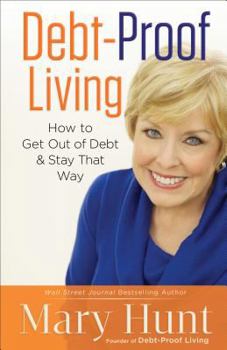

Debt-Proof Living: How to Get Out of Debt and Stay That Way

Select Format

Select Condition

Book Overview

Mortgages, credit card balances, student loans, car loans, and home improvement loans have become a way of life for the majority of us. And debt is putting not only our present at risk as we live paycheck to paycheck, but our futures in jeopardy as shockingly few of us have enough put away for retirement. Personal financial expert Mary Hunt wants readers to embrace the radical but simple truth that they don't need more credit or more stuff--that they...

Format:Paperback

Language:English

ISBN:0800721454

ISBN13:9780800721459

Release Date:August 2014

Publisher:Fleming H. Revell Company

Length:314 Pages

Weight:0.80 lbs.

Dimensions:0.9" x 5.4" x 8.4"

Age Range:18 years and up

Customer Reviews

5 ratings

This book will change your financial life!

Published by Thriftbooks.com User , 17 years ago

Pros: Common sense advice that anyone can follow! It WILL help you get your finances in order and help you change your perspective about the monetary side of life. They should make this a mandatory class for high school and/or college students. The website is extremely useful, as well. Cons: For me, it was disheartening that I could not put the spending plan into immediate action. For someone who is in serious trouble, the advice she suggests may seem too daunting and too difficult to follow. I do not think this is a flaw on Hunt's behalf, but is more an indicator that people with high debt who are spending beyond their means truly need to make more serious and drastic changes to their way of living. I have posted my personal experience with Hunt's Debt-Proof Living for you if you'd like to read about the positive possibilities that following Hunt's plan offers. I read Debt-Proof Living two years ago. At that time, we had about $30,000 in credit card debt, we were paying nearly $3000/month on our mortgage, and my husband and I were both driving around in gas-guzzling shiny vehicles. The financial strain was beginning to take it's toll, putting strain on our relationship, our health, and on every aspect of our life. We were living beyond our means, sinking fast, and I reached for this book in desperation. We were unable to start the spending plan right away because we did not have money to start it with. Every paycheck that came in went right out to keep bills paid just barely on time. As Mary suggested, this was a warning sign that we were living beyond our means and would need to make more drastic changes in order to get to a financially secure place. First, we traded in my gas-guzzler for about $9000 and I bought a more economical $4000 used car. I still have it, and other than routine maintenance, we have incurred no other cost with it. It also cut our gas expenses significantly. We used the money to make some home improvements so we could put our house on the market. Unfortunately, it took almost a year for our house to sell. All the while we were now falling behind on our mortgage payments and incurring even more credit card debt maxing them all out at $50,000 before it was all said and done. We finally sold our 3 acre, 4 bedroom, 4 bathroom home last August, we sold a lot our stuff, or just got rid of it, and we moved to a much more modest 3 bedroom, 1 bathroom home, with a small back yard. (I LOVE it!) That cut our mortgage payment by more than half, not to mention cutting my cleaning time by half, too. I took on a part-time job and my husband picked up some extra hours. This year, we finally got to the place where we could use our tax return to fuel the spending plan suggested by Hunt. It is working like a dream! No more credit cards. We pay cash. If we can't pay cash for something, then we don't get it. We have a savings cushion for unexpected and expected emergencies. This is how it should be. Everyone in my family is happier

It's like giving yourself a raise.

Published by Thriftbooks.com User , 18 years ago

With all the passion but none of the overbearing noise of the ex-smoker, the formerly indebted-up-to-her-eyeballs Mary Hunt dispenses not just advice, but a combination of encouragement and practicality to those who are being eaten alive by the modern scourge we call consumer debt. The author is convinced there's hope, but only if the reader firmly accepts how bad things are without determined action to turn the tide. She constructs a sensible-as-nails approach based on the RDRP (Rapid Debt-Repayment Plan), Contingency Plan, and Freedom Account. Formerly known as the `Everyday Cheapskate', Hunt has now acquired grativas. She also runs a handy subscription service, the online version of which is rich with tools and links. If you or someone you know is enslaved to debt, Hunt's books are a very good place to start the climb to sanity.

Do yourself a favor - read this book!

