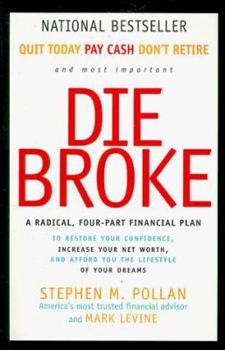

Die Broke: A Radical Four-Part Financial Plan

Select Format

Select Condition

Book Overview

From America's most trusted financial advisor comes a comprehensive guide to a new and utterly sane financial choice. In Die Broke, you'll learn that life is a game where the loser gives his money to Uncle Sam at the end. There are four steps to the process: Quit Today No, don't tell your boss to shove it...at least not out loud. But in your head accept that from this day on you're a free agent whose number one workplace...

Format:Paperback

Language:English

ISBN:0887309429

ISBN13:9780887309427

Release Date:September 1998

Publisher:Harper Business

Length:320 Pages

Weight:0.59 lbs.

Dimensions:0.9" x 5.3" x 7.9"

Customer Reviews

6 ratings

Must read for seniors

Published by Mary D , 1 year ago

Great read for understanding saving and spending for family. Share while you can, watch your children enjoy their inheritance but, don't jeopardizing your comfort.

4 Simple Steps

Published by Thriftbooks.com User , 19 years ago

Much of what you'll find here has been written before, but Pollan puts it together in an easy to understand, easy to read style. A word of caution.....although this book is thought provoking, but must be taken in context with other readings and life experiences. That said, Pollan reduces his financial plan to four steps. They are: 1) Quit Your Job. Pollan recognizes that the vast majority of businesses don't care about their employees. When push comes to shove, anyone that isn't vital is gone with no regrets. Many readers already know that. Pollan argues that since your employer is no longer your protector, you should treat the relationship as a relationship of equals. That means doing what your employer is doing......by putting your needs first. Give him or her an honest day's work, but think always in terms of where you're going and what skills you need to get there. You are a free agent. You are responsible for your professional growth, not the person in the corner office. For some, this may mean stepping out on their own. For others, it may mean staying on the job but approaching it differently. Whatever it means to you, recognize that when things go bad for the company, nobody's going to care about your mortgage, credit card bills and braces for the kids. You need to make sure that you've got that covered by developing a set of skills and attitude that can't be replaced. That's what free agents do. 2) Pay Cash - Bingo. I stopped buying on credit years ago. I won't even buy a car unless I can pay cash for it and have accelerated mortgage payments and will soon have paid off the house. This is extreme behavior modification for many of us, but it is the true path to freedom in life. The bottom line is that you should never buy anything on credit (cars included) that will be worth less next year than it was last year. I can't say this in strong enough language. If you don't owe anyone money, they can't control you. If they can't control you, you can think in terms of what is truly best for you. If you're in debt for any consumer purchases (credit cards, cars, etc) develop a plan to get out as quickly as you can. You will be amazed at the impact it has on the rest of your life. 3) Don't Retire - Retirement is a concept from the days when everyone did physical work they hated because they had to put food on the table. If you truly love your work, you won't want to quit. The secret is to get out of debt so that you can quit that job that you hate and start doing what you love, even if it pays less. 4) Die Broke. This is an eye-catching statement, but what Pollan really means is, don't worry. If you don't need to retire because you love what you do and are capable of doing it, you don't have to save for retirement. You can only do this by having the right skill set and living below your means. Since most of us aren't saving for retirement, we're going to be working anyway. We might as well do what we love. I deci

Read this book first! (and give a copy to your kids)

Published by Thriftbooks.com User , 24 years ago

This is my personal favorite in a long list of books on financial planning, although I think it caused the hairs on the back of my financial planners neck to stand up. Actually, that might be a good sign. The advice in this book goes against everything a sensible planner says to do. The traditional advise is to protect, nurture and grow your 'estate.' You know the bumper stickers you see that say "We're Spending Our Children's Inheritance"? This book is based on that theory, although with a kinder philosophy behind it. The authors recommend you 1) Quit Your Job. (virtually,not actually)Rather than leaving your job, start thinking of yourself as an independent contractor - and make sure you do what you like, get what you want) The work world has changed, employers complain about lack of employee loyalty, but will 'right size' you tomorrow 2) Pay Cash - Get rid of credit card thinking and credit card debt. This is not your father's credit card system anymore! 3) Don't Retire - The idea of putting yourself out to pasture at a given age is as dated as the concept of thinking you have to grow your inheritance to leave to your kids. 4) Die Broke. Spend your money wisely now, use legal ways you can take care of your parents and your kids while you are still alive. The idea is not to live poor or foolishly, but to rethink entirely why you are struggling so hard now for a tomorrow that may or may not come. Use your money today, to take care of yourself and your loved ones. This book is easy to read without talking down to the reader, is full of good advice with possible to practice wisdom. A good investment!

Financial Planning for Stunt Pilots

Published by Thriftbooks.com User , 26 years ago

Die Broke is an extremely seductive book. Stephen Pollan's idea is that you'd be a fool to save your money for a rainy day. He says spend it now, which is contrary to what evey other personal finance expert advises. Take a round-the-world cruise, buy that new Mercedes, or better yet, lease it. This advice goes against the grain, and I found myself fascinated by such an original approach. It's tempting to adopt his methods and live for the present, but my advice is listen to the book, but don't take it too seriously.

Sound advice for any age.

Published by Thriftbooks.com User , 26 years ago

Written for "baby-boomers," but, most definitely recommended for us younger folks too. I took a chance, liked what I heard, and bought a set for a '25ish' friend; whose nose is always stuck in one financial book or another. He was immediately hooked, and, has already begun to change his way of spending, thinking, and doing. Just last week, he was thinking of buying the paper edition to reinforce what he listened to! Generally, I don't do well with audio-books (or even the written financial word), but, this one is worth picking up in any form. My Dad raised me on many of the same practices and principles preached within, and I couldn't agree more with the concept of; dying broke, paying cash, and giving now!, instead of leaving it later.

Read this book first before you read any other

Published by Thriftbooks.com User , 27 years ago

Die Broke is an excellent book. Author Stephen M. Pollan takes a philosophical look at our concept of retirement--a concept created for another generation based on a different value system. The idea that we must retire at the age of 65, build wealth until we die, and leave a big inheritance for our children is one founded upon the needs of society during the industrial age. Pollan's idea is that now that we are in the information age, there is no need to retire until we want to. We also needn't wait until we die to help our children (long past their most needful times). By setting up proper cash-flow investments, we can live a good life, help our children, and keep ourselves financially secure until we die. Many people, including myself, worry continually about how to raise the money needed to survive for thirty years after retirement. Pollan's ideas help us to break out of the outdated concepts that give us these feelings so that we can feel better about ourselves and our current financial state.