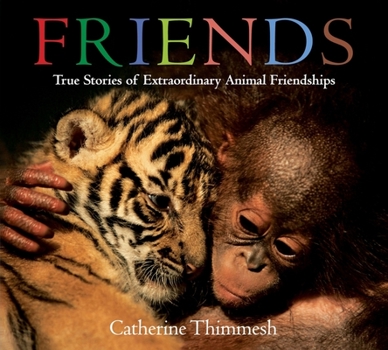

Friends Board Book: True Stories of Extraordinary Animal Friendships

What makes a camel friends with a Vietnamese pig? Or a wild polar bear pals with a sled dog? Author Catherine Thimmesh makes us wonder at the beauty of unlikely animal friendships. Because the stories behind these friendships are true, they give readers insight into animals, and the rhyming text shows the audience that support and love for another crosses all divides. This book also expresses tolerance of differences and makes us look at the kindness of animals--and humans--a little differently. Because they were there at just the right time, photographers in Siberia, India, Africa, the United States, China, England, Germany, and Japan were able to capture the truth and mystery of these existing friendships and allow us to appreciate them in this new board book format.