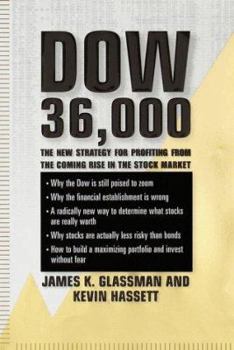

Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market

Select Format

Select Condition

Book Overview

"Every stock owner should read this book." -- Allan H. Meltzer, professor of political economy, Carnegie Mellon University * A radically new way to determine what stocks are really worth * Why the Dow... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0812931459

ISBN13:9780812931457

Release Date:September 1999

Publisher:Crown Business

Length:304 Pages

Weight:2.40 lbs.

Dimensions:1.1" x 6.5" x 9.6"

Customer Reviews

5 ratings

Great investment?!

Published by Thriftbooks.com User , 22 years ago

Buy this book now. The Dow should probably decline to 5,500 which is its fair value. And then it would take over 24 years at 8% annual growth to reach 36,000. If you keep this book in good "mint" condition, it might then fetch 10 times what you paid for. That way you would have beaten the Dow!Not all bad investment books are good investments. But outrageously bad investment books are likely to be great investments. And this book belongs to the latter category!

Buy it now! For a fine keepsake of the internet boom!

Published by Thriftbooks.com User , 23 years ago

With the title alone causing histerics, placing this on your coffee table will elicit your guests to share their best .com horror story.How they invested their $100,000 second mortage in Cisco Systems @$80 after reading it, waiting for it to become $500 (as predicted in this very book) only to see it dive to $17.How another friend invested all their cash in Etoys after reading in Sept 99, when Etoys was $60 ... wishing now that they got their shares in rolls of soft two ply.I mean, just the thought of this book, gives me the chuckles. But it now before its just a memory!

New Ideas that might be correct

Published by Thriftbooks.com User , 25 years ago

I received the book as a present and was very skeptical. After reading it, I have found that it is surprisingly provocative. This book might be right, and thinking about that eventuality is a useful endeavor. The book might be wrong about where the market is headed, and the authors lay out the best arguments on the other side as well. I have not written a review before, but as a finance professor, I was amused that one of the reviewers revived the old double counting accusation first launched at Slate. The accusation is incorrect, and the explanation of why is in the book. For the technically minded, cash flow and earnings are often about the same thing, so using one to approximate the other is useful for back-of-the-envelope calculations. The reason is that earnings already subtract depreciation, and that is a good measure of investment often. To go from earnings to cash, you need to add back depreciation and subtract investment. If they are equal, that step has no effect. I am not sure the book is correct, and the authors might overstate the case, but thinking about the issues raised by Glassman and Hassett has been fun.

How to value stocks and understand the market

Published by Thriftbooks.com User , 25 years ago

Despite the sensational title, Glassman and Hassett have written a very useful, and fundamentally conservative, book. It is really two books in one: the first half outlines an economically sound method for how to determine the "perfectly reasonable price" of a stock based on the future earnings of the underlying company. The second half is a very useful guide to the intricacies of the market for the beginning to intermediate investor: someone who is familiar with P/E's, but has not yet mastered REITs and DRIPs.Unlike many financial books, the combination of a rigorously trained economist and market savvy journalist has lead to a very readable book, which none the less is based on sound principles. Anyone who is investing in the market should read this book.Reading the other reviews, I was fascinated how they are split between 5 star and 1 star ratings. Clearly, many of the 1 star raters did not bother to read the book, or completely misunderstood its central message. Others claimed the mathematics is wrong. As a Ph.D. scientist, I made the effort to run the numbers myself, and, given the assumptions of the book, they are right. Anyone who cannot follow the arguments presented probably should limit their involvement in the market to purchasing broadly based mutual funds: several good ones are recommended in the book.

Valuable and important book!

Published by Thriftbooks.com User , 25 years ago

Here's why I think this is a valuable and important book.1. It looks forwards instead of backwards at what a stock should be worth to you. The histories of companies and stocks can certainly be entertaining, but I'd much rather know what's in it for me! A lot of the apparent uncertainties of the market get washed away when you can look at a reasonable stream of future dividends and figure out that it's several times a bond yield. You can easily plug in your own assumptions and get a straightforward, rational answer that helps you make decisions.2. It demystifies market risk. Millions of column inches get written every day about how the stock market bounces around; all that ink is just a distraction that confuses people about the long term stability of the growth of economies. If you're planning to take all your money and buy a car in a year (like a friend of mine), stocks may be the wrong choice. If you're really focused 20 years out, do yourself a favor and quit watching the ticker.3. It respects both investing psychology and efficient markets. Psychology tells you that a) people behave within a context -- they do things that "make sense" -- and b) they don't make decisions the way mathematicians say they should, but they usually get pretty good results anyway (by using rules of thumb to simplify decisions). Similarly, markets are efficient, but only within a context. Investment analysts on Wall Street will reasonably argue today whether IBM is worth $130 or $135 a share, even while I may be convinced it's worth $400 or more over time. It can make perfect sense that many individuals have done extremely well over the last few years while investment analysts and fund managers mostly haven't.4. It respects the fact that the world changes. If "past performance is no guarantee of future results," who do the pros behave as if it is? The market behaved differently prewar and postwar, in the 1950s vs. the 1960s vs. 1982-1994 vs. since 1994. Investors behave extremely differently now than before IRAs and 401(k)s.5. Even if the conclusions turn out to be wrong, the advice is still good. Personally, I think these guys are probably right. But if you've taken their advice and the market doesn't do what they say, you've still bought fairly-valued stocks, saved and invested your money, and resisted short term churning and flailing. You'll probably still make out pretty well -- certainly better than most fund managers and day traders.