Published by Thriftbooks.com User , 18 years ago

Mary Hunt's "Debt-Proof Living" is one of the books that all families should read and then put the concepts into action. We used an earlier version of this book to get our expenses in control and I used that book to teach a class about handling their money. People that were desperate about their money problems were finally able to be optimistic about how to take control. It will help you learn how to set up a "spending plan" and to maintain your money so you will have it for both necessities and for things you really want. You should read this book but also think about getting her "Debt-Proof Living" newsletter. Be an online subscriber so you can take advantage of the fantastic Toolbox and calculators. Go to www.cheapskatemonthly.com. I used her "Rapid Debt Repayment Calculator" to first be totally shocked at how much interest we would have to pay for the credit card debt and how long it would take to pay it off. We then used it to figure out how we could pay it off much faster and we saved over $14,000 in interest plus now enjoy the freedom of being "out of debt"! Now is the time to get control of your finances and this book will tell you how to do it!

A practical guide that I am still using 5 years later

Published by Thriftbooks.com User , 19 years ago

In 2000, I left Graduate School with over $20,000 in debt from a student loan, car loan, and credit card bills used to pay for groceries during my graduate studies. ($800/month is not a lot to live on!) I didn't learn any sensible budgeting techniques in high school, college, or graduate school. I decided I needed to learn to handle my money better and needed to get out of debt. I found this book at the Christian bookstore and purchased it. It revolutionized my financial thinking. It took about 18 months for me to get out of debt, and I have stayed out of debt since. 1. KEY THOUGHT: The Freedom Account. To this day, I still use a Freedom Account. I am married now, but my husband and I have a freedom account fully stocked for a new car in our future, health care, flood insurance, home insurance, car deductibles, etc. It is so freeing to realize you have that money set aside for things that may well/are going to happen. A great technique. 2. KEY THOUGHT: The RDRP (rapid debt repayment plan). So many people tell you you should pay off your highest-interest debts first. To me, it was motivational to start with my smallest debts. It was like a steamroller taking the money that I once was paying for debt A and sending double,triple, or quadruple payments to debt b. I really liked this technique! Currently, my only debt is a house mortgage. I use techniques I learned from the RDRP to pay down my mortgage early as well. I usually make more than twice the monthly payment so I can end my 30 year mortgage within 8 years. 3. KEY THOUGHT: Save 10%, Give 10%, Live off 80%. I really liked that Mary had her 80/10/10 rule . I think it's so important to realize that you have to save and give while still paying off debts. It was a very unique view, and refreshing! I really think people will enjoy this book. I also subscribed to Mary's Cheapskate Monthly newsletter for several years as I got my finances in order. One nice thing there is as a subscriber you can have access to all the previous issues! I learned about many things there not covered in this book: Price Books, Once-a-month Cooking, Maximizing Food Dollar Value, etc. Fascinating reading :) I hope I've helped someone... At the very least, you could check tihs book out from a library to read... but, you will likely find that it is well worth the price to buy it!

Simply excellent

Published by Thriftbooks.com User , 24 years ago

What can I say? This is a darn good book. After reading "How to Get Out of Debt, Stay Out of Debt and Live Prosperously" by Jerrold Mundis, I thought I had read it all. That book changed my life. This book by Mary Hunt has taken me to a higher level.Strangely enough, what I like most about this book is the writing style. The content is excellent, but much of it I've read before. You know, cut up your credit cards, cut your expenses, save 10% of your income, etc. etc. etc. The style of writing makes the subject matter so much more enjoyable to read. I felt like the author was speaking directly to me as a human being. Considering the author had at one time $100,000 in unsecured debt, I'm impressed. She practices what she preaches.In terms of content, the writing style is a joy to read, but there are some really good points made in this book. One idea, which was definitely worth the purchase was chapter 8. I had already been implementing that idea a little bit, but now I can refine it with the author's method and really make it work.The point of this book is to make dealing with debt a proactive issue. Don't just work on paying off debt. Structure your life in such a way that you avoid debt at all costs. If you plan your life properly, it's entirely possible and quite easy I might add. Been there done that.My favorite quote from the book came in the chapter about college students getting their first credit card. Most people I know have at least one credit card in case of an "emergency." Here's what the author had to say about that:"If you accept a credit card with a big line of credit, I can guarantee you will have lots of emergencies. They'll come in the form of pizza and airline tickets, clothes and social events."My advice if you're going to buy this book is read it through and mark the areas of interest. The chapters toward the end really didn't apply much to me, so I breezed through them rather quickly. The beginning chapters were excellent. The author has a way of understanding human nature having been there herself.I'm giving this book 5 stars. That was easy. I found a couple of pieces of really valuable information in here. I plan to go back and read the book a couple more times to start mapping out my plan to the next level. If you have already paid off your debts, this book will help you keep it that way. If you are in debt, that's two reasons to buy this book. Just be sure to use your debit card, not your credit card. Well, in this case, you can cheat.