of the American republic This enthralling historical narrative of the birth of speculative capitalism in America opens in... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0670018414

ISBN13:9780670018413

Release Date:January 2008

Publisher:Viking Books

Length:442 Pages

Weight:1.50 lbs.

Dimensions:1.5" x 6.5" x 9.0"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

4 ratings

Lively history of an original con man

Published by Thriftbooks.com User , 15 years ago

Andrew Dexter Jr. is the villain of historian Jane Kamensky's book on America's first bank failure, which occurred in the early 1800s. He used worthless banknotes to finance construction of Boston's Exchange Coffee House, at seven stories then America's tallest building. In the process, he financially ruined hundreds of laborers who worked on the project. By the time they learned that his banknotes were bogus, Dexter was long gone. Kamensky deftly tells his tale with fascinating detail and little-known facts. In brilliant writing she traces the rise of "speculative capitalism." She offers the bittersweet saga of a man with little conscience and big dreams he never fulfilled. getAbstract finds that her book compellingly depicts America's early financial history - and, perhaps, one facet of its emerging fiscal personality - through the tale of this colorful charlatan.

4.5 stars-Speculation leads to widespread destruction

Published by Thriftbooks.com User , 16 years ago

Kamensky has done an excellent job in this book.The book is a detailed study of the events leading up to the first bank failure in American history.In March,1809,the Farmers Exchange Bank of Gloucester,Rhode Island,collapsed.The story starts in late 1807 as a real estate speculator named Andrew Dexter,Jr.,is able to convincingly persuade many investors to financially back his Exchange Coffee House,a gigantic seven story building which will supposedly allow financial and commercial interests to conduct their business affairs in comfort and style, with easy access to other members of the Boston financial community ,instead of haphazard meetings spread out over a number of different street corners.At this point in time the failure of Dexter's speculative " house of cards " would have had a relatively small impact.It is here that Dexter is able to use the completed but practically empty building as collateral to buy a controlling interest in a number of banks.He then used the banks currency creation power to further leverage his own speculations.Dexter's banks did not have anywhere near the necessary required reserves in gold and silver.Suspicious merchants finally started taking the notes in to redeem them for the claimed metallic backing.It was soon realized that there was no such backing.The collapse of Dexter's speculative endeavor now led to a panic and crash that severely impacted businesses that had accepted the now worthless bank notes as payment. The most important part of the book is an implicit generalization that can be universally observed in all speculative bubbles.In order for the bubble to grow and cause great damage in the future when it deflates,bankers must extend credit to the speculators ,allowing them to leverage their own precarious debt position many times over.Without banker complicity(many times the bankers themselves begin to engage in speculative behavior,compounding the damages already done through their loan committments to speculators in the first place)the speculative bubble can't grow. I have deducted one half of a star because the author is not aware of the extensive warnings made by Adam Smith ,in 1776 in his The Wealth of Nations,about the extreme dangers to economic growth and welfare if bankers are allowed to make loans to speculators.Smith's conclusion,that the savings will be wasted and destroyed,is as true today,as we witness the destruction being wrought by the banker financed and directed sub prime mortgage backed bonds fiasco.

Superb tale of a building, a bank failure, and the man behind both

Published by Thriftbooks.com User , 16 years ago

This book describes the making and unmaking of the largest building in Boston---at the time---all built on bank notes of questionable value. It is a superb tale. The building construction is fascinating, the shaky finance more so, and the man behind it even more.

exchange artist

Published by Thriftbooks.com User , 16 years ago

Very interesting story and a nice piece of Boston and US history. The author has covered this event well. In some cases she uses an affected present tense when referring to historical events - can make reading a bit confusing until you get used to it. But the insights on the history of banking and the rise of paper money are fascinating.