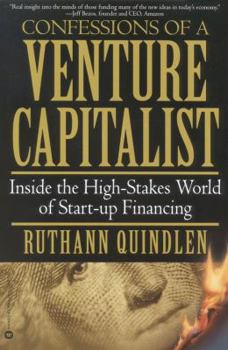

Confessions of a Venture Capitalist: Inside the High-Stakes World of Start-Up Financing

Select Format

Select Condition

Book Overview

Regarded as one of the leading experts in entrepreneurial analysis, Ruthann Quindlen educates the reader on the pitfalls and opportunities available in the world of venture capitalism. Her ideas are founded in ten commandments for entrepreneurs.

Format:Paperback

Language:English

ISBN:0446677000

ISBN13:9780446677004

Release Date:May 2001

Publisher:Business Plus

Length:240 Pages

Weight:0.80 lbs.

Dimensions:0.7" x 6.0" x 9.0"

Customer Reviews

5 ratings

Read this book IF you want to be a "Serious" Entrepreneur

Published by Thriftbooks.com User , 19 years ago

Recently I read that, according to a report by Staples *, the "Percentage of American adults who say they have an idea for a new product or innovation: 42." (* Office Solutions, March/ April 2004, p. 10) Going on the report stated that the "Top reasons for not getting an idea to the drawing board: not enough money (75 percent), not knowing where to start, ..." If you're in that 75%, then reading Confessions of a Venture Capitalist will be an enlightening experience. Ruthann Quindlen, a one-time investment banker now with Silicon Valley's Institutional Venture Partners, lays it on the line in this revealing glimpse inside the mind of a Venture Capitalist. The book is divided into 11 sections, comprising 36 short and entertaining chapters. Section 1: Life in the Bubble A short history on life in Silicon Valley. Section 2: People "People Are to a Business What Location Is to a Restaurant" (need I say more) Section 3: Markets "Find Markets the Size of Texas" Section 4: Business Models "Faster, Better, Cheaper" versus "Brave New World" Business models function as a blueprint on how the company will make money. Section 5: Venture Capitalists Stages to funding process and the role of Venture Capitalists. Section 6: Entrepreneurs Common mistakes and other words of wisdom for entrepreneurs. Section 7: The Fine Line between Bizarre and Brilliant Section 8: The Dumbest Decision I Ever Made Section 9: Valuation and More "You Can Have a Small Piece of a Large Pie or a Large Piece of Nothing" Section 10: A View from the Trenches Section 11: Five Short Years to a Revolution If you're serious about transforming your ideas into market reality, you'll most likely need external funding from investors. "Confessions of a Venture Capitalist" will help you gain insight into how investors think. With this knowledge you'll certainly be able to put your best foot forward when asking for money. ------- Michael Davis, President - Brencom Strategic Business Consulting

A Venture Capitalist's View of Starting Up to Make It Big!

Published by Thriftbooks.com User , 24 years ago

The families of entrepreneurs should require those who are about to start or join a start-up to read this book. Ruthann Quindlen writes a "lessons I learned on the way to the poor house" story about what to do correctly with start-ups by showing what can and does usually go wrong. Her perspective is from first hand experience in doing early-stage investing in Internet companies for the firm Institutional Venture Partners (IVP) in Menlo Park, California. You will find that her perspective is unusually encompassing: the pros and cons of the hot-house start-up environment of Silicon Valley; the role of excellent people and teams; the importance of large markets; having business models that allow for prosperity; how venture capitalists work; the role of the successful entrepreneur; the difference between a brilliant and a merely bizarre idea; the dumbest decision she ever made (to pass on investing in OnSale); negotiating with venture capitalists and bankers about valuation; the perspectives of other people she respects on these subjects; and on the Internet as an analogy to the Dutch tulip mania (she thinks the Internet is for real). She has a disaster story to underscore every point she makes. The points are valid, and the disaster stories are pointed and powerful.Based on the business plans I receive for start-up businesses, I would say that more than half of this information will be news to the average entrepreneur who wants to get venture capital, go public, and make it big. The information also matches what my venture capitalist friends tell me, and what I hear at conferences for Internet entrepreneurs.As the book points out, you can learn all of your lessons the painful way in the school of hard knocks . . . or you can listen to what is said here and change your behavior. I recommend the latter. Things move too fast in start-ups relative to the burn rate (the rate at which you use up your money) to make unnecessary mistakes that delay your progress. Overcome your disbelief stall that the way to be a great success as an entrepreneur is to do what you've always done.

Interesting look at how those dotcoms get started

Published by Thriftbooks.com User , 24 years ago

I read the book this weekend: Twice. The first time for fun the second in the context of the company I currently work. I will never look at my CEO the same way. "Sand-box CEO".I am only 25, but it was inspiring and informative. It has pushed me in the direction I have always wanted to go, ENTREPRENEURIAL.

IPO: The Book

Published by Thriftbooks.com User , 24 years ago

Ruthann Quindlen has written an authoritative "how to" manual for entrepreneurs. Consider this a "must read" for new companies hoping to raise capital, properly ground their enterprises, and successfully emerge from the difficult start-up phase.Even though her book is mainly instructional, Quindlen certainly has the credentials to write a "confessions" tome. Working in her early years for Alex.Brown and Sons, the investment banking firm, she became Wall Street's first dedicated personal computer software analyst. It was Alex.Brown that took Microsoft public. She later became instrumental in bringing her firm to accept AOL'S Steve Case as a client. Bill Gates phones her for advice. Her husband works with Paul Allen. In Quindlen's current position as a partner in Silicon Valley's Institutional Investment Partners (IVP), she relates stories about the kids who founded Excite--didn't even have a garage!Though all this and more is entertaining, make no mistake about it--this is a business book! Business models, venture capital defined and explaned, how deals are made and valuations decided are all covered. Her book is replete with positive and negative examples every young company should consider. Quindlen has been there, done that, has the t-shirt, and now the book, to prove it.

First of a kind

Published by Thriftbooks.com User , 24 years ago

The book is a recopilation of true short stories that the author experienced as a venture capitalist. I learnt some kind of a lesson from every story. What I liked the most about this book is that it is the first that tells the story from a VC point of view. Other books that I have read are about entrepreneurs building their companies, how to approach VCs, what VCs are looking for in an entrepreneur or business plan, etc... As my title says, this is the first of a kind, it tells the story from the other side, the VC side. I REALLY ENJOYED IT.