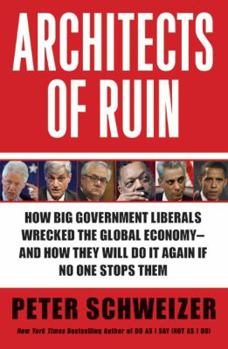

Architects of Ruin: How Big Government Liberals Wrecked the Global Economy---And How They Will Do It Again If No One Stops Them

Select Format

Select Condition

Book Overview

In Architects of Ruin, New York Times bestselling author and conservative historian Peter Schweizer argues that the economic crisis was caused by liberals who used the power of government to create a... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0061953342

ISBN13:9780061953347

Release Date:October 2009

Publisher:Harper

Length:240 Pages

Weight:0.90 lbs.

Dimensions:0.8" x 6.0" x 9.0"

Customer Reviews

5 ratings

Read the book, not the reviews.

Published by Thriftbooks.com User , 14 years ago

Unlike a few of the critical readers, I actually read the book before giving this review. This is a very thorough book that carefully documents the major developments that led up to the financial melt-down of late 2007 including the CRA, the governmental pressure to make home loans to lower-income citizens who could only marginally afford them, the resultant buy-back by the federal government of most of those loans so that banks were relieved of risk in making them, the not-surprising greed of the mortgage industry in promoting these loans, the virtual take-over of Fannie Mae and Freddie Mac by community activists, the establishment of an implied federal backing of this risk, and the resultant bubble that has burdened the tax-payers with more debt in less time than ever in our history. Note that the positive reviews state points made in the book, all of which are carefully footnoted so can be fact-checked. The negative reviews typically say that the book is weak because it is in conflict with some well-known perceived fact. Those "facts" turn out to be the media consensus that is usually not based upon certifiable facts but on some anonymous statement or an editorial opinion. Both supporters and critics point out that the tone can be overly strident. Whether or not this might have been more persuasive to unbiased readers is questionable but it would make for a better read. Those readers who have already made up their minds that the melt-down was the responsibility of an unfettered capitalistic system will quickly dismiss the facts presented. Those readers who had generally concluded that the main contributor was the CRA combined with activist's pressure and capitalist's greed will now have facts and dates to flesh out their suspicions. Objective readers will probably be surprised to discover how long it took for all of these factors to build before the bubble burst. I'm buying four more copies to send to others who need to read this important book. I encourage you to read it and make your own judgment as to how deep our financial and political problems are.

Architects of Ruin by Peter Schweizer

Published by Thriftbooks.com User , 14 years ago

Architects of Ruin by Peter Schweizer By 2007 up to 4.2 Trillion dollars of sub prime loans had been made. "By 2005, almost 33 percent of the new mortgages were interest-only and 32 percent of new home buyers put no money down "(Schweizer, 2009 ). Peter Schweizer's book: Architects of Ruin explains how these dire credit conditions and the resultant economic calamity happened. Schweizer asks and answers this question: "Why has this story been missed? It isn't all that hard to understand. First of course, the operations of quasi-governmental agencies such as Fannie Mae and Fredddie Mac are shrouded in layers of bureaucratic tedium. Few reporters take the time to actually dig into their inner workings. Besides, they are governed by congressional committees, so people naturally assume that some responsible is paying attention." Carter Schweizer details how activist organizations developed tactics to challenge redlining. This was begun by Jesse Jackson's PUSH and Gale Cincotta of NPA and Acorn. "In 1976 Cincotta began pushing for something she called the Community Reinvestment Act (CRA). Again , the idea sounded simple enough: declair that banks have "an afffirmative obligation: to lend to people in their own neighborhoods, and make their record of doing so part of the approval process for mergers, acquisitions, or expansion. In short , make it the law that banks needed to lend in areas they had traditionally avoided out of fear that they were poor credit risks." Page 16. Reagan and Bush I "For more than fifteen years, fair housing activists had been using the Community Reinvestment Act to compel banks to make increasingly risky loans. Using tactics of intimidation, delay, and public embarrassment, they had achieved stunning results. By 1990 some $5 billion had been shaken from banks through these tactics." Clinton "By early 1995, the Clinton administration was pushing a revision to the CRA. It wanted a numerical quota system to be used to evaluate whether banks were loaning enough to low-income and minority groups." Page 66 "By the middle of the Clinton administration, Fannie and Freddie were no longer simple lubricants of the American financial system. Instead, they became ground zero of a vast social engineering project that was willing to take exorbitant risks with taxpayer dollars. Once securely in the hands of idealistic baby boomers who constantly confused their corporate mission with their activist vocation, these institutions soon abandoned their traditional conservative approach to mortgage finance and became avenues for relaxed lending standards, helping in turn to inflate the subprime credit bubble." Page 80 "Meanwhile , the Clinton adminstration had created a culture of government-funded risk in the financial markets and in collusion with Wall Street had midwifed a new form of state capitalism. The constant bailouts of failing Wall Street firms meant that the large banks and investment houses were shiel

Extremely Well-Constructed Narrative

Published by Thriftbooks.com User , 14 years ago

Schweizer has done what few other analysts of the late 2008 financial meltdown have been able, or even willing to do, and that's write a comprehensive and comprehensible narrative of the origins of the crisis. Many analysts of a free market bent will throw off broadsides at Fannie Mae, Freddie Mac, and the Community Reinvestment Act and leave it at that, assuming that, having taken shots at these obvious governmental meddlers, the total picture simply paints itself. Well, it doesn't, and that's where Schweizer excels. Schweizer starts at the beginning and, chapter by chapter, walks you forward into the teeth of the meltdown. A true tour de force. Three points of interest: 1) Schweizer opened my eyes to the neat trick pulled by President Clinton - while declaring the Era of Big Government to be Over, he was concurrently manipulating financial institutions to pick up the wealth redistribution slack, almost wholly under the public radar. Brilliant. Devious. Destructive. 2) I believe Schweizer goes too easy on the Bush administration. While they made efforts to address the worst of the Clinton abuses, they did encourage the same sort of "universal home ownership" mentality as the Clinton cabal. Chalk up their efforts to promote ownership as misguided and their efforts to reign in the worst of the abuses as lacking in sufficient urgency (rather than neglect) - they still failed to head off the financial collapse. 3) Schweizer altered my perspective on the wage controls that were imposed on the executives of the financial institutions that received bailouts. Those wailing about the assault on the free market are, for the time being, off-base. Free market my rear end - a firm like Goldman Sachs has been gambling for decades with the implicit backing of the Treasury; much of their past compensation has derived from that government backstop. Remove the backstop, and I don't care how much they make. Otherwise, as long as they're playing with the House's money, I don't see why they shouldn't be paid government scale wages. (Heh - a monkey could do what the execs of GS are doing now, borrowing at 0% and lending it back to the Fed at 3%. Hardly work worthy of millions in bonuses.)

An important book

Published by Thriftbooks.com User , 15 years ago

This book will be a revelation to those who have let history be warped by political expediance.

How to use racism to extort and destroy

Published by Thriftbooks.com User , 15 years ago

At the time of the collapse of Freddie and Fannie, I had imagined that there was a big secret gala attended by a good many of our congressmen. This book identifies who might have attended that party and why they were celebrating the start of the global financial disaster. Worst thing? The book explains that they are not done. Definitely not reading material for anyone who thinks businesses are innately bigoted or that Progressives actually help poor people.