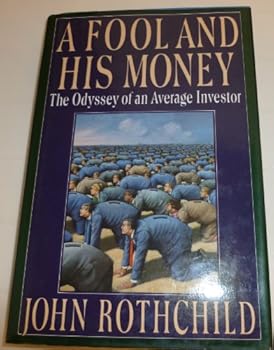

A Fool and His Money

Select Format

Select Condition

Book Overview

"There is one thing that can be said about A Fool and His Moneythat cannot be said about any other colume of investment advice: You will never make a penny from the information in this book. Nowork on... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0670811777

ISBN13:9780670811779

Release Date:March 1988

Publisher:Viking Books

Length:251 Pages

Weight:1.14 lbs.

Customer Reviews

5 ratings

This book was hilarious!

Published by Thriftbooks.com User , 19 years ago

This book is definitely educational and funny! All the tips in the book sound funny but are real. I was laughing so hard from reading this book, my sides hurt...This information although written in 1987/1988 timeframe is definitely timeless! This book was nice break from serious investment books and should not be thought of as less because it is humorous... it kinda reminds you of the humor in the films that Michael Moore creates (although this info is legitimate).

Can the Average Investor Still Make Money??

Published by Thriftbooks.com User , 20 years ago

+++++ This easy-to-read book, by former editor, author, and writer, John Rothchild, is a unique and hilarious book that tells us of his adventure as an average investor in the stock market. Rothchild's original plan for writing this book was as follows: "In the late summer of 1985, during an extraordinary bull market [rising market], I decided to drop everything and devote an entire year to learning how to invest, especially in stocks. I resolved to begin at the beginning, finding out as much as I could about the business and how it really operates, meanwhile putting my own funds [of $16,500] into whatever would make the biggest profit. After achieving [this] winning strategy, increasing my net worth, and achieving financial independence [or security], I'd return to tell you how I did it." Rothchild learned how to invest by doing things such as watching late night television programs "on how to get rich;" going to financial planning places with their money managers; reading newsletters, business publications, and historical financial books; talking to successful investors in order to perhaps learn some inside information; and going to stockbrokers for information on hot stocks, making fully-informed investment decisions, and avoiding irrational markets. During his journey, Rothchild does a good job in explaining the mechanics of investing especially in the stock market and imparting the psychology behind investing. Even though the author does a good job in explaining terms, I feel knowing some basics on investing before reading this book, will help the potential reader appreciate the humor and practical advice of this book even more. (There are over twenty short useful tips in boldface type peppered throughout this book.) Finally, the title of this book "A Fool and his Money" gives an indication of what happened to Rothchild's investment. As a consequence, at the very end of this book, Rothchild has a short glossary of major investment and stock market terms that he has defined as a result of his experience. He defines the terms found in this review as follows: (1) Average Investor: born loser (2) Bull Market: a time when your neighbor's stocks are going up (3) Successful investor: liar (4) Inside information: something you wish they'd tell you; what everybody else has heard (5) Stockbroker: salesperson for stocks, mutual funds, etc.; a person who will never go broke (6) Money manager: expert who manages your financial affairs; someone to whom you pay a large fee so you'll have less money to manage (7) Hot stock: stock everybody is buying; what your brokerage firm calls any stock it wants to sell (8) Irrational market: a market that isn't doing what you want it too; every market (9) Fully-informed investment decision: wild guess (10) Financial security: perpetual care enjoyed by insurance companies, brokers, money managers, and others in the financial security industry. In conclusion, this is a practical and hilarious book t

Information Overload Is Costly!

Published by Thriftbooks.com User , 23 years ago

Mr. Rothschild did something in this book that you should never do. He took a year off to learn how to invest, and looked into every financial category available. As a result, he was soon inundated with advice that he often followed. Usually, he didn't understand the risks of what he was doing, and he almost always ended up making costly and unnecessary mistakes. You will find this book a funny cautionary tale about the relevance of keeping it simple and focusing on what's important.The book is filled with short bits of advice that give you a flavor for its content."Never buy the June call nor sell the October put simultaneously, unless you know what they are." This is a reference to a strategy for making money in very volatile stocks. The stock he used was not volatile enough, and he lost on the position. "'Expert' advice does not agree." So who can you believe?Mr. Rothchild's downfall was that he is an obviously intelligent, curious person who was too good at finding sources of information. Along the way, he met more different investment brokers, security analysts, professional portfolio managers, market makers, commodity traders, and options experts than you can shake a stick at. Although no one held his hand into a fire, he often tried out an idea that he heard about along the way. The salespeople were all trained to let the investor do whatever he wanted, so he was able to get himself into deep water in the process of trying these things. Someone should have pointed out that he could have learned the same lessons by simply taking a theoretical position on paper, and tracking the results. One hilarious sequence has him changing hotels during a vacation to avoid the margin calls that came every few hours. He didn't want his wife to find out that he had raided the household funds to float the first margin call. He could not meet the second one. All the time this is going on, he has been telling his wife and friends how well he is doing. That was technically true for awhile, but did not last long. Soon, his losses are so large that he was embarrassed to let anyone know. "The larger the sum you've lost, the smaller the sums you'll worry about." So he became incredibly stingy in every other part of his life. Meanwhile, his wife's account was doing very well with being handled by a stock broker that Mr. Rothchild decided not to use. This made him feel even worse.Then, the crash in October 1987 happened, and his wife's money was slashed, too. It was a tough year for the Rothchild family, all the way around.After reading this book, you'll be ready for John Bogle and his Common Sense about Mutual Funds. With this information, you can match the market inexpensively, spend little time on investing, and have limited risk of taking a large, permanent loss. Sleeping well is the best revenge.After you read this book, consider your own psychology. How good are you at making rational decisions in an area where the value of what y

One of my favorite finance books

Published by Thriftbooks.com User , 23 years ago

I have read a quite a bit of books on finance (and work in finance). This book is one of my favorites...I could not put the book down. The book is realistic and entertaining. Definitely worth reading.

Excellent Read

Published by Thriftbooks.com User , 24 years ago

I thoroughly enjoyed this book. Whilst Rothchild is not giving out specific advice on the stock market, he does provide a good general overview by relating his one year's journey into the stock market. A clear message from this book was that the "experts" are incorrect more often than not and that there is more rumour than fact floating around.Written with a lot of honesty, great humour, and most definitely worth reading.