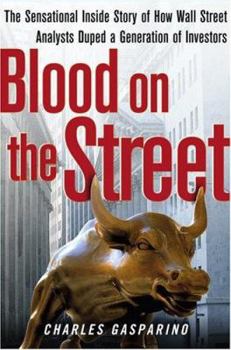

Blood on the Street: The Sensational Inside Story of How Wall Street Analysts Duped a Generation of Investors

Blood on the Street is a riveting account of the Wall Street scam in which ordinary investors lost literally billions of dollars -- in many cases their life savings -- in one of the greatest... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0743250230

ISBN13:9780743250238

Release Date:January 2005

Publisher:Free Press

Length:355 Pages

Weight:1.18 lbs.

Dimensions:1.3" x 6.3" x 9.2"

Related Subjects

Business Business & Finance Business & Investing Economics Finance Investing StocksCustomer Reviews

5 ratings

A cautionary tale we should not forget

Published by Thriftbooks.com User , 19 years ago

Captures the mania of the late nineties analyst scene in a gripping way. Very much a fly-on-the wall account that gives lots of juicy details of the larger than life characters involved. Would be nice if we can say that we learned our lesson regarding the "irrational exuberance" of that era. But unfortunately, history has a way of repeating itself. Let this book serve as a cautionary tale to us all.

Great Tales of Woe

Published by Thriftbooks.com User , 19 years ago

This is a fine review of the Wall Street shenanigans of the mid to late 1990s, which cost investors dearly. The author focuses on three of the sell-side analysts - Mary Meeker, Henry Blodget, Jack Grubman - whose hype and froth helped bring numerous companies public. This generated millions in investment banking fees for Wall Street's biggest banks... with a cut set aside for the analysts. But once the immense fraud was uncovered, no matter the personal or corporate fines levied, these analysts and their firms emerged far richer than before. Only the investors they purported to serve were worse off. If you're looking for a point of action to take away from this exciting read, it's this - be wary of sell-side analysts. No amount of fines, regulation or oversight will cut away at the essense of the sell-side: generate investment banking fees by hyping stocks. You'll be far better served if you look elsewhere for your stock & bond analysis.

Swindlers Running Berserk

Published by Thriftbooks.com User , 19 years ago

Charles Gasperino was the reporter who revealed the corruption and scandals of Wall Street in front-page articles for the "Wall Street Journal". This book tells how Wall Street firms swindled billions during the 1990s. President Clinton's tax increase produced low interest rates that fueled the stock market expansion. But this bubble of New Economy stocks would inevitable burst (p.5). What would falling prices for broadband do to the billions of dollars in bonds (p.7)? The ending of corporate pension plans forced employees into the stock market, where individuals faced unforeseen and unknown risks (p.8). This demand caused prices to rise without any increase in underlying values. The culprits, says the author, was the analysts who pumped out research that justified overvalued stocks (p.8). But this is a cop-out; analysts are employees who do as their told. They're only a pawn in this game (p.10). Were investors "greedy"? That's blaming the victim, and admitting to fraud (misrepresenting the value of the item sold). But crooks can stay out of prison by paying off the politicians and the government they control. NY Attorney General Eliot Spitzer exposed this corrupt process. You should read this book if you plan to invest in the stock market, have an IRA or 401K, or wonder about the plan to invest Social Security monies into the next offerings of Wall Street. The average small investor isn't smart or nimble enough to benefit from advertised offerings. Chapter 1 warns against listening to stock broker's "research": its just advertising designed to get you to buy a product (p.19). Chapter 2 tells how Internet stocks were measured in "hits" and "clicks", not earnings and share prices (p.30). The 'New Economy' is described in Chapter 3; they sold shares in companies that had no profits in the past year (p.55). Chapter 4 tells how companies like WorldCom paid for favorable reports (p.74). The 1996 Telecommunications Act forced telephone companies to open up to new competitors (p.85). Chapter 5 explains how average people were enticed to buy stocks with their savings (pp.96-97). Brokers peddled stock to small investors to gain sucker money (p.99). Could a dot-com company's headquarters be a post office box (p.105)? Does "get rich quick" investing work (p.112)? Chapter 6 explains what happened when stocks could no longer be pumped up - the price slumped to its real value. Chapter 7 tells how analysts' true function was to sell deals to investors (p.131). The slow crash of tech stocks was one of the biggest destructions of wealth in the nation's history (p.187). The SEC was snoozing while people were losing (p.190). Upper class brokers stole more than organized crime (p.193)! The 9/11 tragedy distracted America from the various scandals and losses (p.230). Did Spitzer persecute Merrill (p.260)? Was the SEC asleep on the job? The end of the Glass-Steagall Act created massive financial companies that served the rich and powerful (p.266). Page 273 explained

A Wall Street journalism masterpiece

Published by Thriftbooks.com User , 19 years ago

"Blood on the Street," by the former Wall Street Journal reporter Charles Gasparino is a journalism masterpiece. To this end, the author has firmly established himself as one of the "best & brightest" financial journalists in the nation today. Moreover, "Blood on the Street," is a sure bet to command strong attention for several big-time book awards. On that note, Gasparino is a tireless investigator. His fascinating narrative tells the story of how Wall Street's most powerful investment banking groups (and senior management) often tailored "New Economy," dot com and telecommunication research to win deals that generated hundreds of millions of dollars in fees. The sad thing about the unsavory/criminal practice is that hundreds of thousands of small investors suffered massive losses because they considered the research honest. However, the frightening aspect of Gasparino's reporting is that the Federal watchdogs at the Security Exchange Commission did little to protect small investors across the nation. Gasparino's portrayal of the cast is superb. Jack Grubman, the top telecommunications analyst at Salomon Smith Barney and one of the highest paid executives on Wall Street is arrogant, mean-spirited, shallow and not particularly good looking. Henry Blodget, the Merrill Lynch golden boy from Yale (affectionately known as "King Henry," before the dot com bubble bursts) is a talented communicator but way out of his league when it comes to the earnest work of crunching numbers. And Mary Meeker called the "Queen of the Net," by Barron's is "petite, Midwestern, and famously hardworking" according to Gasparino. Meeker is the best of the lot (by far) but still succumbs to the pressure from investment bankers and becomes a "cheerleader" for big fee clients. The primary hero of this sensational story is New York State attorney general Eliot Spitzer. He takes on the giant financial institutions and particularly humiliates Sandy Weill, the Citigroup CEO who without a doubt is the most powerful player on Wall Street. Unfortunately, there is no happy ending. Reforms are implemented and some investors manage to win litigation but for the most part "Wall Street analysts gets away with duping a generation of investors." Highly recommended. Bert Ruiz

Stop the politics and just read the book for yourself

Published by Thriftbooks.com User , 19 years ago

Yawn to those reviewers who appear to have an ax to grind with the author of this book. Judging by their writing styles, they sound more like insiders than the "average citizens" who commonly post to this website. As an average citizen (and proud of it, by the way), I enjoyed the story being told. The book read like a novel, and for me that's a plus. Who needs jargon or technical mumbo-jumbo when all we are really talking about are greed and corruption? I recommend this book to all who, like me, want to be informed and entertained....and not be condescended to. Focus on the story, which is both compelling and scary; not to mention probably very TRUE.